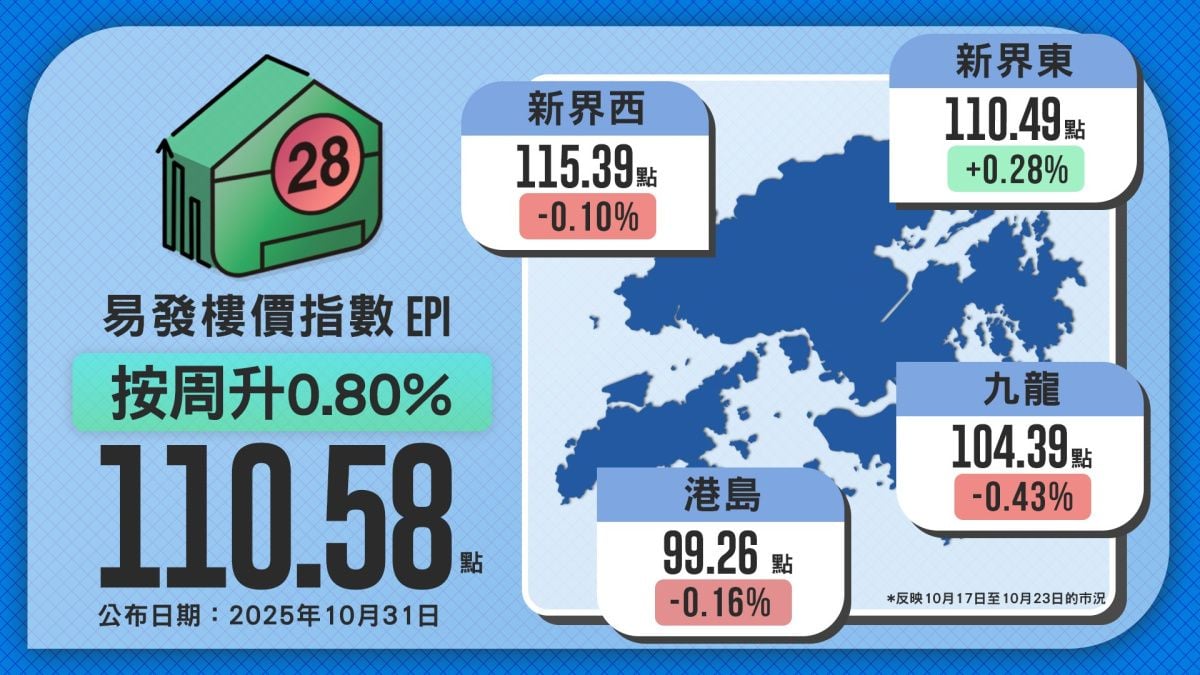

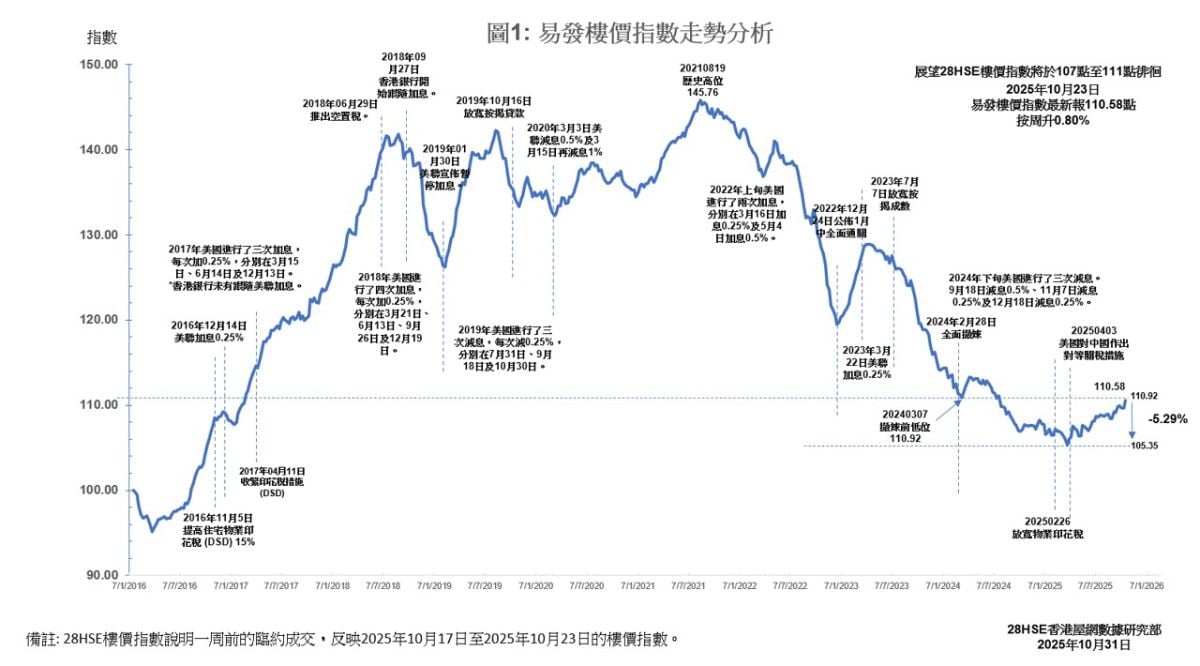

According to the latest data from the Eva Property Index (EPI), the index rose 0.80% week-on-week to 110.58 points, marking the first time it has surpassed the 110-point threshold since the government lifted property cooling measures. The index is expected to gradually approach 111 points, potentially breaking the pre-cooling low of 110.92. Compared to the beginning of the year, prices have climbed 3.41%, though they remain approximately 24% below the historical peak of 145.76 points.

Regional performance showed a “three down, one up” pattern, likely driven by expectations of an imminent rate cut by the U.S. Federal Reserve and continued declines in local mortgage rates, which have lowered homeownership costs and encouraged some renters to enter the market. Despite ongoing fluctuations in China-U.S. relations, the impact on Hong Kong property prices remains limited. The strongest performing region was New Territories East, while the other three districts saw declines.

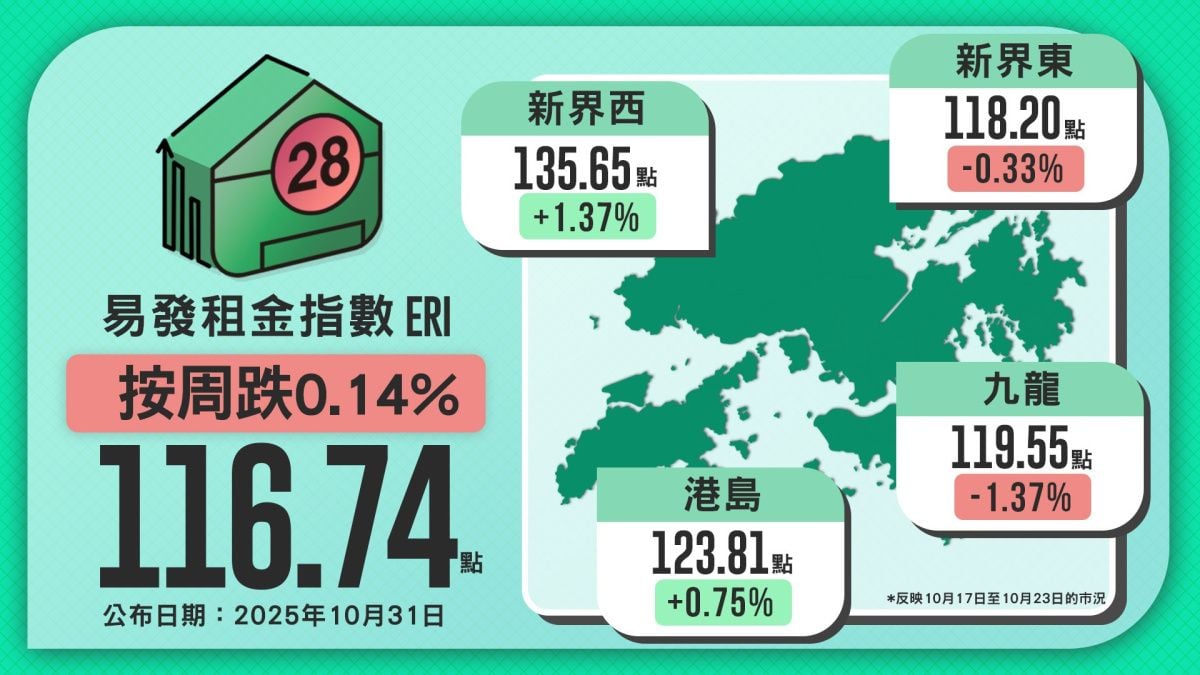

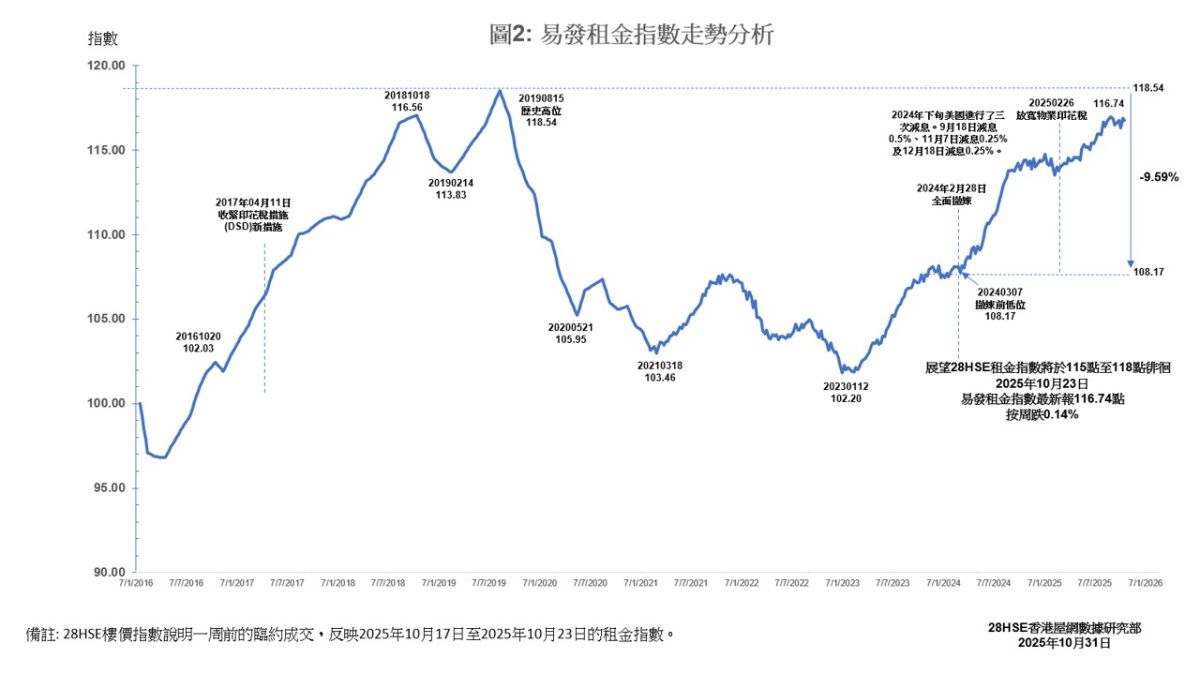

The latest Eva Rental Index (ERI) stood at 116.74 points, down 0.14% week-on-week, yet has remained above the 116-point level for twelve consecutive weeks. Regional rental trends were mixed, with two districts recording gains and two showing declines, reflecting sustained housing demand. In the near term, the rental index is expected to fluctuate narrowly between 115 and 118 points.

Hong Kong’s property prices have remained stable in recent weeks. The Eva Property Index rose 0.80% this week to 110.58 points, up 3.41% year-to-date, though still 24.73% below the 2021 peak. This marks the first post-cooling breakthrough of the 110-point level, edging closer to the pre-cooling low of 110.92 points. Market sentiment has improved, with buyers and sellers viewing geopolitical tensions as short-term. Optimism is further supported by expectations of a Fed rate cut at month-end, which could boost purchasing power and drive transaction volumes. These factors are seen as favourable for buyers and may continue to lift market confidence.

Regional Home Price Trends: Three Down, One Up

This week’s regional home price indices revealed a “three down, one up” trend. Kowloon recorded the largest decline, falling 0.43% to 104.39 points. This was mainly due to a quarterly increase of 359 unsold units, bringing the total to 9,771 units, with significant inventory growth in Wong Tai Sin and Kai Tak (up 1,071 units). Weak initial sales at new developments such as Victoria Harbour Bay Phase 1A and 1B further weighed on secondary prices.

Hong Kong Island’s index dropped 0.16% to 99.26 points, while New Territories West fell 0.10% to 115.39 points. In contrast, New Territories East was the only district to post a gain, rising 0.28% to 110.49 points, marking its second consecutive weekly gain.

On Hong Kong Island, unsold inventory rose for the second straight quarter, up 43 units to 3,271. Tepid sales at the HEADLAND RESIDENCES Phase 1 and JARDINI led to inventory increases in Shau Kei Wan and Causeway Bay (up 537 and 105 units, respectively). Although sales at the DEEP WATER PAVILIA - THE SOUTHSIDE Phase 5A and 5B were solid, the overall rise in inventory slightly dampened secondary market prices.

Looking ahead, the one-month HIBOR has hit a record low, potentially reducing mortgage costs and boosting buyer interest. Investors remain optimistic despite geopolitical uncertainties, and analysts expect the home price index to continue climbing toward 111 points.

Rental Index Dips 0.14%, Remains Elevated

In the leasing market, the Eva Rental Index edged down 0.14% this week to 116.74 points. With the summer rental peak now over, rental levels have slightly softened but remain near year-to-date highs. A new peak remains within reach. The government’s expansion of non-local student quotas at tertiary institutions is expected to continue supporting rental demand, keeping the index within the 115–118 point range in the short term.

This week saw mixed rental performance across districts. New Territories West led gains, rising 1.37% to 135.65 points, extending its two-week rally. Hong Kong Island followed with a 0.75% increase to 123.81 points, also up for two consecutive weeks. Conversely, Kowloon fell 1.37% to 119.55 points, while New Territories East declined 0.33% to 118.20 points.

The data reflects market conditions from October 17 to October 23, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |