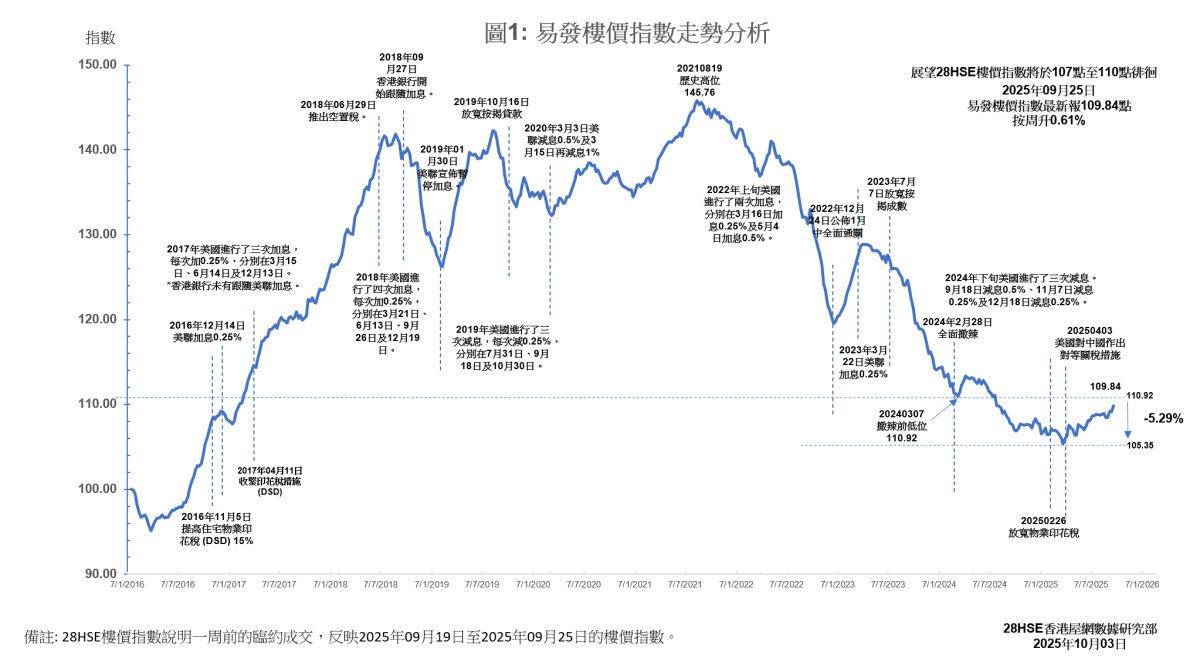

Hong Kong’s property market continues to recover, with the latest Eva Property Index rising to 109.84, a year-to-date high and up 3.09% so far this year. Although still more than 32% below its 2021 peak, the steady rebound reflects a stabilizing market. Recent interest rate cuts by major banks, following the U.S. Federal Reserve, have lowered mortgage costs and released purchasing power, driving transactions upward. According to agency data, the city’s top 10 housing estates recorded up to 15 deals over the September 20–21 weekend, nearly 60% higher week-on-week, highlighting stronger buyer activity. The latest Policy Address also added momentum, with the Capital Investment Entrant Scheme lowering the residential investment threshold from HK$50 million to HK$30 million and raising the non-residential cap from HK$10 million to HK$15 million, further boosting investment sentiment. With both monetary and policy support, the index is expected to challenge the 110.92 level later this year, the benchmark seen before cooling measures.

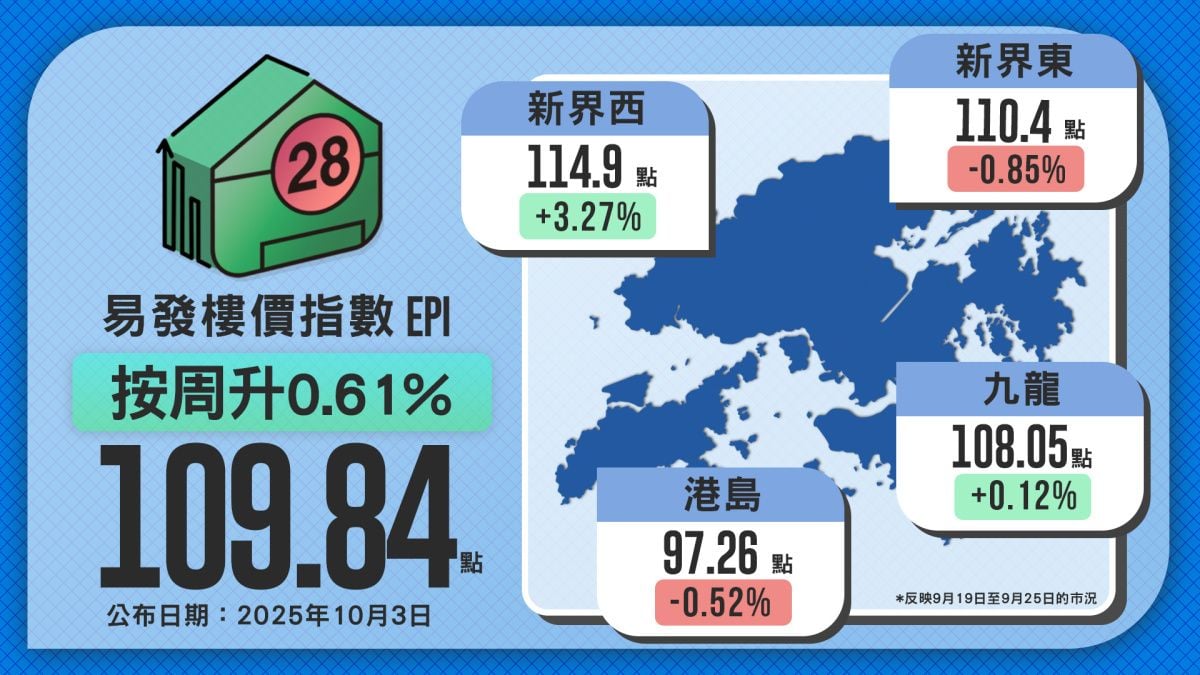

Mixed Performance Across Districts: “Two Up, Two Down”

The latest sub-index data shows a divergent trend. New Territories West led gains, surging 3.27% to 114.9, marking a three-week rally as more discounted listings spurred buyers to enter before prices rise further. Kowloon edged up 0.12% to 108.05, ending its losing streak, thanks to strong first-hand sales such as The Vertex and The Haddon, which together saw over 60 transactions. Meanwhile, New Territories East slipped 0.85% to 110.4, while Hong Kong Island fell 0.52% to 97.26, both affected by disruptions from super typhoon Koinu, which reduced weekend viewings by nearly 3.6%.

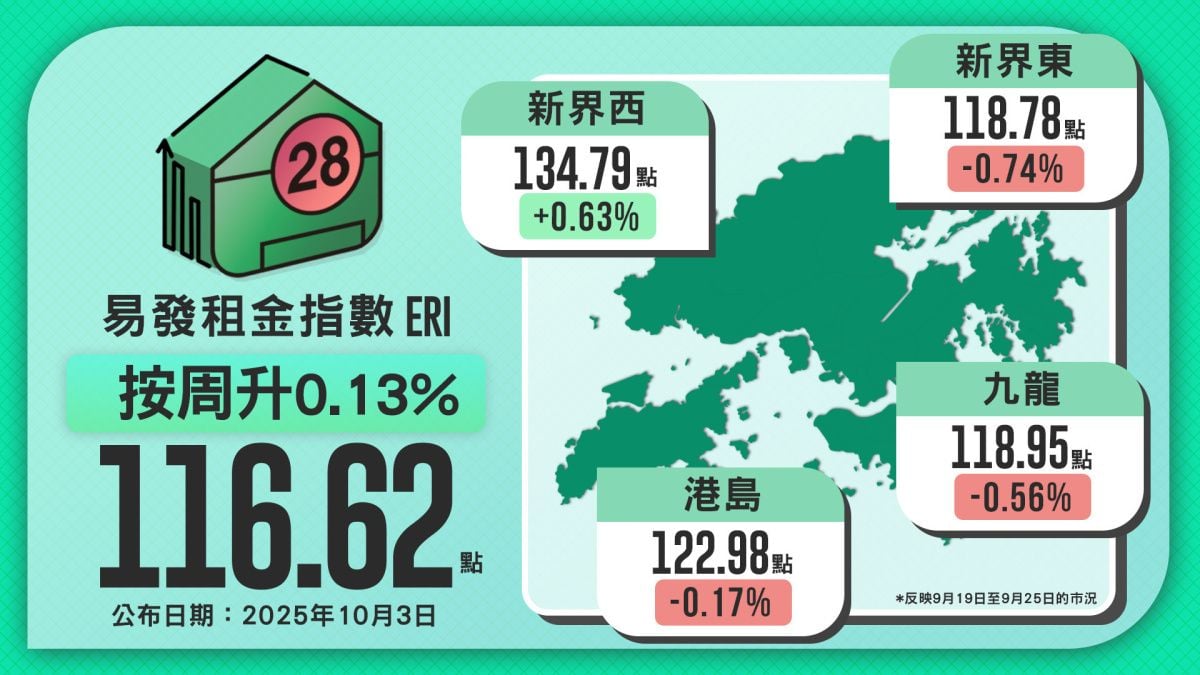

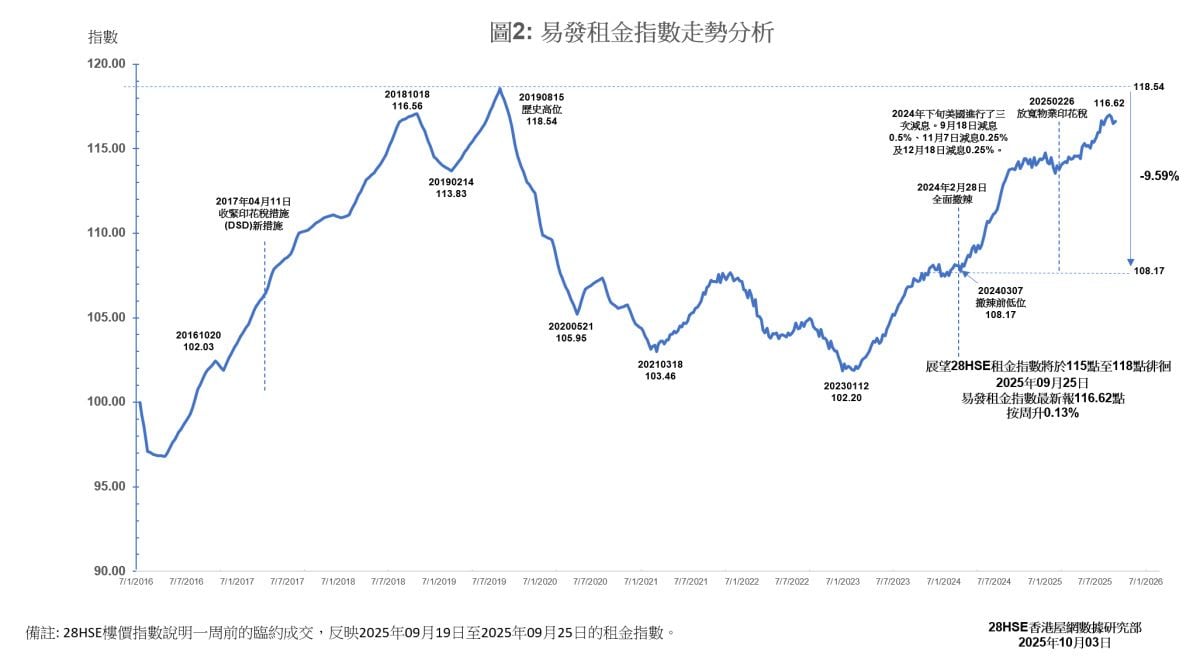

Rental Market Holds Firm at Year’s High

The rental market remains robust, with the Eva Rental Index at 116.62, still near its annual high after a slight 0.13% weekly gain. However, with the summer peak season ending and banks adjusting rates, rental demand may soften over the next three months, likely keeping the index in a narrow 115–117 range. District data shows a “three down, one up” pattern: New Territories West rose 0.63% to 134.79, reflecting solid demand for rental units, while New Territories East (-0.74%), Kowloon (-0.56%), and Hong Kong Island (-0.17%) all edged lower. Overall, while leasing activity remains strong, a mild correction is expected in the short term due to seasonal factors and changing interest rate conditions.

This week's index reflects the market conditions from September 19, 2025 to September 25, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |