"One family buys a house, and the whole family suffers." It is about the painful history of buyers who borrowed 90% of their mortgages. Fortunately, the Hong Kong Interbank Offered Rate (Hibor) has fallen in a row recently. The latest one-month offer rate is 0.06%, which is 1 pip down from the previous trading day. It is a record low in 11 and a half years and is the record low (0.05%) on December 15, 2009. ) The difference is only 0.01%. In other words, buyers who use the interest rate mortgage can reduce the burden on the mortgage interest rate. Some mortgage agents believe that inter-bank interest rates will challenge new lows again, and the pain of home ownership will be slightly reduced. However, it is important to note that the current property prices have reached the top. It is not advisable for ordinary citizens to enter the market blindly at low interest rates. They should pay attention to the "commitment trap" to avoid losing their power for many years. "Hardcore money." reporter Li Zitian

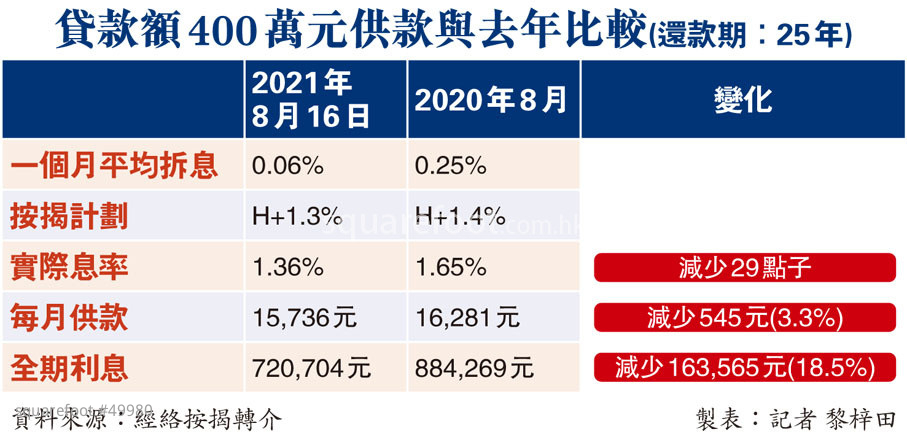

Calculated based on the current interest rate mortgage plan, assuming a loan amount of 4 million yuan and a repayment period of 25 years, using yesterday's (August 16) HIBOR and the interest rate mortgage plan H+1.3%, which is the same as the average one-month HIBOR in August last year. Comparing the 0.25% and the H+1.4% interest rate mortgage plan, the actual interest rates of the two are 1.36% and 1.65% respectively, a difference of 29 points. The monthly payment has dropped from 16,281 yuan to 15,736 yuan, which is a difference of 545 yuan or 3.3%. The interest expenses for the whole period also decreased from about 884,000 yuan to 721,000 yuan, a decrease of about 164,000 yuan or 18.5%.

Pay attention to stress testing and prepare more cash turnover

Even if the mortgage burden is reduced, the meeting (looking for a bank to undertake a mortgage) involves many operations and risks, including the need for banks to conduct stress tests on buyers, property valuations, etc. Buyers need to make full personal financial budgets and prepare sufficient cash. Be able to attend the meeting conditionally. Just as the New World recorded about 30 large tart orders in two markets recently in just one week, these buyers entered the market because of the real estate agent lobbying that they would be able to attend the meeting. They all used the construction period payment, and they only found the bank after they moved in. Mortgage undertaking is also a reminder to the general public not to believe in propaganda slogans such as "guarantee to go to the meeting".

In addition, the meeting must be "safe", and prospective buyers are best to conduct a stress test for themselves (currently calculated at an interest rate plus 3%), such as going to the bank for pre-approval or looking for relevant professionals to evaluate. Don't let the property price break the ceiling. , Blindly enter the market as soon as the brain is hot. As for the possibility of facing sudden risks after attending the meeting, such as unemployment, injury and illness, etc., it is best to prepare for yourself half a year or more of contributions and living funds for emergencies. At the same time, citizens can buy insurance in advance so that in case of unemployment, injury or illness, insurance companies can provide mortgages on their behalf, so as not to be forced to cut off their mortgage payments.

Historical high balance of interest rate or drop

Cao Deming, chief vice president of Meridian Mortgage Referral, said that as of August 13, the balance of the Hong Kong banking system still reached a historical high of 457.5 billion yuan, and it has maintained more than 450 billion yuan for more than 9 months. Cao Deming expects that there is still a high chance that the interest rate will remain below 0.1% during the year, which is almost zero interest rate. One-month interest rate will be expected to challenge the history of 0.05%Low, and can save more interest for mortgages and home buyers.

Cao Deming mentioned that although the Fed has also "ventilated" to close water, the actual resumption of delisting is expected to take place next year, and the U.S. interest rate hike cycle will not begin until 2023 at the earliest. With reference to historical records, even if the United States raises interest rates, Hong Kong will not immediately follow. I believe that Hong Kong does not have an urgent need to raise interest rates. The low interest rate environment in Hong Kong will remain at least until 2024. Therefore, Hong Kong interest rates will remain very low in the next three years. Level, which has a supportive effect on the property market. It is expected that the proportion of people who choose H will maintain a historically high level in the future.

He believes that in order to strengthen risk management, local banks have little chance of direct competition with mortgage interest rates. It is expected that mortgage interest rates will remain below 1.5% during the year. On the contrary, banks may adjust mortgage offers and services to attract customers, and have the opportunity to increase the cash rebate for new mortgages or refinancing, or gradually lower the loan amount threshold for cash rebate, which will have a positive impact on the property market.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |