- Home

- News

- Property Hit News

- Property Prices Rose In April This Year, The Highest

Kowloon most small household price epilepsy feet a month rose 5.7%

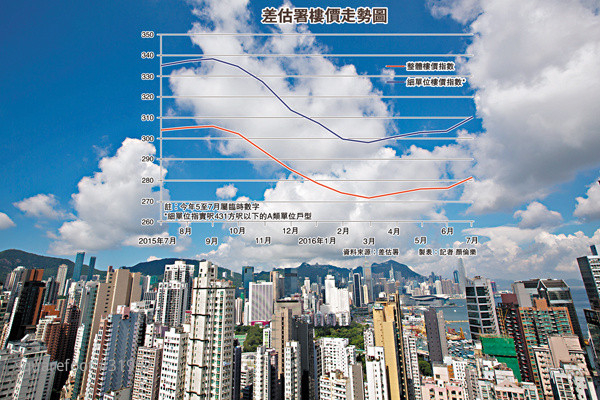

news (reporter Yan Lundu) property market picked up in recent months, heavy rail, but more liters more urgent. Rating and Valuation Department announced yesterday, the latest private home prices index in July rose for four months, up to 281.4 points this year, surged 1.88% on a monthly basis, the largest increase in more recent months. The latest index and the lowest level in March this year for comparison, but to see prices have rebounded 3.68 percent. Various types of area units were recorded for prices to rise in the salable area of 431 feet or less A small unit class showed the largest monthly anxious shells 2.21%.

Estimated difference Department announced yesterday, July prices index was 281.4 points, 1.88% monthly rise, continuous rise in four months. Although the summary of the first seven months of this year, compared with last year at 5:00 on December 28, the latest index is still down 1.26% over last year fell 7.5%, However, if the lowest bit in March this year to be compared, the current prices index has rebounded 3.68 percent compared with the time.

Fine performance Johnson Big Unit Unit

All units of various types of index, rising by the maximum fine for the Class A units, 7 monthly 310.4 points compared with 303.7 points in June rose 2.21%. An area of 432 feet to 752 feet of Class B units SMEs also increased by 1.9 percent to 267.7 points. Slower increases in larger type for the Class C units, with an area 753 feet to 1,075 feet, an increase of only 0.68%, reported 253.5 points. The area is more than 1,076 feet of Class D and Class E Unit reported 265.3 points, up 1.03%.

District, the apparent rapid rise in property prices in some areas. Wherein, A class of small units, the most obvious gains on Hong Kong Island, the monthly price rise 3.13% to an average of 12,525 feetYuan, Kowloon A unit average price per square foot rose only 0.66%, the New Territories and even edged down 0.02%. Class B sized units, the fastest increase in places in Kowloon, surged 5.7% on a monthly basis to 10,894 yuan, back to the level of last September, the New Territories of Hong Kong Island and Class B units rose only 0.46%, respectively, and 2.05%.

Although prices rebounded, but still down compared to the same period last year, about 7.5%, Knight Frank, Senior Director and Head of Valuation and Advisory Lin Haowen estimated high compared with August last year, to the end of the year the overall decline of about 5-8%, if in the year 2016 alone is estimated that at most only 2% decline, compared with the first expected to fall 5% less. He also said that, at current market situation, the property market adjustment is still 1 to 2 years, but fell very low, only minor adjustments. The future can affect the property market is interest rate changes, economic trends, housing supply and government policy.

Centaline Property, Senior Associate Director Liang-liter believes that property prices have rallied confirmed, consistent with economic trends, and the rest of the year material prices will continue to rise, this season more than 1% per month, increased at a slower fourth quarter. He added means, if prices rise through September last year high, the government has the opportunity to add spicy.

Rent increases behind prices

Private House Rent Index increases were registered in July, the latest reported 166.9 points, 1.03% monthly rise, moving up three months, but the increase in property prices rally behind. Compared with the same period last year, in July rent index is still down 4.74 percent, the first seven months of this year, figures also fell 2.5%, but should be aware that the lowest level this year, compared with April, July rents have rebounded 2.1%. And in July rose the most units for Class D and Class E units of large monthly rose 1.33 percent to 144.7 points, A Class to Class C sized units on a monthly rose 1.01 percent to 169.4 points.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |