- Home

- News

- Property Index

- Eva Property Index Holds Steady At 108 Points For 6 Weeks, New Developments Suppress Second-hand Market, Rental Index Remains Strong

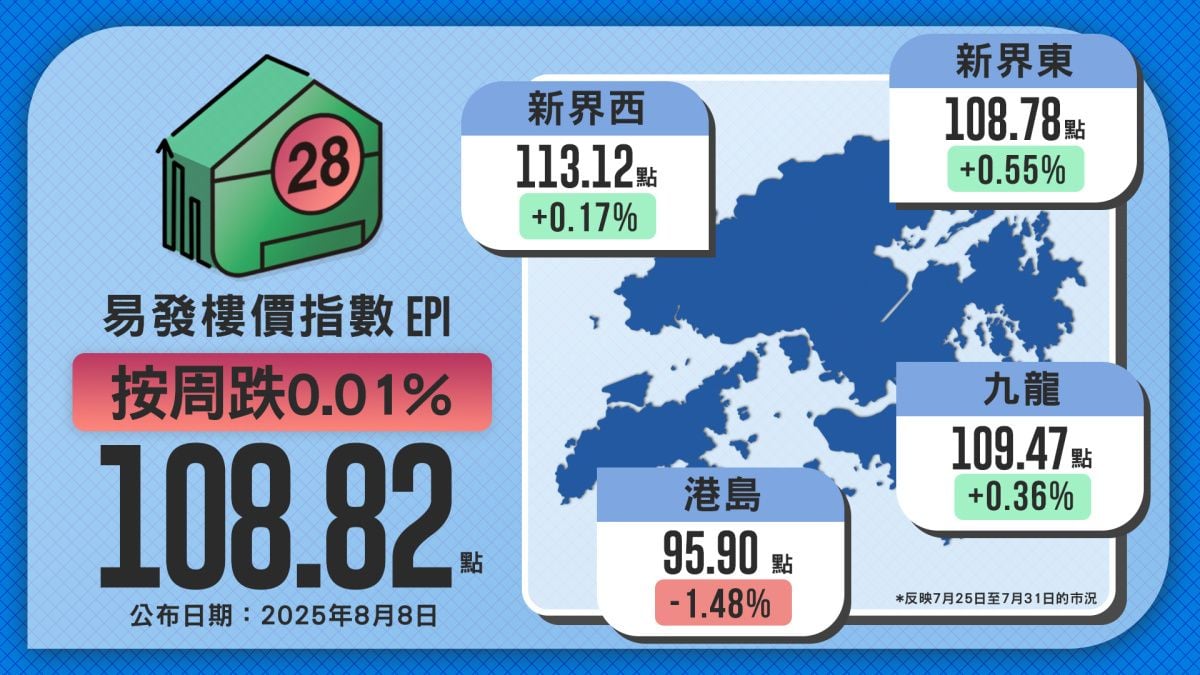

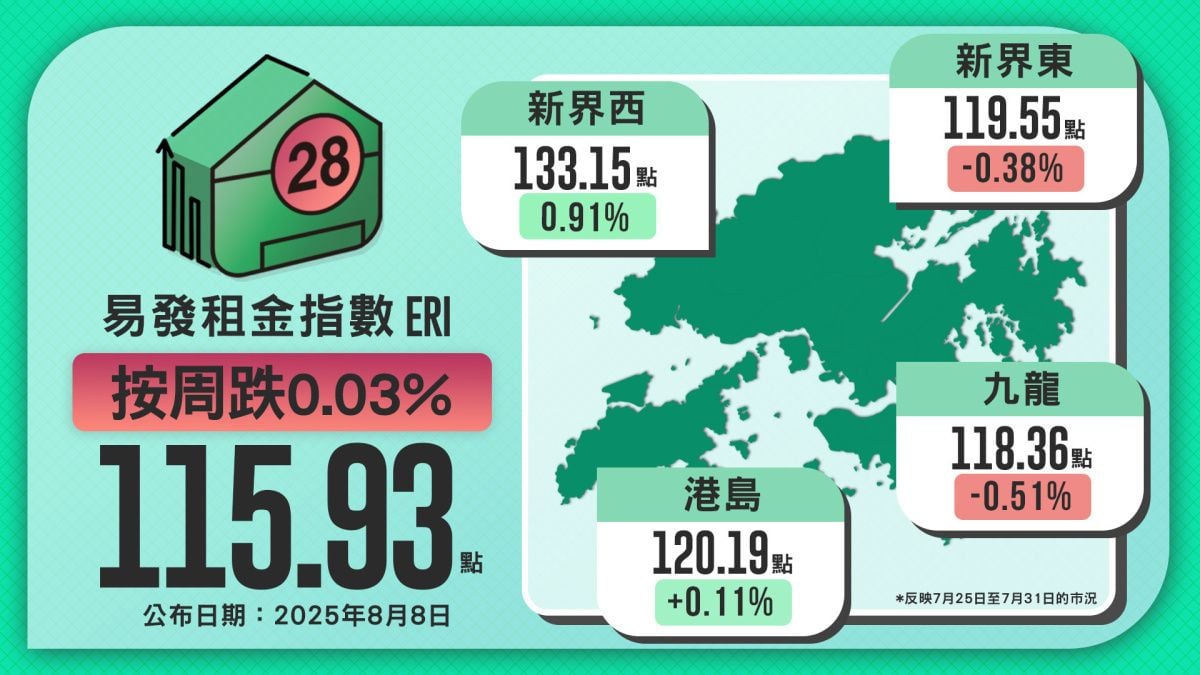

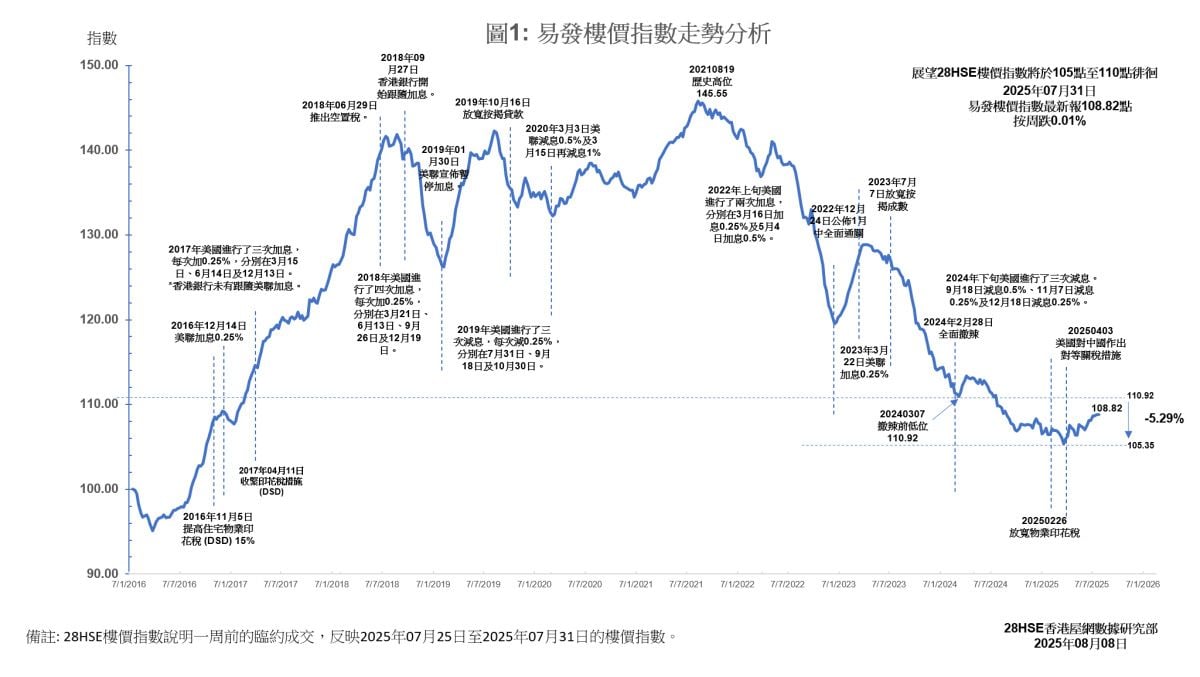

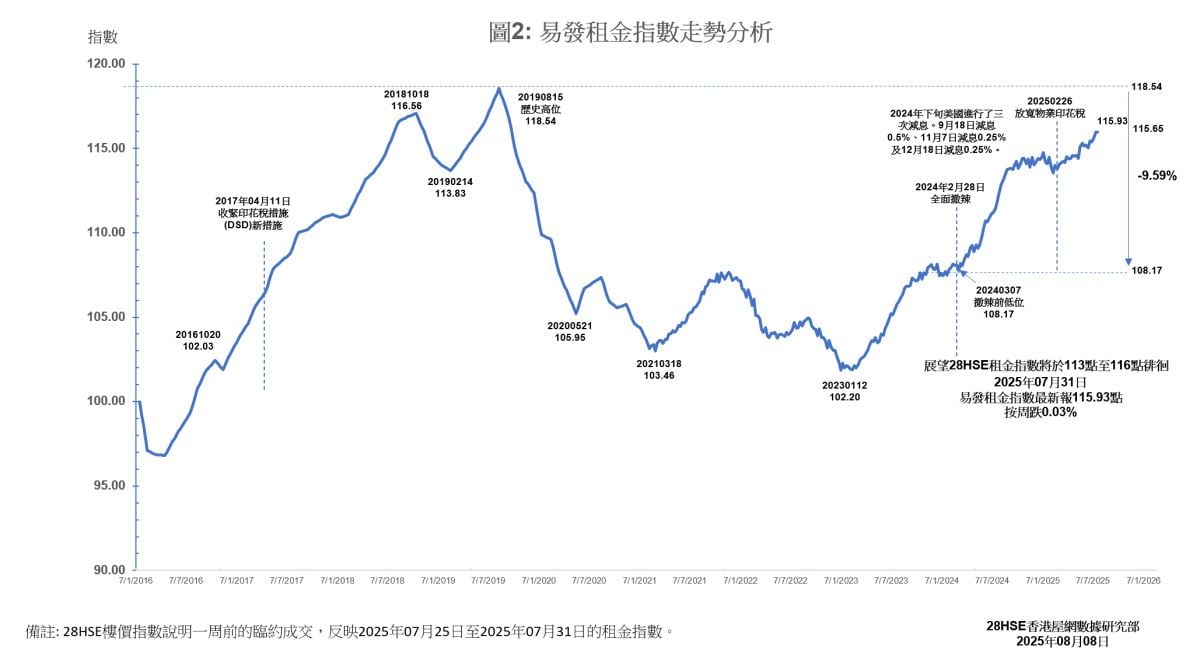

The Eva Property Index reported 108.82 points, remaining stable at the 108-point level for six consecutive weeks, though transactions hit a 13-week low. The second-hand market faces pressure from primary inventory and low-price promotions, potentially testing the 107-point level. Hong Kong’s new developments are selling strongly, dragging second-hand prices down by 1.48%, while Kowloon and the New Territories recorded gains. The rental index reported 115.93 points, holding firm for 11 weeks, with Hong Kong and New Territories West rising, while Kowloon and New Territories East saw declines.

Eva Property Index at 108.82 Points, Stable for Six Weeks

The Eva Property Index stood at 108.82 points, maintaining the 108-point level for six weeks, signaling initial signs of a price bottom. However, it dipped slightly by 0.01% in the latest week, indicating a stagnant market. The U.S. Federal Reserve has kept the federal funds rate unchanged at 4.25% to 4.5% for five consecutive meetings, and Hong Kong’s three major banks have maintained their prime rate at 5.25%, influencing property price trends. Potential buyers, observing the Fed’s inaction, are largely adopting a wait-and-see approach. Agency data shows that over the July 26-27 weekend, transactions at the top 50 estates totaled just 75, down 14% week-on-week, marking a 13-week low. While rate cuts are widely expected in September, the primary residential inventory remains high at around 20,000 units, with developers continuing low-price promotions, diverting purchasing power to the primary market. This is likely to keep second-hand prices under pressure in the short term, with the Eva Property Index potentially testing 107 points later this month.

Hong Kong District Drags Overall Index, Regional Trends Show “Three Gains, One Loss”

The new development market in Hong Kong remains robust, further diverting demand from the second-hand market. The “Morning II” project above Wong Chuk Hang sold about 90% of its 88 units in its first launch, highlighting strong appeal for new developments in the area and significantly drawing buyers away from the second-hand market. As a result, Hong Kong’s property price index fell to 95.9 points, down 1.48% week-on-week. In contrast, Kowloon performed relatively well, rising 0.36% to 109.47 points. New Territories East rebounded, up 0.55% to 108.78 points, while New Territories West continued its eight-week upward trend, reaching 113.12 points, up 0.17% week-on-week.

Eva Rental Index Holds at 115 Points for 11 Weeks, Latest at 115.93 Points

As Hong Kong enters the traditional peak rental season, rental performance remains strong. The Eva Rental Index reported 115.93 points, down slightly by 0.03% week-on-week but holding above 115 points for 11 consecutive weeks, indicating stable rental demand. Regional trends showed a “two gains, two losses” pattern: Hong Kong rose 0.11% to 120.19 points, and New Territories West climbed 0.91% to 135.15 points, continuing a two-week rise. Conversely, Kowloon fell 0.51% to 118.36 points, and New Territories East dropped 0.38% to 119.55 points, marking its first decline after seven weeks of gains, suggesting rental demand in the area has been digested, leading to an adjustment in the rental index.

This week's index reflects the market conditions from July 25, 2025 to July 31, 2025

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |