- Home

- News

- Property Index

- Eva Property Index Holds Steady At 108 Points With Mixed Regional Trends: Three Down, One Up|rental Index Remains Near Record High Despite Slight Dip

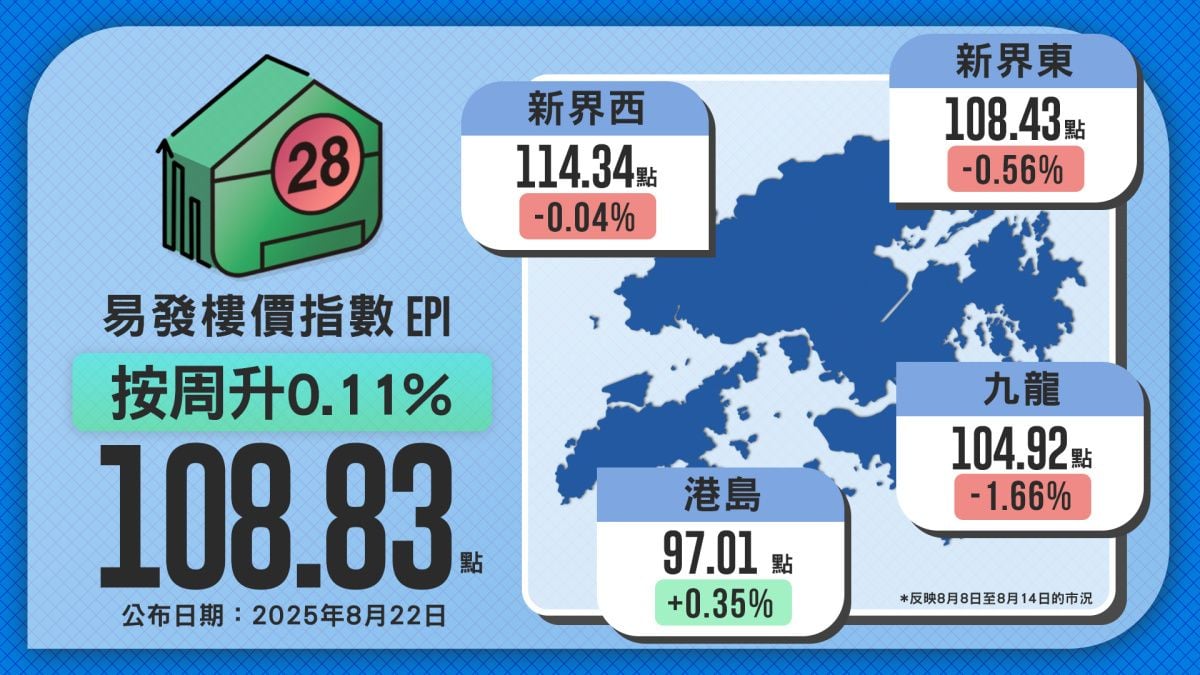

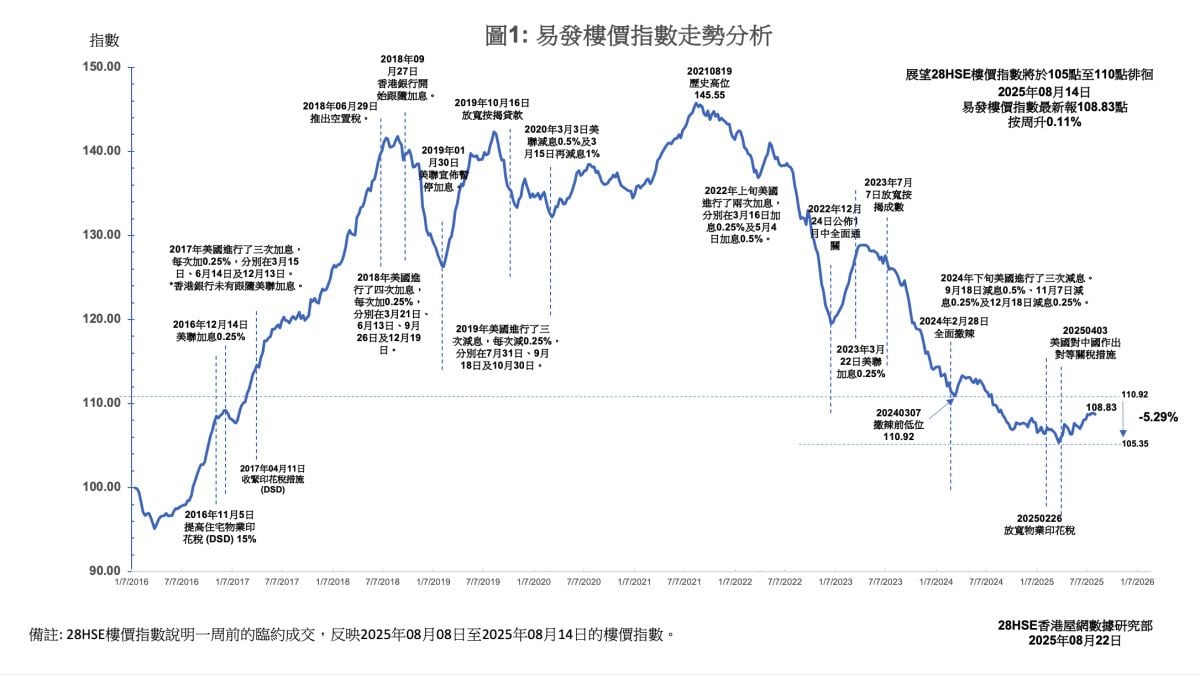

The Eva Property Index recorded 108.83 points this week, marking a slight weekly increase of 0.11%. This is the eighth consecutive week that the index has remained above the 108-point level, signalling a warming trend in the overall market sentiment. However, regional index trends show a "three down, one up" pattern, likely influenced by the strong sales of new developments in the former Kai Tak Runway area.

The largest decline was observed in Kowloon, with its property index dropping 1.66% week-on-week to 104.92 points. New Territories East followed, reporting 108.43 points with a 0.56% weekly decline. New Territories West saw a marginal dip of 0.04%, settling at 114.34 points. Conversely, Hong Kong Island was the only region to experience growth, with its property index rising 0.35% to 97.01 points.

This week’s Eva Property Index at 108.83 points, up 0.11% week-on-week, reflects a stable market. However, the key factor affecting short-term property prices remains interest rate trends. Over the past few months, mortgage rates (Hibor-linked) have fluctuated significantly, with the effective rate peaking at 2.85% last week—a three-month high.

When the effective rate surpasses 4%, exceeding the capped rate of 3.5%, it leads to higher monthly payments. For example, a loan of HK$4 million with a 30-year repayment term now costs 25% more in monthly payments compared to mid-June when rates were at their lowest.

According to research by 28Hse, rising borrowing costs may deter buyers, potentially leading to a decline in both primary and secondary market transactions in the short term. While property prices appear stable, agents report that sellers have become more aggressive in pricing. However, buyers are hesitant to meet these higher asking prices, especially given the rising interest rates. This suggests that sellers may find it harder to set high prices, and short-term property prices may face downward pressure.

The market is now closely watching for the potential Fed rate cut in September, which could prompt Hong Kong banks to lower their prime lending rates. If that happens, the Eva Property Index may climb back to 110 points in October.

Mixed Regional Trends: "Three Down, One Up"

The regional indices show a mixed trend of three declines and one rise, with notable price drops in regions where new projects were actively sold.

The steepest decline was in Kowloon, where the index fell 1.66% week-on-week to 104.92 points. This drop is attributed to the launch of Victoria Voyage in Kai Tak, particularly Phase 1B of the project, where the developer set record-high prices for the area. Last Friday, the first batch of 62 units was released, with half sold on the same day–an outcome better than expected.

Meanwhile, other unsold units in the area are actively being promoted, likely diverting purchasing power away from the secondary market in Kowloon.

New Territories East experienced the second-largest drop, with its index falling 0.56% week-on-week to 108.43 points. This is likely due to the strong sales of remaining units at Villa GardaVILLA GARDA III at Lohas Park, which also diverted demand from the secondary market. New Territories West saw only a slight decline, down 0.04% to 114.34 points.

In contrast, Hong Kong Island was the only region to record an increase, with its index rising 0.35% week-on-week to 97.01 points.

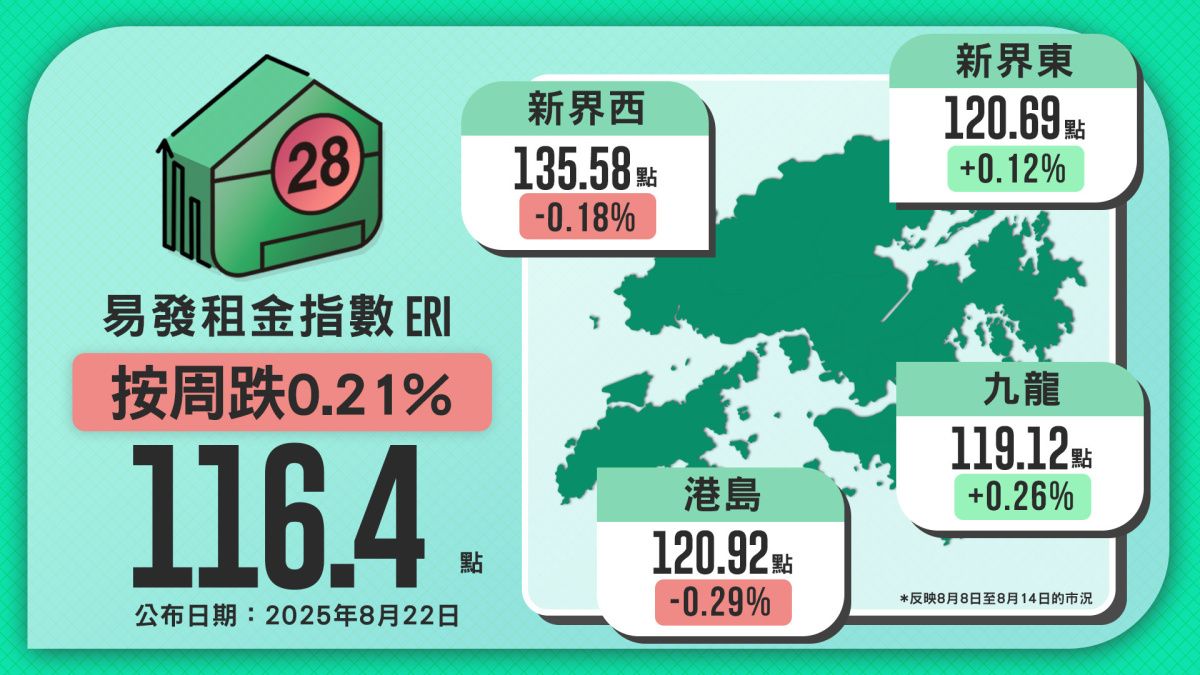

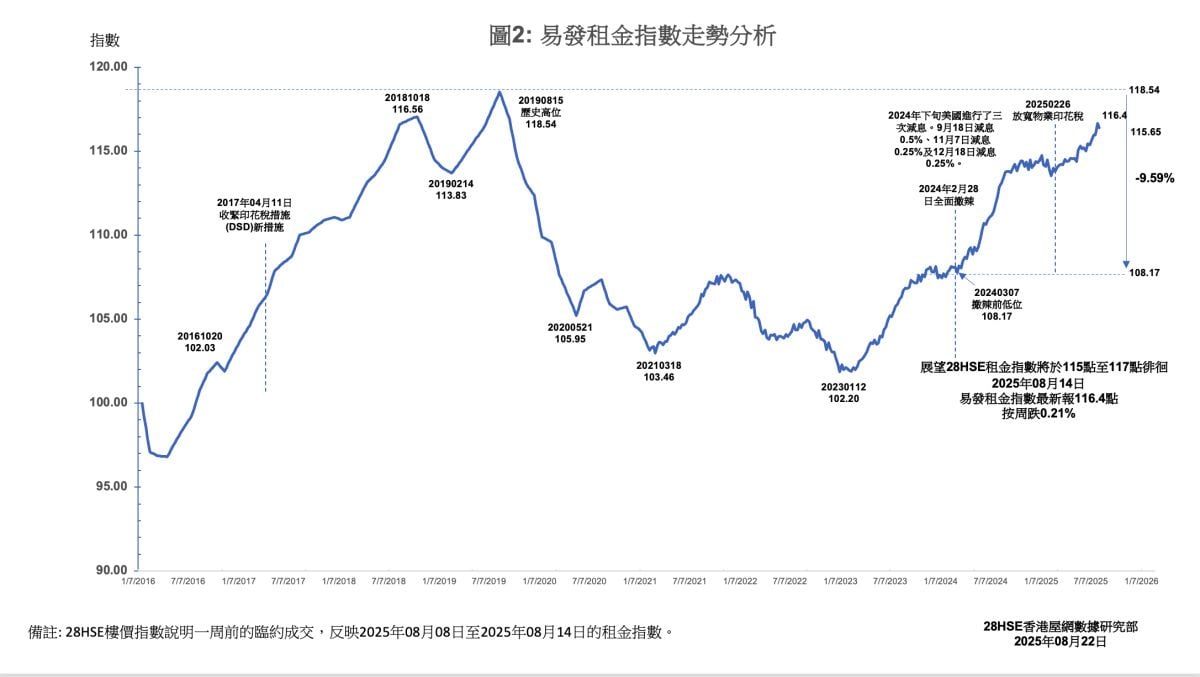

Eva Rental Index Sees Slight Dip of 0.21% but Remains Near Record High

Following a record high the previous week, the Eva Rental Index dipped slightly by 0.21% this week to 116.4 points, maintaining its position near historical highs. Regional trends show "two up, two down," with Hong Kong Island experiencing the largest decline, dropping 0.29% week-on-week to 120.92 points.

New Territories West also recorded a marginal dip of 0.18% to 135.58 points. On the other hand, Kowloon saw the largest increase, rising 0.26% to 119.12 points, while New Territories East edged up 0.12% to 135.58 points.

The strong rental demand has been driven by the summer leasing season and the arrival of skilled mainland professionals in Hong Kong. However, with the summer season nearing its end, the student rental surge may also wind down, potentially softening rental prices. Nonetheless, rents are expected to remain elevated. Over the next two months, the Eva Rental Index is expected to fluctuate between 115 and 117 points.

This week's index reflects the market conditions from August 08, 2025 to August 14, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |