The epidemic has slowed down the progress of building and selling houses, and new projects in the next 4 years will "surge" in disguise

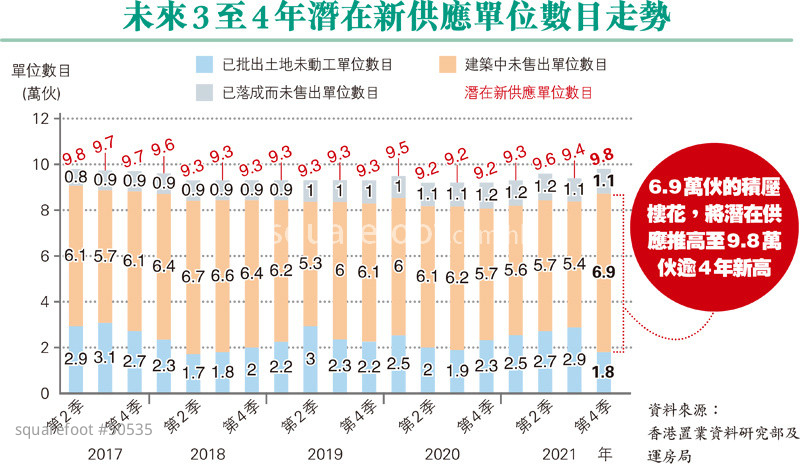

The Bureau of Transportation and Housing of the Special Administrative Region Government announced yesterday the private housing supply figures for the fourth quarter of last year, showing that the potential new housing supply in the next three to four years will reach 98,000 units, an increase of 4,000 units quarter-to-quarter, a 4.5-year high and tying the record high. However, a careful analysis of the potential supply situation is mainly due to the fact that last year, many projects were affected by factors such as the epidemic and the economic downturn. The delay in construction and the delay in the sale of new properties by developers resulted in a sharp increase in the backlog of uncompleted properties, such as unsold uncompleted properties in the previous quarter. Compared with the 54,000 units in the third quarter, it increased by nearly 28% to 69,000 units. The industry did not change its forecast on the future housing supply shortage yesterday, believing that the government cannot relax the construction of land. ◆reporter Yan Lunle

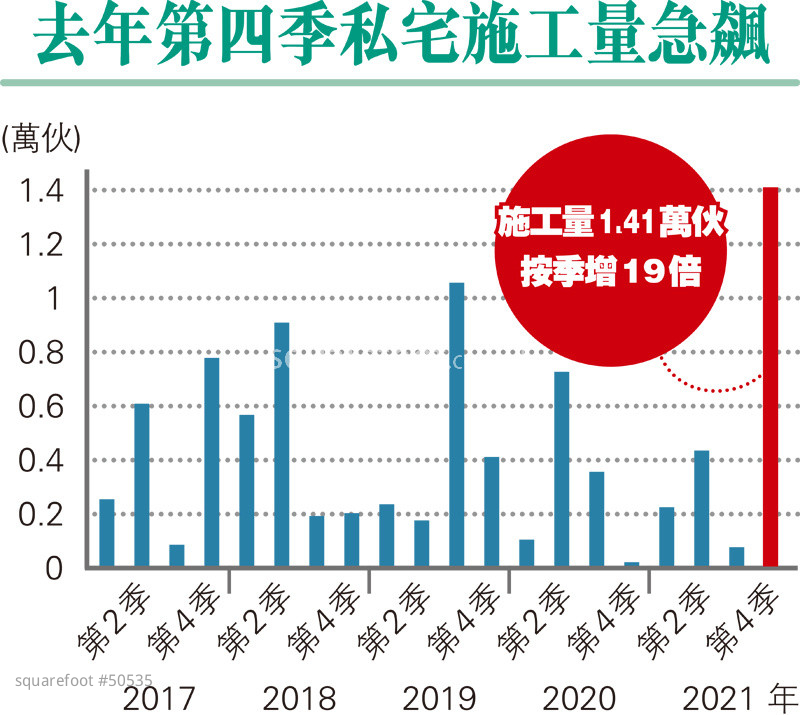

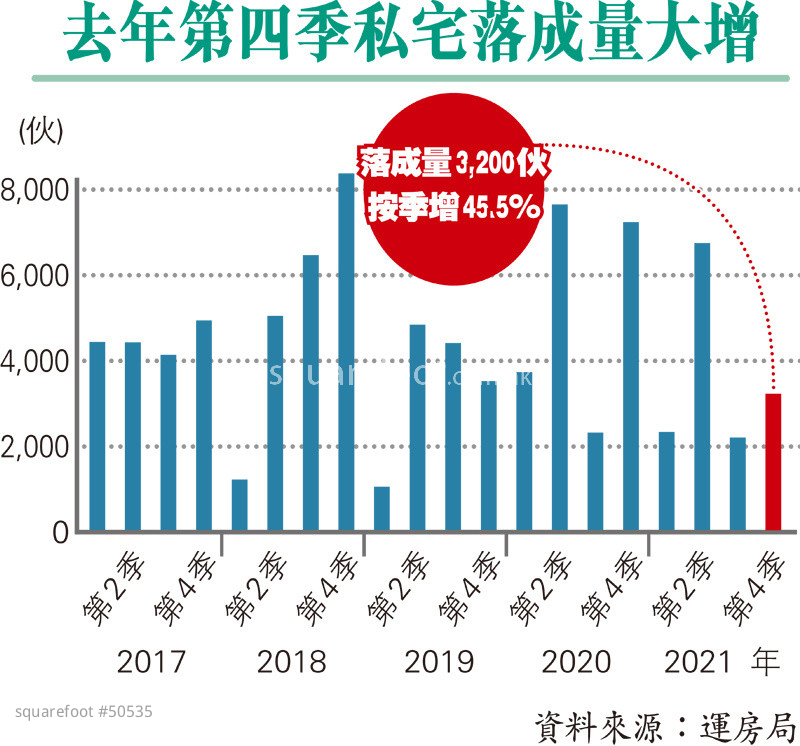

According to the announcement, the construction volume of private residences in the fourth quarter of last year was 14,100 units, an increase of more than 19 times compared with the 700 units in the third quarter, a record high; An increase of 9,500 units or 80.5%, the highest number in the past five years. Due to the increase in construction volume, the number of uncompleted units for sale also increased to 69,000 units, an increase of about 27.8% from the 54,000 units in the third quarter. At the same time, the number of units at the end of the goods did not decrease, maintaining 11,000 units for two consecutive quarters. As a result, the number of potential supply in the next three to four years has soared to 98,000 units, an increase of 4,000 units quarter-on-quarter, tying the record high in the second quarter of 2017, which was a 4-1/2-year high.

Make up for the lagging construction progress in the first three quarters

A spokesman for the Transportation and Housing Bureau added yesterday that among the 98,000 potential supply units, it is estimated that 85,000 units are small and medium-sized units with a usable area of less than 70 square meters (753 square feet), accounting for 87% of the overall supply, an increase of 5% from the previous quarter. %. The bureau expects nine residential sites to be converted into ready-to-use land in the next few months, providing about 6,400 units. The spokesman pointed out that as the government continues to increase the supply of housing and land in an orderly manner, it is believed that the supply of private housing can be maintained at a relatively high level in the next three to four years.

However, the industry generally believes that the large increase in new supply is mainly due to the impact of the epidemic, which has caused a sharp increase in the backlog of uncompleted properties. The actual increase is not much. Statistics show that the construction volume in the first three quarters of last year was only 7,200 units, a record low for the same period in 2012. Therefore, the construction volume in the fourth quarter only recovered the lagging progress in the first three quarters. Even though the annual construction volume finally rose to a high of 21,300 units last year, in 2020 and 2021, the average annual construction volume for the two years is actually only 16,550 units, which is still slightly lower than the annual average of 17,967 units from 2017 to 2019, and the project construction It will take time to complete, so the short-term supply will not increase significantly due to the surge in construction last year.

Fiscal year land supply purely depends on private projects to increase suddenly

Furthermore, most of the new construction sites are from private projects, and the sustainable supply is questioned. Liu Jiahui, chief analyst of Midland Properties, pointed out that the land sales plan for this fiscal year will reach 20,000 units, which is more than 55% higher than the annual target of 12,900 units and a new record in four years.However, if you look closely at the source of land, the land supply in the fiscal year exceeds the standard. The over 10,000 units actually come from the category of private development/redevelopment projects. In the past, the average annual supply of this part was only about 3,000 units. Reconstruction projects can provide stable supply, and potential new supply can continue to stabilize at a high level.

Huang Liangsheng, senior co-director of the research department of Centaline Real Estate, also believes that the latest increase in potential supply is not a signal of a sharp increase in supply. It is due to the low construction volume in 2020 and the delay in construction of many projects until 2021. For example, this situation has also occurred in the past. In 2015 (14,200 units) and 2016 (25,500 units), the two-year average was 19,850 units.

The completion of the project is postponed to this year or it will be greatly increased

He continued to point out that although the latest potential supply reached 98,000 units, it was as low as 92,000 units at the end of 2020. This situation is also due to the impact of the epidemic on the construction progress, and the 2021 figure was pushed up due to construction delays, not because of a shortage of supply. increase. It is worth noting that in the fourth quarter of 2021, the number of new supply of land that has been approved and yet to start construction dropped to 18,000 units, a decrease of about 37.9% from the 29,000 units in the third quarter, the lowest level in recent years. Whether the number is temporarily low due to the epidemic, or continues to be low, is related to the rise or fall of new supply in the future.

The number of completions was also affected by the epidemic. In the fourth quarter of last year, 3,200 units were recorded. Although it increased by 45.5% quarter-on-quarter, it was only 14,400 units for the whole year. The RVD's annual completion forecast is about 18,230 units, a decrease of about 21%, which is about 3,800 units less than the original forecast last year. These units will be completed later this year. Therefore, the number of completions this year will increase significantly. Midland predicts that there will be about 20,000 units, and Central Plains estimates that it will reach as many as 24,700 units.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |