- Home

- News

- Property Index

- Rate Cuts Continue To Boost Property Market: Home Prices Extend Gains, Rents Stabilize At High Levels Amid “two Up, Two Down” Regional Trend

Hong Kong’s property market continues to warm up under the influence of interest rate cuts, with home prices maintaining an upward trend and the Eva Property Index hitting a new high for the year. However, increasing new project supply has put pressure on the secondary market. Regional price trends reveal a “two up, two down” pattern — with notable gains in the New Territories West and Hong Kong Island, while Kowloon and the New Territories East recorded mild declines. Meanwhile, rental levels remain high but are stabilizing, as some tenants shift from renting to buying, signaling a gradual market adjustment.

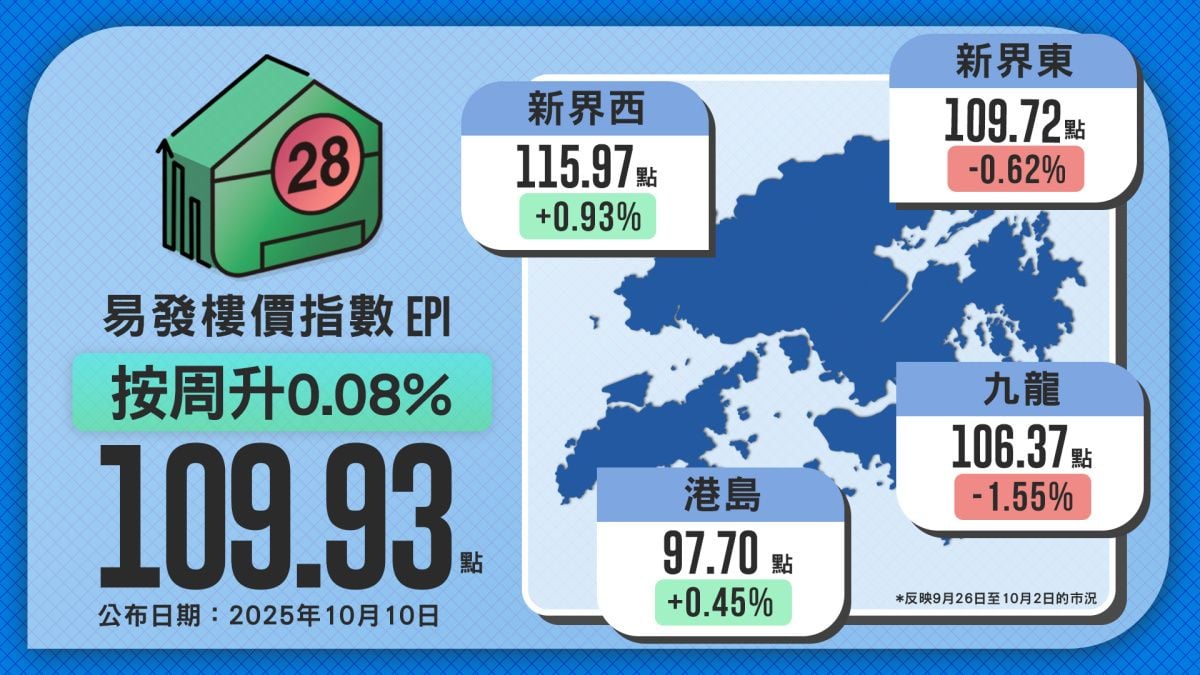

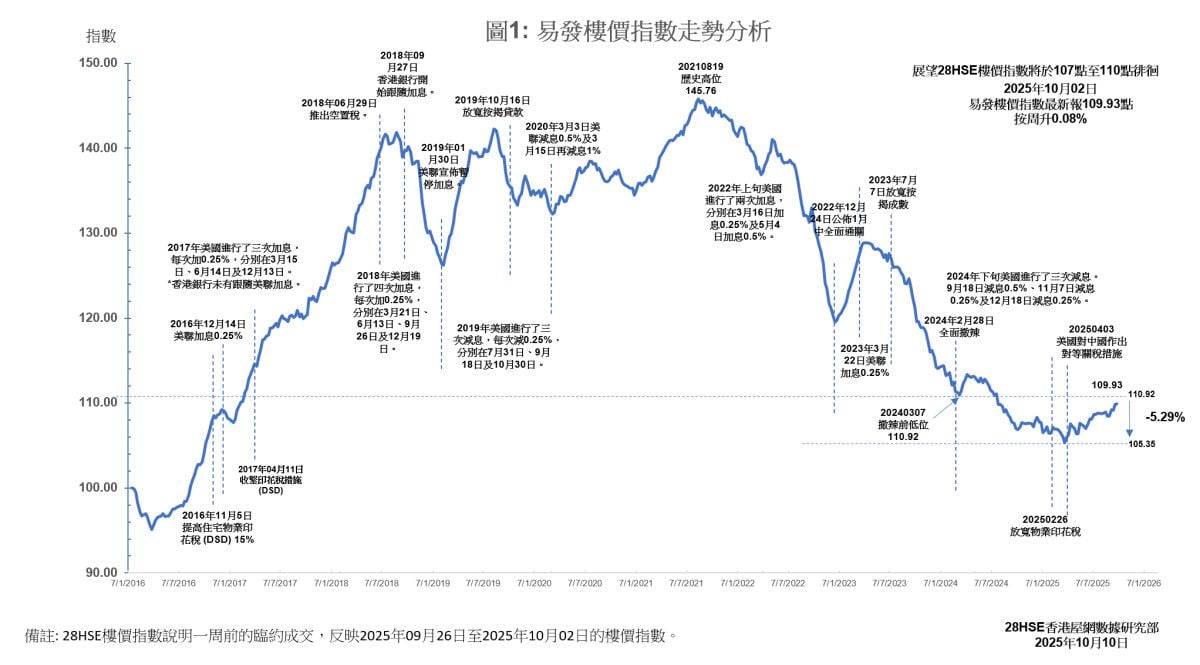

Following successive rate cuts by local banks, market sentiment has visibly improved and buyer confidence has strengthened, sustaining the rise in property prices. The latest Eva Property Index rose 0.08% weekly to 109.93 points, climbing for a second consecutive week and setting a new yearly high. Although still more than 30% below the 2021 peak, prices have gained around 3.18% year-to-date, reflecting how lower borrowing costs have stimulated homebuying demand. According to property agency data, the ten major housing estates recorded double-digit weekend transactions on September 27–28, with some agencies seeing a nearly 30% weekly increase, confirming that rate cuts have accelerated buyers’ entry into the market. Analysts expect the U.S. Federal Reserve to cut interest rates by another 0.25% later this year, further easing local mortgage rates. If the low-rate environment persists, home prices could rise another 5% by year-end, pushing the Eva Property index toward 110.92 points — near pre-measurement-lifting levels.

However, the market also faces challenges from new project launches, including The Henley II in Kai Tak and Bakker Peak in Yau Tong, which could divert demand from the secondary market. With developers actively seizing attention, short-term pressure on secondhand home prices is expected. Overall, the interplay between interest rate cuts and new project competition will continue to shape market dynamics in the coming months.

Regional Divergence: “Two Up, Two Down,” New Territories West Leads Gains

The latest regional price index highlights a divergent “two up, two down” pattern across Hong Kong’s property market. The New Territories West led the gains, climbing 0.93% weekly to 115.97 points — the fourth straight weekly rise. According to the 28Hse Research Department, homeowners in the area expanded negotiation margins to avoid head-on competition with the soon-to-launch The Grand Mayfair III in Kam Sheung Road, driving stronger transactions and sustained price growth. Hong Kong Island also rebounded, rising 0.45% to 97.7 points, supported by strong sales at the Mid-Levels luxury project The MVP, which helped restore buyer confidence. Conversely, Kowloon fell 1.55% to 106.37 points, while the New Territories East dropped 0.62% to 109.72 points — its second consecutive weekly decline.

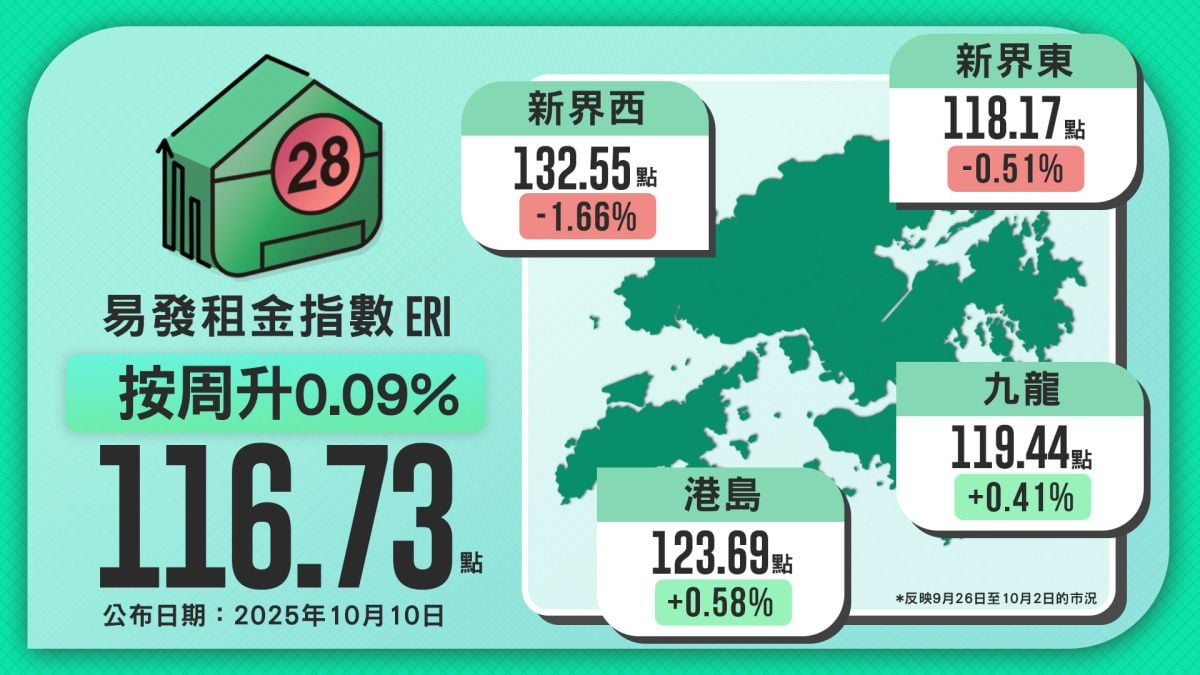

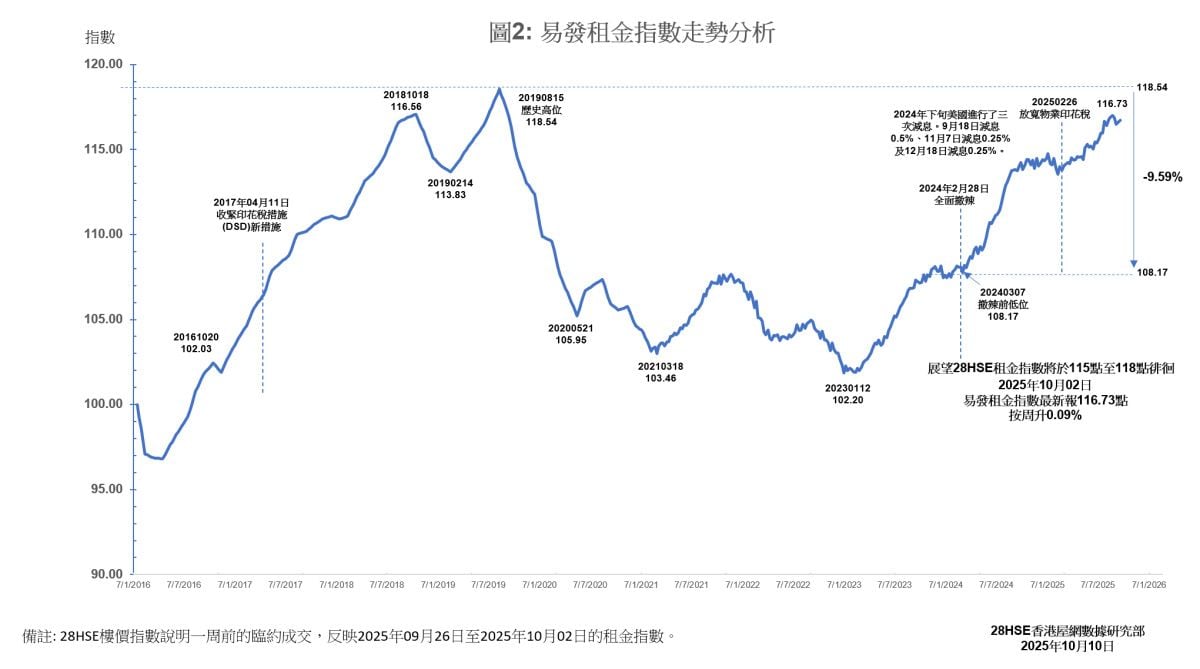

Eva Rental Index at 116.73 Points, Regional “Two Up, Two Down” Pattern Persists

Private residential rents continue to outperform home prices, supported by solid leasing demand. The Eva Rental Index rose 0.09% weekly to 116.73 points — its second consecutive weekly increase — and remains near its annual high. With banks continuing to trim mortgage rates and the market expecting further rate cuts within the year, lower ownership costs may prompt more tenants to transition into homebuyers, potentially moderating rental growth. The Eva Rental index is expected to fluctuate within a narrow range between 115 and 117 points in the short term, consolidating at high levels.

By region, Hong Kong Island rents rose 0.58% to 123.69 points, and Kowloon climbed 0.41% to 119.44 points, reflecting steady demand in urban areas. In contrast, the New Territories weakened — the West fell 1.66% to 132.55 points, and the East dropped 0.51% to 118.17 points, marking a fourth consecutive weekly decline. Overall, while rent levels remain relatively high, the gradual effects of rate cuts suggest the leasing market may soon enter a stable adjustment phase.

This week's index reflects the market conditions from September 26, 2025 to October 02, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |