Sheung Shui Tai Ping broke the record sold in $ 2.8 million HKD

Hong Kong's Wen Wei Po News (Reporter Huang Jiaming) "decline in value does not fall" is now the government moves after each time, the property's inevitable response, price index by the introduction of double peak in mid-March after the stamp duty reduced by approximately 4%, spicy successive strokes to the citizens on the car dreams of little help. Actual housing needs of the users can not wait indefinitely, even without the premium market units will also increase the Habitat II, the car is still baked passenger grab. Sheung Shui public housing taipingcun now before a new high turnover, in fact, the middle 494 feet households even premium 2.8 million HKD turnover, real ft 5,668 HKD, a record high Taiping. In addition, managing HOS free premium may apply for proof of purchase, the market worried about Penny dish again pulled high prices, the whole city to grab Penny potential lift plate tide, passengers on the train harder to realize their dreams.

Surge in property prices in recent years, private homes, without premium market trading Habitat II unit prices will also increase, coupled with the government last year announced the launch of free premium flats buy green table after prices rose more fuel to the flames, because a lot of grassroots budget constraints can not get on the train. Under the situation of people can't afford the price of the private property ang the HOS , useful,people prefer to public housings. Jinlong estate director Feng Yucheng said Block A, Sheung Shui Tai Ping Middle the 10th room, building area 685 feet and 494 feet of usable area, has even sold premium to $2.8 million HKD, $5,668 HKD practical ft, refresh the Lunar New Year a new high before the transaction, then the transaction price of $5,630 HKD utility feet, sold in $2.01 million HKD. The price of transactions and real ft get a new high record.

Free premium of the HOS white apllication form released today

Feng Yucheng said that the buyer of this transaction have been previously moved to Hong Kong residents are now returning to Hong Kong, units purchased their own homes. It is understood that the original owners hand to the government in 2003 to $180,000 HKD to buy, hold stocks of 10 years, although it was difficult to estimate the amount of premium, but the appreciation of about 10 times estimated unit.

In fact, the market prices at a high level joint HOS rampant, with free premium qualified people buy second-hand HOS starting today may apply to the Housing Department for proof of purchase. Many people worry GF qualified source disk into the market later increased competition, have accelerated the market, stimulating the recent increase in market transactions Habitat II. Among og all, Kwai Chun Court 8 Upper Floor, Block A, construction area of 515 feet and 401 feet of usable area, at Habitat II market of $2.5 million HKD turnover,$4,854 HKD per architectural ft ,$6,234 HKD per practical ft. Original owners in August 2010 RRP $ 1.34 million HKD green form of units purchased, hold stocks nearly three years, the book profit 41.16 million HKD, the unit appreciation of 87%.

Only 364 transactions have recorded in the second-hand market of HOS in April

Ricacorp Properties head of research Chou MoonKit said, the high price of flats, so it leaded the transactions of the second-hand market of HOS dropped. According to the Housing Authority and Housing Department the latest data, the first four months of this year recorded only 364 transactions in the second-hand market of HOS , involving an amount of about $1.032 billion HKD, compared with last year's 572 and approximately $1.222 billion HKD, respectively, greatly reduced 36% and 16%.

Classification of property prices, property trading Penny was the most shade. Value of 200 yuan (Habitat II) market, the first four months of this year only 64 trading turnover, compared with 276 last year greatly reduced by 77%. Total turnover over the same period also dropped 74% to about $1.10 million HKD. In addition, the value of two million to three million yuan trading volume between the values of the property, also reduced by 35%, respectively, to 147 cases and 3.64 ten million HKD.

Chou MoonKit said, the first batch of 2,500 white sheet is not yet gush Habitat II market, prices have been the first to fry up, and if so, together with the premium should be calculated, prices may be more expensive than a private building, coupled with shorter HOS mortgage Even if the application of a monthly income of $40,000 HKD can't afford this price,it is believed that the purchasing power may not be fully released to the Habitat II market.

Charming sold in $5.92 million HKD,recorded the most expensive price thois month

Centaline Senior Research Associate Director Wong LeungShing said, there are recorded four transactions which involved in more than $5.0 million HKD of registered second-hand HOS sale this month. Among of these,the top high price of the transactions recorded in Tai Kok Tsui Charming Garden Room H unit ,recorded in $5.92 million HKD, followed by Tai Wai Ka Love Ka Keng Court Court (A Block) Middle one room flats, sold record $5.248 million HKD.

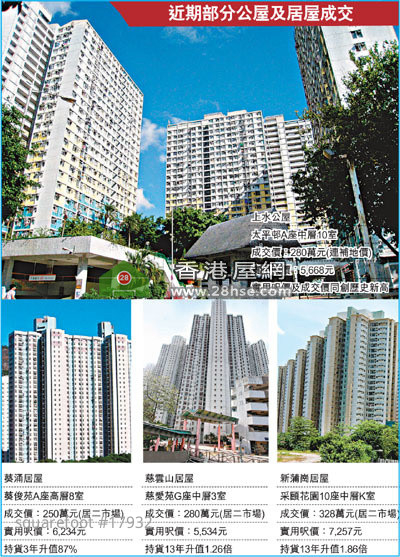

Transactions in some public housing and HOS recently

Sheung Shui public housing

Block A, Room 10, Middle taipingcun

Price: $2.8 million HKD (even premium)

Practical Unit Price: 5,668 HKD

Practical ft and Genesis record price

Chung HOS

Kwai Chun Court 8 Upper Floor, Block A,

Price: $2.5 million HKD (Habitat II market)

Practical Unit Price: 6,234 HKD

3 years hold stocks rise 87%

Tsz Wan Shan HOS

Tsz Oi Court Room 3, Block G, Middle

Price: $2.8 million HKD (Habitat II market)

Practical Unit Price: $5,534 HKD

Hold stocks rise 1.26 times in 13 years

San Po Kong HOS

Middle Rhythm Garden 10 K,

Price: $3.28 million HKD(Habitat II market)

Practical Unit Price: $7,257 HKD

Hold stocks rise 1.86 times in 13 years