- Home

- News

- Property Index

- Property Market Sentiment Continues To Heat Up: Eva Property Index Hits New High Of The Year, Strong New Launch Sales While Rents Edge Lower

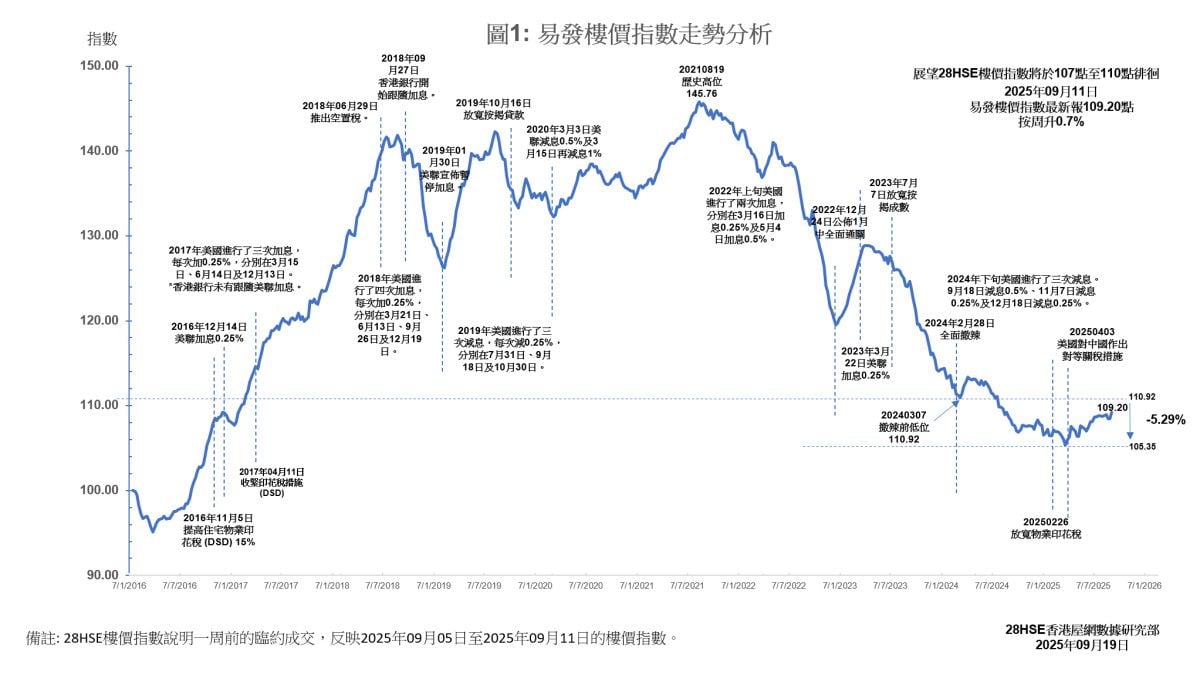

Hong Kong’s property market sentiment continues to strengthen, with the secondary market price Eva Property index rising to 109.20, a new high for the year. New project sales remained solid, led by Phase 1 of “Grand Jete” in Chai Wan, while more launches are in the pipeline. By district, the Eva property index showed a “three up, one down” pattern, with Hong Kong West recording seven consecutive weeks of gains. Meanwhile, the Eva Rental index slipped slightly to 116.86, ending a four-week uptrend, pressured by some tenants shifting from renting to buying, and is expected to remain range-bound in the short term.

The secondary housing market has recently trended upward, with the Eva Property Index at 109.20 for the week of September 5–11, up 0.7% from the previous week, ending two straight weeks of decline and hitting its highest level this year. Although still more than 33% below the peak in August 2021, it has accumulated a 2.49% gain so far in 2025. The market is anticipating supportive housing measures in the government’s mid-September Policy Address, coupled with possible U.S. Federal Reserve rate cuts, prompting some buyers to enter the market early to avoid price hikes by sellers once policies are confirmed. According to agency data, sentiment over the weekend of September 6–7 improved, with one agency recording 12 deals in the top 10 housing estates, a 33% weekly increase. With multiple positive factors and a buoyant stock market, the Eva Property index is expected to test the 110 mark later in September.

New projects remain the highlight, with developers eager to launch before the Policy Address to capture market demand. Over the September 6–7 weekend, around 180 units were sold in the primary market, similar to the previous week, reflecting steady demand. Phase 1 of “Grand Jete” in Chai Wan stood out with 87 transactions, while “The Coastline” in Lohas Park contributed 24 deals, alongside absorption of leftover stock, showing growing confidence among buyers. More new launches are expected in September, including “The MVP” in Mid-Levels West, “Jinbo” in Ma Tau Wai Road, and Phase 1 of “One Muk” in Ma Tau Kok, which are set to further fuel market activity.

District Indices: Three Up, One Down; Hong Kong West Rises for Seventh Consecutive Week

By district, the Eva property index showed mixed performance. Hong Kong West led with the strongest growth, rising 0.98% to 99.14 and extending its rally to seven weeks. The surge was supported by new launches such as “J Residence.Tin Hau” on King’s Road and “The MVP” in Mid-Levels West. New Territories East rose 0.59% to 109.25, its third consecutive week of gains, while New Territories West edged up 0.32% to 110.83, breaking a four-week losing streak. Kowloon, however, slipped slightly by 0.05% to 109.83, ending three straight weeks of growth, highlighting divergence across districts.

Eva Rental Index Ends Four-Week Rally, Eases 0.11% to 116.86

The Eva Rental Index stood at 116.86, down 0.11%, halting a four-week rise. Anticipation of Fed rate cuts reduced borrowing costs, prompting some tenants to switch from renting to buying, causing slight downward pressure on rents. Across regions, the performance was mixed (“two up, two down”). New Territories West saw the sharpest decline, down 0.78% to 134.56, with Tsuen Wan showing the highest proportion of price-cut listings, signaling tenants seizing opportunities to buy. Kowloon also fell 0.38% to 118. In contrast, Hong Kong Island continued its rally, up 0.65% to 124.44, marking four consecutive weekly gains, while New Territories East inched up 0.15% to 122.84, extending its winning streak to six weeks, reflecting resilient end-user demand. Looking ahead, with interest rate expectations and underlying demand in play, the Eva rental index is expected to remain range-bound between 115 and 117 throughout the year.

This week's index reflects the market conditions from September 05, 2025 to September 11, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |