The escalation of the trade war affects the property market. The industry appeal to prepare for property stop rising.

(by Li Zitian)

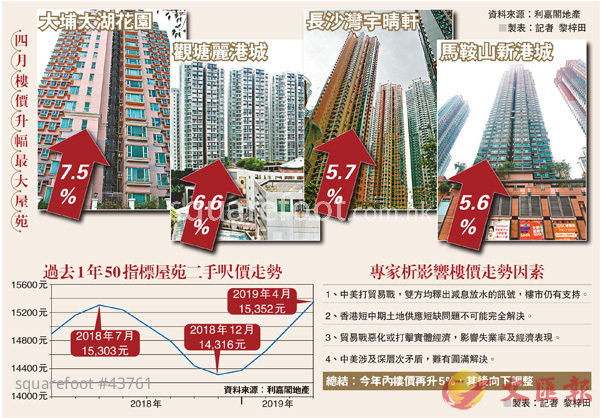

The property market was prosperous in last month, with more than one thousand new houses being sold on one day, which is the hottest in nearly six years, and both first hand and second hand property prices are rising during the competition. According to statistics from Ricacorp yesterday, the weighted average sq ft price of 50 indicator housing estates in Hong Kong rose 2.4% more to HKD15,352 in April, a historical new high, and higher 0.32% from the previous peak of HKD15,303 in last July, however, it is expected that the future increase will narrow. Some scholar pointed, the Sino-US trade war will cause both sides to increase the money supply for self protection, and the market expects interest rates to fall downwards, but the trade war will damage the real economy, although there would be insufficient supply in future housing, the property price will turn downward after rising 5% more within this year.

The president of Ricacorp Properties, Liao Weiqiang expressed, property prices would continued to rise and once again hit the historical high, and it is expected property price rise is not easy to complete stop even if there is a change in the trade war, so the market outlook is expected to stable rising. Synthesizing the data from their research department, the weighted average sq ft price of 50 indicator housing estates in Hong Kong hit a record high in April and had risen for four months, at HKD15,352 , up 2.4% from HKD14,992 in March and also rose 0.32% more than the previous peak of HKD15,303 in last July. As for the first four months of this year, property prices had risen by 7.24% from low levels.

New Territories property rises is faster than of the leading market.

Liao Weiqiang pointed, the property prices in Hong Kong Island, Kowloon and New Territories all rose by more than 2%. The weighted average sq ft price of the eight indicator housing estates on Hong Kong Island increased by 2.1% to HKD19,252. The average sq ft price of 21 indicator housing estates in Kowloon was reported at HKD16,600, up 2.3% month-on-month. As for the 21 indicator housing estates in the New Territories, the average sq ft price outperformed that of the market, rising 2.6% to HKD12,971. Among them, Kingswood Villas has the lowest sq ft prices once again exceeded the level of HKD11,000, rising 3.2% month-on-month.

This company pointed out that 43 among the 50 indicator housing estates listed on the observation list reported rose last month. Among them, the real estates have significant rising including Serenity Park in Tai Po, Laguna City in Kwun Tong, The Pacifica in Cheung Sha Wan and Sunshine City in Ma On Shan, with the rising ranges in 7.5%, 6.6%, 5.7% and 5.6% respectively.

Liao Weiqiang pointed out that in recent months, the property prices had risen sharply and the market is optimistic, while the Sino-US trade war changed dramatically in early May, and the situation became tense, which just cooled down slightly of the hot property market. He expects that the trading volume of the 50 indicator housing estates in May would continue to fall by 20% to 30%, while the property prices were expected to continue to rise steadily, but the increase will be narrowed.

The Sino-US trade war might broke and would cause interest rate cuts.

A lecturer at the Department of Real Estate at the University of Hong Kong, Zou Guangrong expressed, the trend of the property market in Hong Kong mainly depends on two major factors. The first is to see whether interest rates will rise. For example, the Sino-US trade war would broke, then the two countries would not raise interest rates, and even have the possibility of interest rate cuts, while the market expects interest rates to fall downwards and buyers will continue to enter the market. . Another factor is supply, if the land supply recommendations of the Land Supply Task Force are not successfully implemented, then the short- and medium-term supply cannot be resolved.

Zou Guangrong also pointed out that the actual reason for the downturn of the property market last year was not due to the Sino-US trade war, but that the United States began to shrink and expect interest rates to rise, while as this year’s trade war heats up again, "the two countries would increase the money supply to save the economy." , which may bring possibility of interest rate cuts, supporting the property market. However, it is expected that property prices will rise by another 5% this year, if the situation continues to deteriorate that the real economy is hit and the unemployment rate rise, which is difficult to support the property market. Sino-US trade involves deep-seated contradictions, and its effect will continue to exist until a new round of US presidential elections. Among them, political factors are even more difficult to estimate, so the most important thing is to calculate your own afford ability and prudently on house purchasing.