- Home

- News

- Property Hit News

- The Price Of Property Stop The Six Months Decline

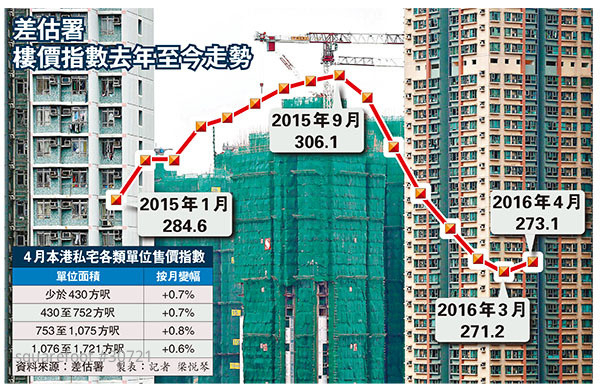

finally see the Hong Kong residential prices have fallen for six months after gasping for breath, the Rating and Valuation Department data show that in April monthly prices index rose slightly by 0.7% to 273.1, small and medium units larger rebound. First four months of this year, the cumulative decline narrowed to 4.18%, with the peak in September last year prices are down more than 10.78%. Market participants believe that prices are merely a brief rebound in April, Hong Kong's economic outlook remains bleak, single-handedly face of increased supply and interest rates continued haze in the second half material prices continued to fall 3-10%.

Department difference estimate yesterday announced April monthly private residential price index to rise 0.7 percent to 273.1 points, regardless of medium and small units or large units over thousand feet, and property prices have rebounded, but was down about 8%. Among an area ranging from 753 feet to 1,075 feet in large units larger rebound, an increase of 0.8%. As an area of less than 430 feet of small units also rose 0.7%. The area above 1,076 feet and large residential units priced index was 258.8 points, a monthly rise of about 0.6%, compared with September last year, the high tired and fell about 8%, reflecting a strong rebound of small and medium units.

Central China: Kowloon East estates rising market power

Another data show that in April rent private houses fell slightly 0.12% to 163.2, dropping seven months, but the decline narrowed 0.19 percentage points compared with March this year, the cumulative down 4.67%, compared with the high of 177.5 in September last year, tired and fell 8.05% . Among Hong Kong Island and the New Territories area of 431 feet or less per square foot rent small units fell, were 36.7HKDand 22.3 yuan, down 1.5% on a monthly basis and 4.4%. However, Kowloon related sq.ft Rent 29.6 million, a monthly rise of 4.9%.

Centaline Property Research seniorAssociate Director Liang-liter pointed out that the private residence of April prices rebound after rebound in property prices was mainly attributable to the Lantern Festival, which led to Kowloon overall market to rise. 10 week total, Laguna City, Kowloon East (tired rose 10.4%), Depot Garden (tired rose 9.8%), Amoy Gardens (tired + 7.6%), Telford Gardens (tired rose 6.5%) and Grand View garden (tired rose 4.7%). Price Trend Since the second half of the year will depend on the global economic situation may be, as the representative of the United States economy to raise interest rates, our exports are expected to improve the market without fear of interest rates will make prices plunge.

Another leading agency, CEO Midland Residential cloth less clear that the first phase has ended or even decline in property prices rebounded, but still depends on the future trend of prices of new supply in one hand and push real estate strategy, as well as changes in economic conditions , property prices fell further in the second half is expected 3-5 percent.

Scholar: If interest rates fall another 5-10%

Ideal city business valuation, group director Zhang Shengdian said that before the general atmosphere of the market is not ideal, tend not rational Sale, causing some transaction costs low. He also believed that this time belongs to rebound more than the price adjustment, has not changed because of objective factors, such as the supply of the primary real estate continues to increase, the United States have the opportunity to hike, I believe there are opportunities in the second half of the property market down 5-10%.

Professor of Marketing at the Department of Chinese University of Hong Kong, Ming Xian also believes that property prices index is only of a temporary stabilization in the current global economy and poor emergence of new supply, etc., the property market lacks upward momentum. If the Fed decides to raise interest rates next few months, estimated Sin Yat Ming, local residential property prices are still 5-10% decline.

Nine built: Clearance limited increase Housewives

Prospect property price movements, nine Jian, general manager of marketing and sales department Yangcong Yong pointed out that the recent signs of stabilization economy, since supply of new homes completed when required, and as a listed company has to take into account profitability, the face of the construction cost is still high, the developer Sale limited space, but "increase Youwu sleep easy," the second half of the material property prices relatively stable. Prices index, A, B, Class C (1,075 feet or less) unit by sales, Sino Land Sales Associate Director Tian Zhaoyuan believe that the more significant rebound in small and medium sized units, small units reflect market demand.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |