- Home

- News

- Property Index

- New Property Discounts Attract Buyers, Shifting Market Focus — Eva Rental Index Hits New High For 2025

Low-Priced New Developments Divert Market Attention

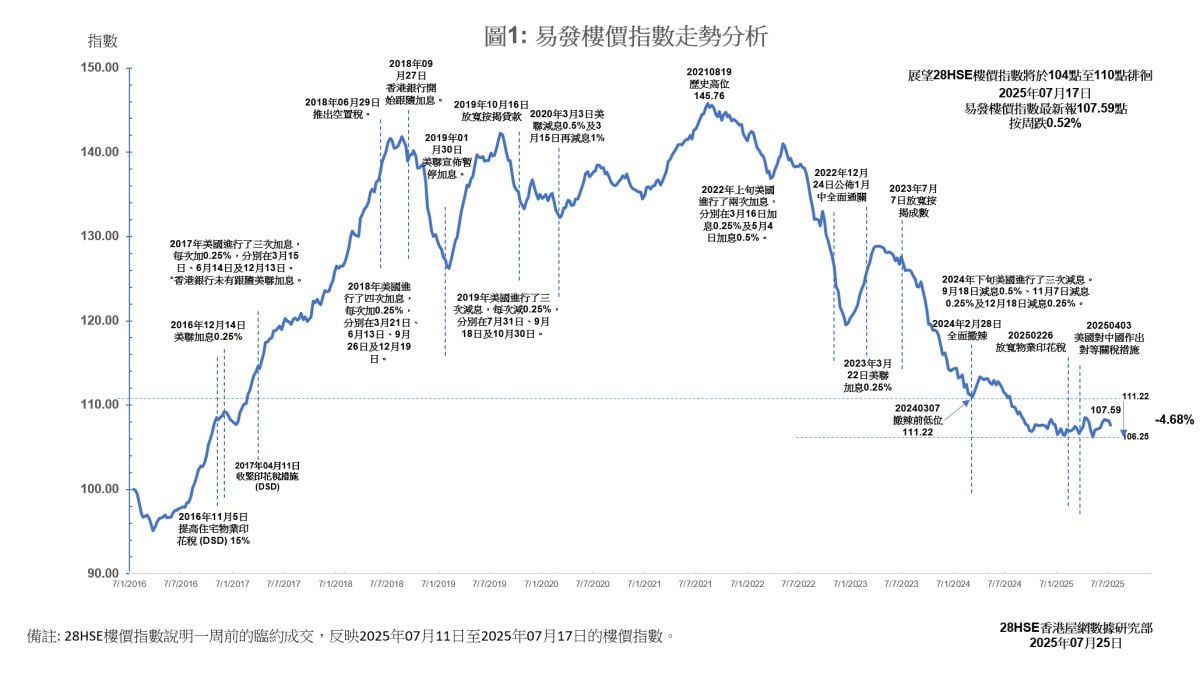

Recently, discounted promotions of new developments have drawn the spotlight, diverting attention from the second-hand market. As a result, second-hand transactions have slowed, and the Eva Property Index has hovered between 107 and 108 points for nine consecutive weeks, reflecting a stalemate in the property market.

However, regional price trends are diverging: New Territories East has seen gains for four weeks in a row, and Kowloon also recorded notable increases. In contrast, Hong Kong Island experienced declines.

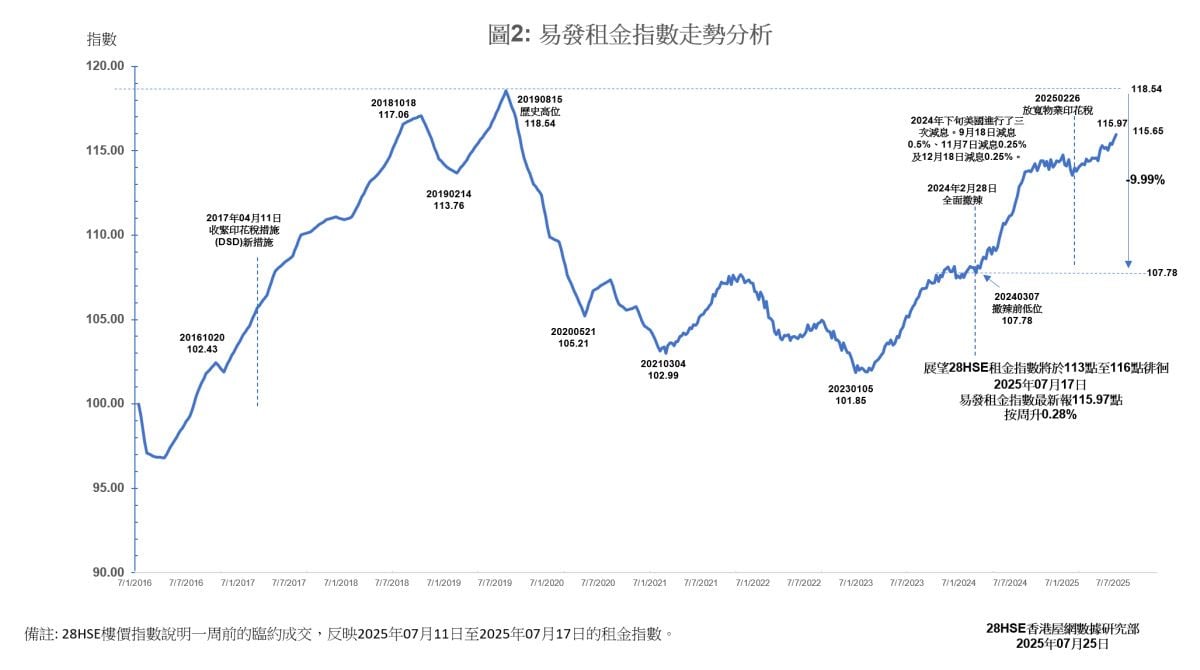

Meanwhile, the summer rental peak season has driven up rental demand. Mainland students renting early ahead of the school year have pushed up rents, with the Ricacorp Rental Index climbing to 115.97 points — a new high for the year — and it is expected to continue rising before the academic term begins.

Stalled Eva Property Index Amid Mixed Signals

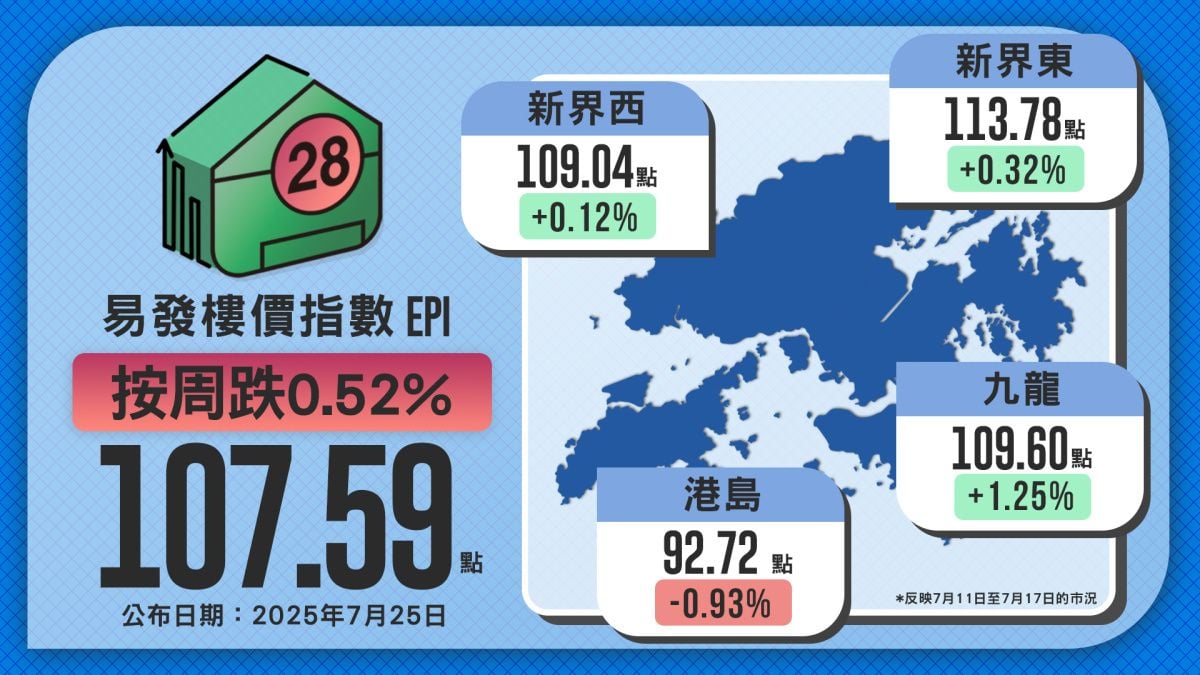

The latest Eva Property Index stands at 107.59, a slight week-on-week drop of 0.52%, indicating narrow fluctuations amid a lack of new positive drivers.

Over the past weekend, although there were no major new project launches, some leftover units were aggressively discounted. These included 65 units sold in one day at 9 Eastern Street in Sai Ying Pun and 109 transactions recorded in a new round of sales for Phase 3A of Novoland in Tuen Mun. These deals absorbed much of the buying power, leaving the second-hand market quieter.

Additionally, macroeconomic uncertainty — including U.S.-China tariff concerns and speculation over whether the U.S. Federal Reserve will start a rate-cut cycle in September — has led many buyers to adopt a wait-and-see attitude, dampening their interest in entering the market.

Data from the four major property agencies show that second-hand transactions at the top 10 housing estates dropped to single-digit levels over the weekend, down about 30% week-on-week. With no fresh momentum, the price index has remained in a narrow range between 107 and 108 for nine weeks, reflecting a tug-of-war in the market. Unless significant policies or positive macroeconomic news emerge, the market is expected to remain stagnant in the short term.

Regional Trends: Three Rise, One Falls — New Territories East Up 4 Weeks

While new launches have attracted attention, some buyers who failed to secure their desired new flats have returned to the second-hand market, creating diverging price trends.

Recent data shows three regions with rising prices and one with a decline:

Kowloon: Most significant rise, index at 109.6 (+1.25% week-on-week)

New Territories East: Continued strength, index at 113.78 (+0.32%, 4 weeks of increases)

New Territories West: Ended previous decline, index at 109.04 (+0.12%)

Hong Kong Island: Continued downward pressure due to aggressive promotions at 9 Eastern Street and the upcoming launch of The Southside II in Wong Chuk Hang. Index fell to 92.79 (−0.93%), remaining at the low range between 92 and 93.

Overall, while new projects support market sentiment, their "diversion effect" has pressured certain districts. Short-term price trends are likely to continue showing regional discrepancies.

Eva Rental Index Hits 2025 High — Climbs for 2 Weeks in a Row

With the summer rental peak underway, many mainland students have begun renting flats early for the upcoming school year, fueling sustained growth in the rental market.

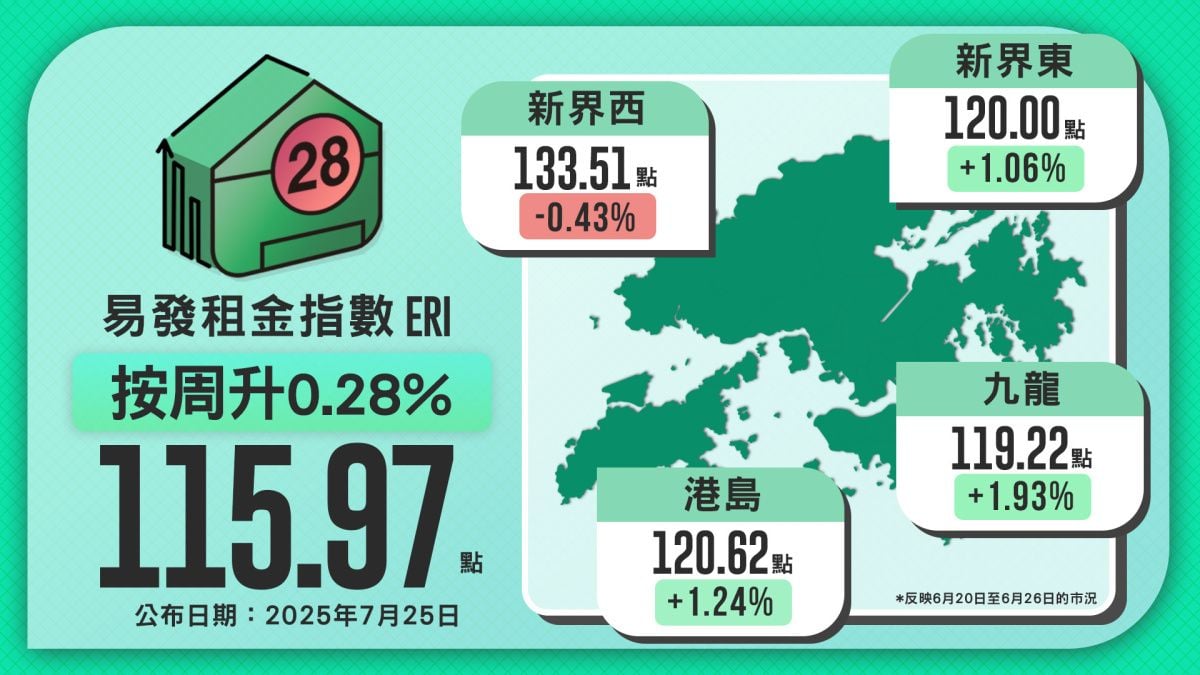

The Eva Rental Index rose to 115.97 (+0.28% week-on-week), marking its second consecutive weekly increase, signaling steadily rising rental demand.

Rental increases were especially notable in areas near universities:

Hong Kong Island: 120.62 (+1.24%), 2 weeks of gains

Kowloon: 119.22 (+1.93%)

New Territories East: 120.00 (+1.06%), 5 weeks of gains

These increases highlight strong demand in core areas with good transport and education resources.

By contrast, New Territories West underperformed, with the index slightly down to 133.51 (−0.43%), the only region to register a drop.

Overall, the summer surge and academic-related rental demand are pushing the rental index upward. With the school term approaching, there is still room for further rent increases.

This week's index reflects the market conditions from July 11, 2025 to July 17, 2025

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |