Developers step up efforts to launch; In One increases prices by 4.5% to push 80 units in Phase IC

The Hong Kong property market is booming, unaffected by the United States’ second interest rate hike this year. Over 555 units were sold over the weekend (March 25 and 26), the biggest set of weekend transactions in seven months since August last year. Developers are taking advantage of the market to launch new properties, with Chinachem and MTR's In One Phase IB development in Ho Man Tin. Prices for the first batch of 80 units in phase IC were announced yesterday, at a discounted average price of HK$25,953 per square foot and a discounted entry fee of HK$12.16 million for a two-bedroom apartment, which is about 4.5 per cent higher than the first batch in Phase IB. Yin Kao-ling

Following the US announcement of a 0.25 per cent interest rate hike last Thursday, the same as in February, Hong Kong banks did not follow the US rate hike for the second consecutive time. The mortgage industry in Hong Kong believes that the large banks in Hong Kong have sufficient funds, and are in a good position to not follow the interest rate hike or delay it. Under the shadow of the European and US banking crises and economic recession, the US interest rate hike cycle may peak in May this year, and it also indicates that the rate hike cycle in Hong Kong will come to an end this year. The slowdown in rate hikes is expected to support the property market.

In One Phase IB and Grand Jete sell out all flats

As the first batch of new properties to be launched after another US interest rate hike, two new properties were launched last Saturday (March 25), namely Grand Jete’s phase two development in Tuen Mun and In One’s Phase IB development in Ho Man Tin Station, both of which were sold out with a total of 523 units. Among them, the 179 units of Yuyi IB phase were sold out on the same day last Saturday (March 25), cashing in a total of more than HK$3.425 billion. On the other hand, Grand Jete’s phase two development, a joint venture between CK Asset (1113) and Sun Hung Kai Properties (SHKP) (0016), also launched 400 units on Saturday, of which 344 units were sold, accounting for 86 per cent of the total number of units put up for sale and generating a total of HK$1.6 billion. Together with other new developments, over 555 units were sold in the past two days, the busiest weekend in the market since 680 units were sold in two days on August 6 and 7 last year.

During In One’s sales on Saturday, Centaline Group chief executive Alex Shih took a hands-on approach to supporting the property market as a first-time buyer, purchasing a HK$26 million three-bedroom apartment for himself as an investment; Ms Chan, who bought a one-bedroom apartment at In One, said that since In One’s phase two development had a relatively long period of incomplete construction, the interest rate hike would likely have little impact on the pressure of mortgage payments.

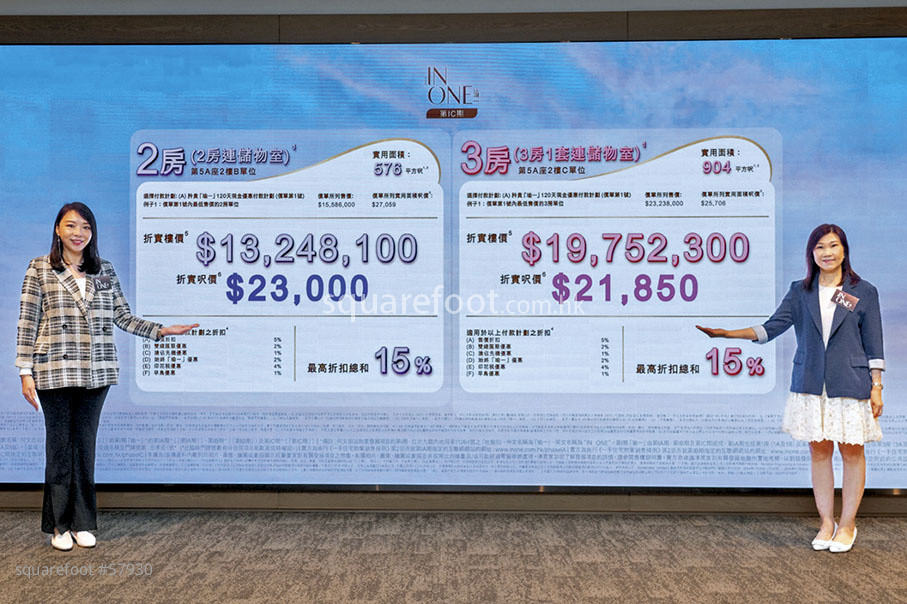

The launch of In One’s Phase IC was announced yesterday. Helen Fung, sales director of Chinachem Group, said that the first price list of Phase IC covers different types of units, offering 80 units worth about HK$1.5 billion total. The price includes 55 two-bedroom flats and 25 three-bedroom flats with a saleable area of 465 to 934 square feet. She added that as the project is located above the MTR station and has a sea view, there are expected to be some upward price adjustments in the future.

In addition, In One phase IC will continue to provide three payment methods. After deducting the highest discount of 15 per cent, discounted prices range from approximately HK$12.601 million to HK$25.8434 million per square foot, and discounted prices per square foot from HK$21,850 to HK$30,563.

KOKO MARE may launch an additional 80 units today

Following the launch of the first 98 units of Wheelock’s KOKO MARE at Lam Tin, Ricky Wong Kwong-yiu, managing director at Wheelock Properties, said that as of yesterday, the project had received about 1,200 tickets, indicating an over-subscription by more than 11 times. Due to the overwhelmingly positive market response, over 10 per cent of the units will be put up for sale today at the earliest, ranging from 60 to 80 units of mainly one- to two-bedroom flats, with up to a 10 per cent price increase. The additional units will be concentrated in Block Eight, which provides some sea view units. Yesterday was the second day that KOKO MARE opened its showroom to the public, with over 6,000 visitors recorded.

In addition, Kowloon Development's (0034) Manor Hill also continued to record transactions, with two recorded over the weekend, generating over HK$8 million. In addition, Henderson Land (0012)'s Baker Circle Euston was reported to have collected about 300 votes up to yesterday, an over-subscription of more than 4.3 times.

Dave Ma, chief executive of Hong Kong Property Services (Agency), said yesterday that the new property market was blossoming, offering a wide range of choices to prospective buyers, and that a number of new properties were selling well. The cumulative number of first-hand transactions in the first quarter has exceeded 3,000, nearly tripling from the fourth quarter of last year, and the recovery of the economy has boosted purchasing power.

Like 18

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |