- Home

- News

- Property Index

- Triple Negative Pressures Weigh On Property Market: Weak Transaction Volumes And Continued Narrow Fluctuations In Prices

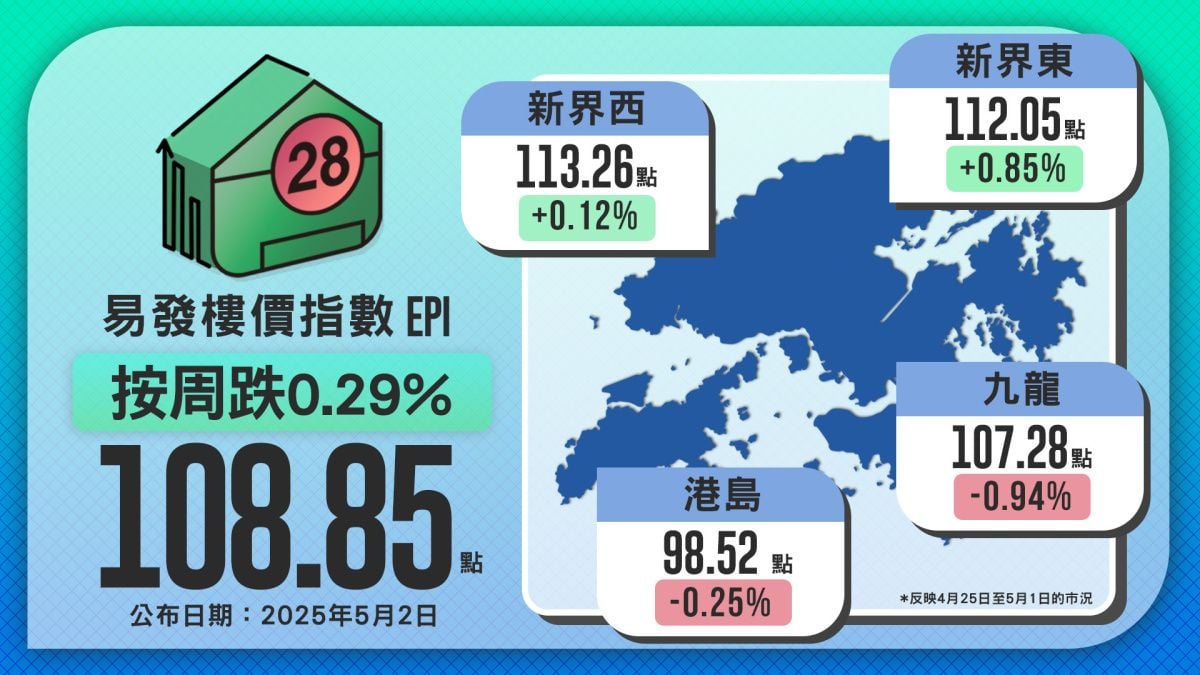

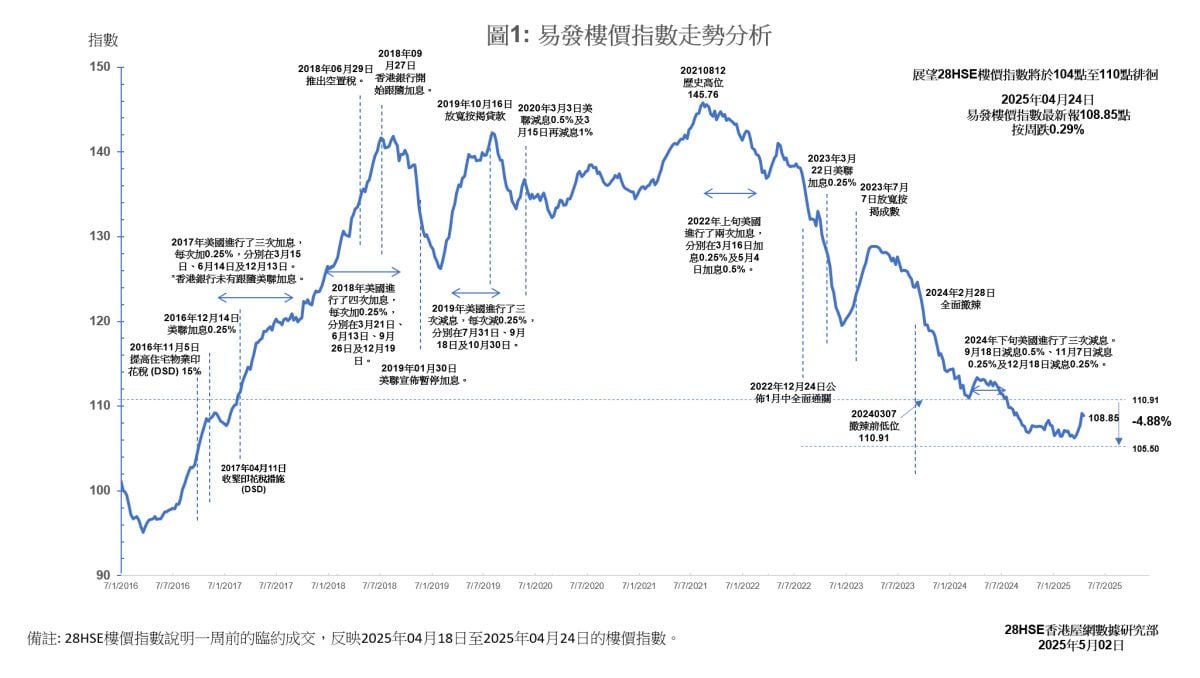

The Hong Kong property market remains weak amid multiple negative factors. According to the latest data, the Eva Property Price Index stands at 108.85 points, down 0.29% week-on-week, reflecting that housing prices continue to trend downward due to a lack of substantial transaction support, with no signs of overall market improvement.

This week's index reflects market conditions from April 18 to April 24, 2025. Coinciding with the Easter long holiday, a surge in outbound travel became one of the main reasons for the short-term cooling of the property market. According to Immigration Department data, about 2.46 million outbound trips were recorded during the holiday, significantly dampening the traditionally busy property season. The flow of tourists diverted purchasing demand and hindered property viewings, leading to a sharp drop in second-hand transactions and a lack of momentum for price increases.

In addition to the holiday effect, supply pressure continues to build, becoming a significant structural issue weighing on prices. Real estate agents report that the inventory of unsold new private housing units has increased for four consecutive quarters, remaining above 20,000 units for seven straight quarters, highlighting the substantial clearance pressure developers are facing. Against this backdrop, developers have been actively launching projects with prices aligned with or below market expectations to boost sales. This week’s highlight is the first-round sale of Sierra Sea in Sai Sha, expected to attract strong buying interest due to its appealing pricing, further diverting demand from the second-hand market and intensifying competition.

Meanwhile, global uncertainties are further dampening buyer confidence. The resurgence of China–U.S. trade tensions, with the U.S. recently announcing tariffs of up to 145% on all Chinese imports, has heightened geopolitical and economic risks, sparking concerns over the global economic outlook. Combined with Hong Kong’s sluggish economic recovery and unclear trends in inflation and interest rates, many prospective buyers have become cautious, pushing second-hand market activity further into the doldrums.

Property Price Index Shows Mixed Trends Across Regions

The latest weekly Eva Property Price Index presents a “two up, two down” pattern, indicating diverging price trends across regions and an overall lack of stable market sentiment. Among them, the New Territories performed relatively steadily. The New Territories East index rose 0.85% week-on-week to 112.05 points, the highest increase across all regions; New Territories West also recorded a slight increase, up 0.12% to 113.26 points. The upward trend was mainly supported by some recent transactions, showing continued demand from end-users and first-time buyers.

In contrast, urban property prices were weaker. Kowloon saw the sharpest decline, with the index dropping 0.94% week-on-week to 107.28 points, possibly due to weaker buyer confidence and greater room for negotiation. Hong Kong Island also recorded a slight dip of 0.25%, with the index at 98.52 points—the lowest among all four regions—likely linked to a slowdown in high-end property transactions.

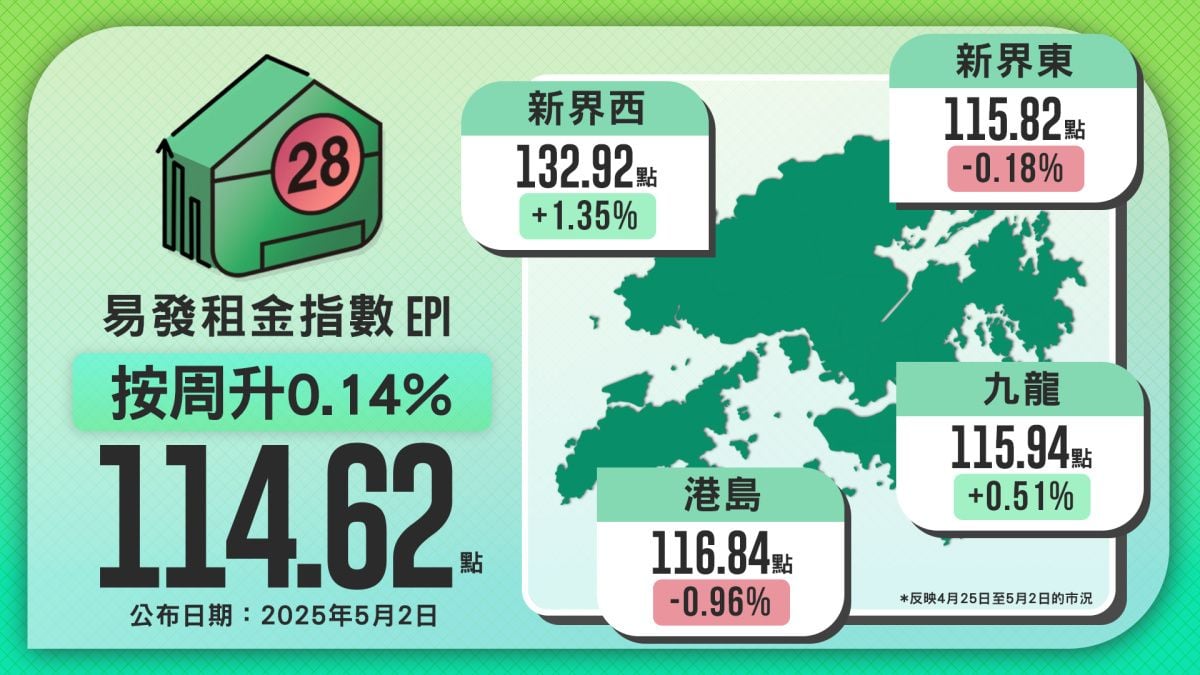

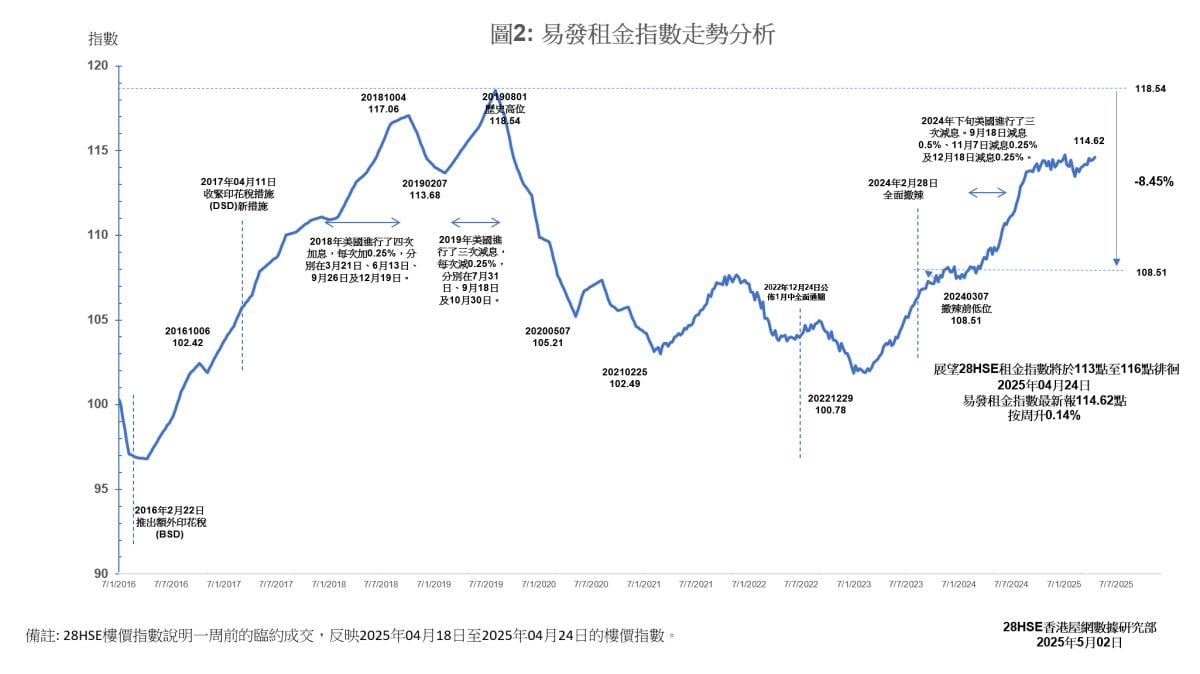

Cautious Market Sentiment Spurs Continued Rise in Rental Index

With property prices under continued pressure and concerns over further declines, many prospective buyers have adopted a wait-and-see attitude and opted to rent instead of buy, revitalizing Hong Kong's rental market. The latest Eva Rental Index rose 0.14% week-on-week to 114.62 points, marking two consecutive weeks of increase and reflecting steady growth in leasing demand.

By region, New Territories West saw the most notable rental increase, with the index up 1.35% week-on-week to 132.92 points. The strong rental demand there may be due to relatively low base rents, ongoing improvements in transport infrastructure, and rising demand for affordable rentals. Kowloon also recorded a notable rise, with the index up 0.51% week-on-week to 115.94 points, showing that the urban rental market is also benefiting from the shift from buying to renting.

Looking ahead, as more potential buyers delay home purchases and turn to renting, the rental index is expected to continue its moderate upward trend in the short term. If market sentiment does not improve significantly, and with the student rental season and influx of foreign professionals in the second half of the year, the rental index could potentially reach 115 points by year-end—a new high for the year.

This week's index reflects market conditions from April 18 to April 24, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |