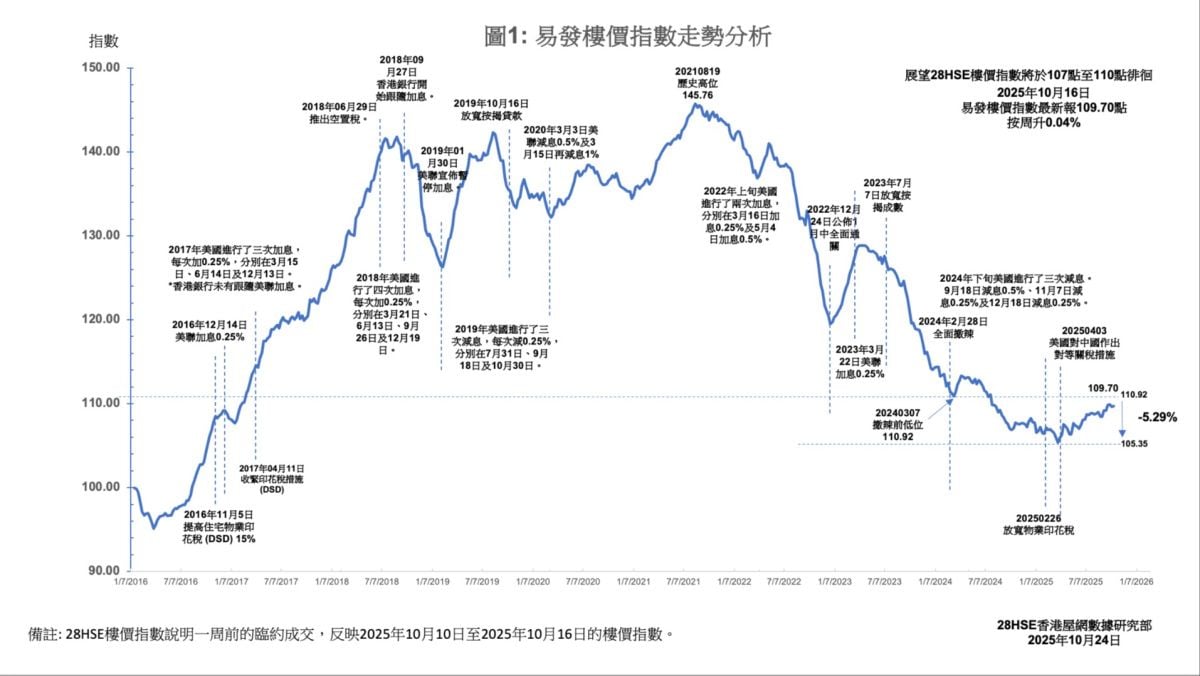

The local secondary property market is gradually entering an upward trajectory, with the latest Eva Property Index (EPI) at 109.7 points, recording a slight week-on-week increase of 0.04%. This is only about 0.13% lower than the year’s high recorded earlier this month. Towards the end of the year, a potential interest rate cut may further release purchasing power for residential properties, driving transaction volume and improving market sentiment. The property price index is expected to reach 110.92 points by the end of the year.

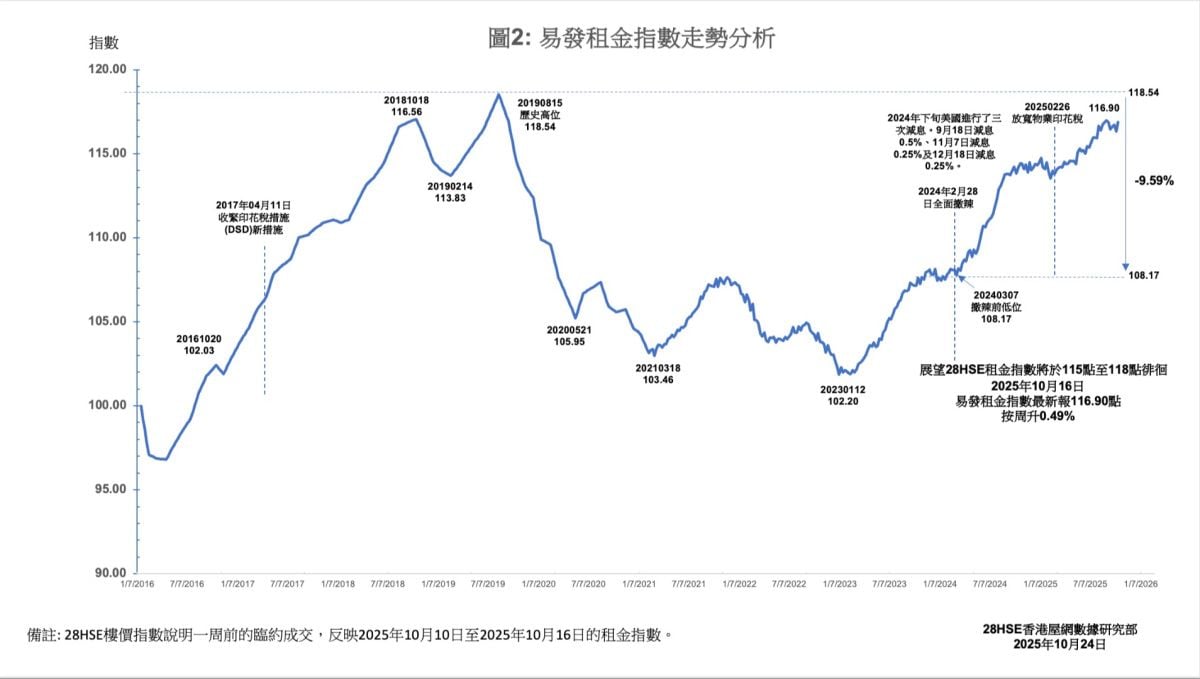

Regionally, the market showed a "three rises and one drop" pattern, with only Kowloon recording a week-on-week decline of 1.17%. Analysts suggest that while no new property launches have occurred recently in Kowloon, it remains the area with the highest number of unsold units, totaling over 10,000 units, which accounts for more than half of all unsold properties in Hong Kong. This oversupply has diluted purchasing power in the secondary market. Meanwhile, the Eva Rental Index (ERI) showed an overall increase, with the latest reading at 116.9 points. However, as the summer rental peak has ended, rental prices may see slight corrections in the near future.

Secondary Property Prices Continue Upward Trend

The secondary property market in Hong Kong continues its upward trend, with the latest Eva Property Index standing at 109.7 points, a slight week-on-week increase of 0.04%. While this is about 0.13% lower than the year’s high, the index has already risen approximately 2.6% compared to January this year. With only two months left in 2025, the market is closely watching the possibility of another U.S. interest rate cut by the end of the year. Should this happen, Hong Kong banks may adjust their rates accordingly, providing positive momentum for the property market. This could further release residential purchasing power, increase transaction volumes, and improve market sentiment. According to 28Hse Research, property prices for the entire year are expected to rise by about 4%, with the Eva Property Index possibly challenging 110.92 points by year-end.

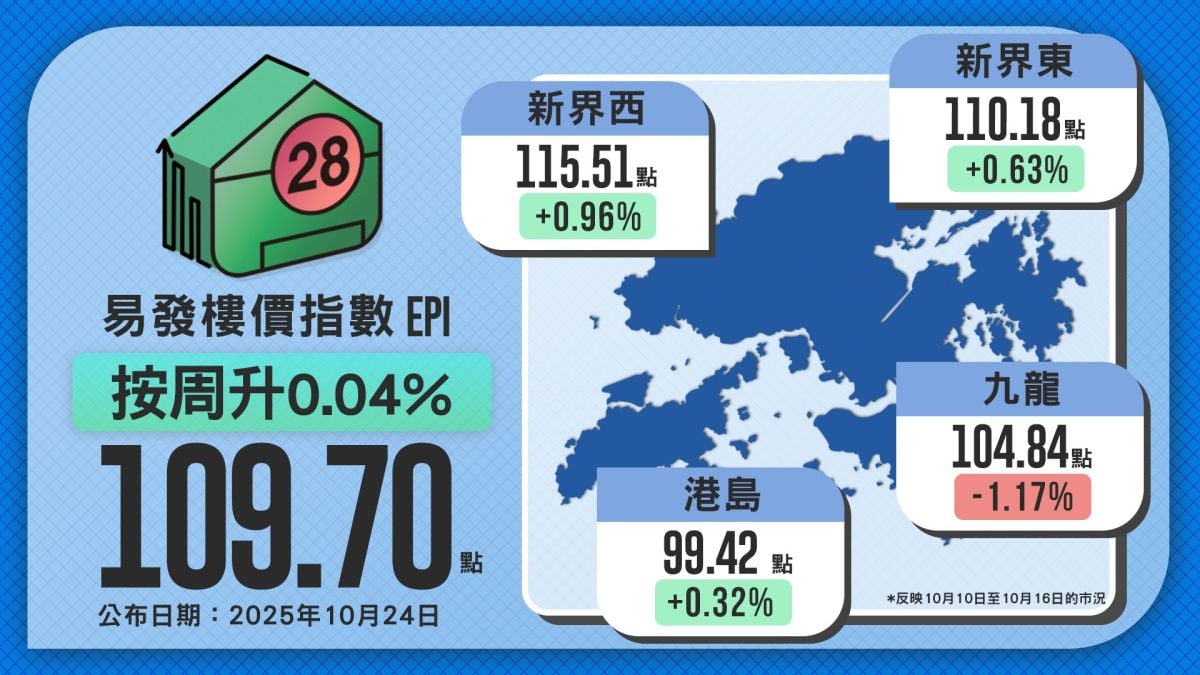

Regional Performance: "Three Rises and One Drop"

In terms of regional performance, the property price index showed a "three rises and one drop" pattern. The most significant increase was recorded in New Territories West, with the latest index at 115.51 points, rising 0.96% week-on-week. This surge is mainly attributed to the launch of Grand Mayfair III near Kam Sheung Road Station, which prompted secondary property owners in the area to sell their units more quickly before the railway-linked new development officially hit the market, indirectly boosting secondary property prices.

Following this, New Territories East recorded an index of 110.18 points, up 0.63% week-on-week, while Hong Kong Island stood at 99.42 points, rising 0.32%. In contrast, Kowloon was the only region to see a decline, with the latest index at 104.84 points, down 1.17% week-on-week, marking its third consecutive week of decline.

Kowloon’s weaker performance may be due to the lack of new property launches in recent months. However, as the region with the highest unsold inventory in Hong Kong, Kowloon had an unsold stock of 10,550 units as of September this year, accounting for more than half of the total 19,000 unsold units citywide. The large volume of unsold units has drawn the attention of potential buyers to the primary market, further weakening demand in the secondary market and dragging down the property price index for the region.

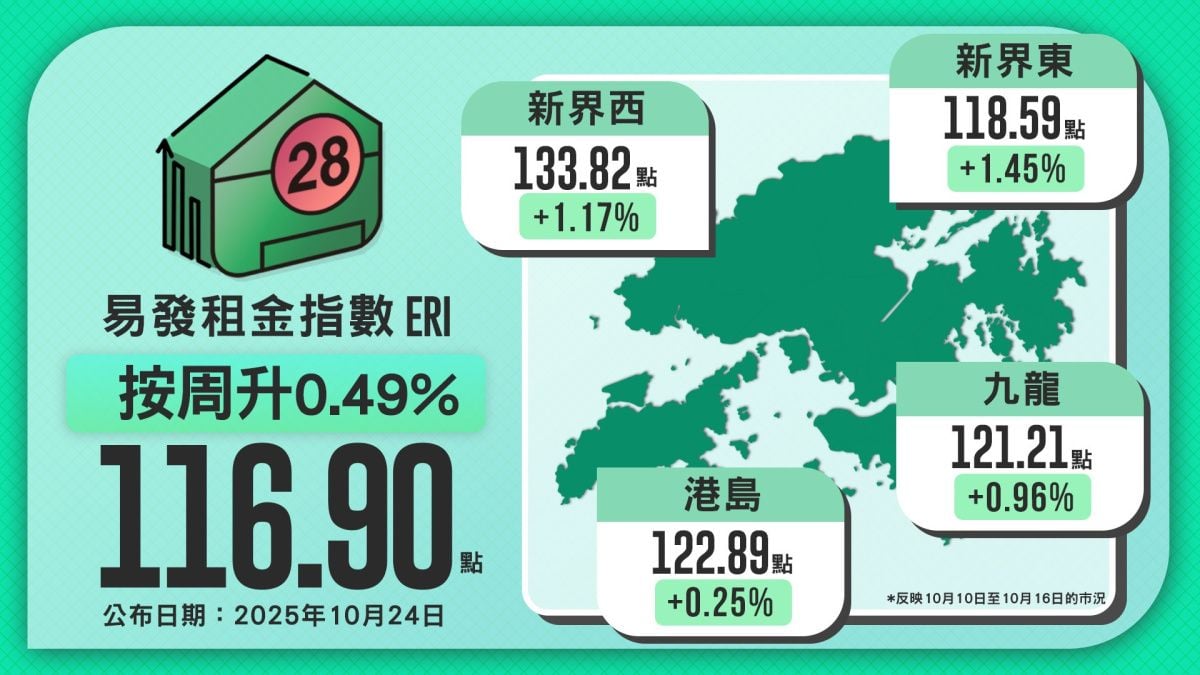

Rental Index Rises 0.49% Weekly, Near Historic Highs

This week, the Eva Rental Index (ERI) recorded an overall increase, with the latest reading at 116.9 points, up 0.49% from the previous week. Despite the end of the summer rental peak season, the lingering impact of the earlier rental surge has prevented rental prices from dropping quickly, keeping the index near this year’s high. However, breaking past this year’s peak level is expected to be challenging. As the summer peak fades, rental prices may see slight corrections in the coming weeks.

Regionally, New Territories East recorded the largest increase, with the latest index at 118.59 points, rising 1.45% week-on-week. This was followed by New Territories West, with an index of 133.82 points, up 1.17%. Kowloon recorded an index of 121.21 points, rising 0.96%, while Hong Kong Island remained relatively stable at 122.89 points, with a modest week-on-week increase of 0.25%.

With the property market gradually recovering and the possibility of a year-end interest rate cut on the horizon, the Eva Property Index is expected to see further gains in the remaining months of the year. However, the concentration of unsold units in Kowloon and seasonal factors affecting the rental market may continue to play key roles in shaping market performance.

This week's index reflects the market conditions from October 10, 2025 to October 16, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |