- Home

- News

- Property Index

- Interest Rate Cut Expectations Intensify – Stalemate Between Buyers And Sellers Continues Secondary Market Transactions Hit 11-week Low, While Rents Remain Resilient

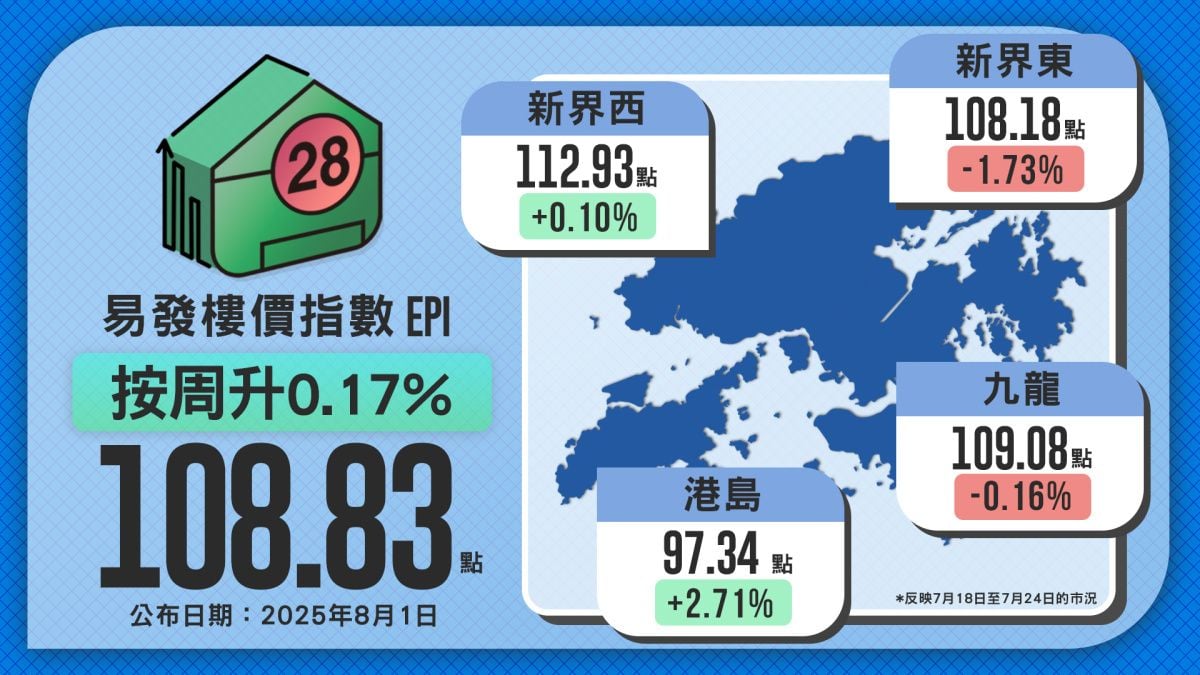

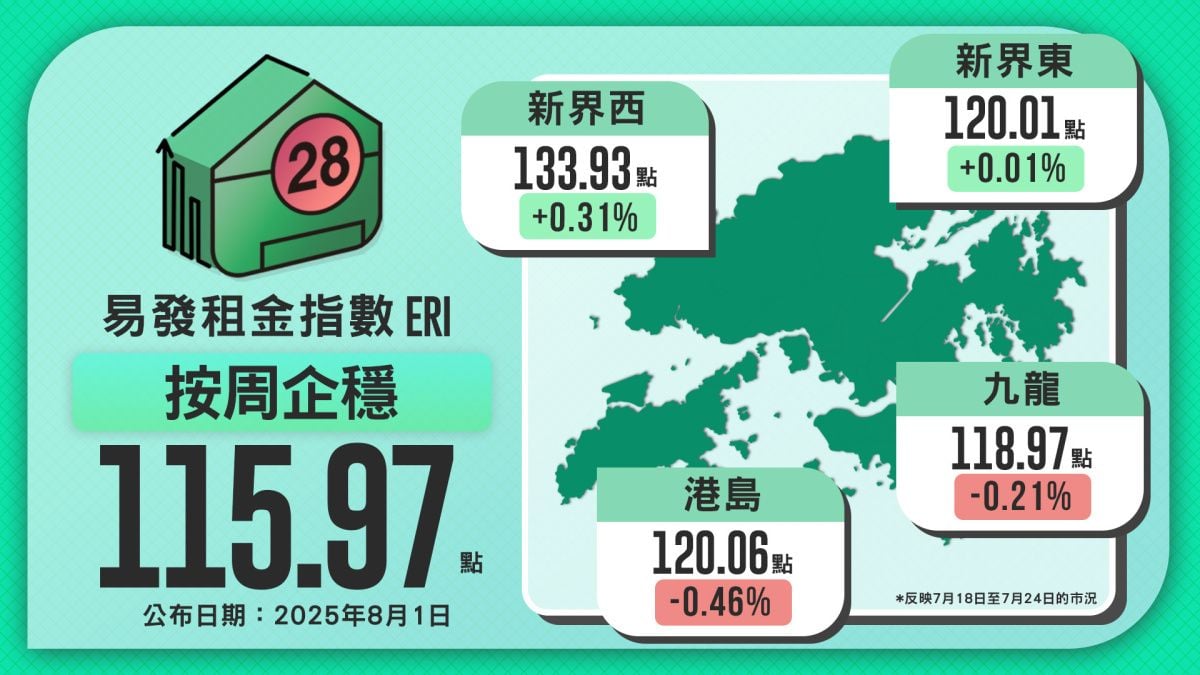

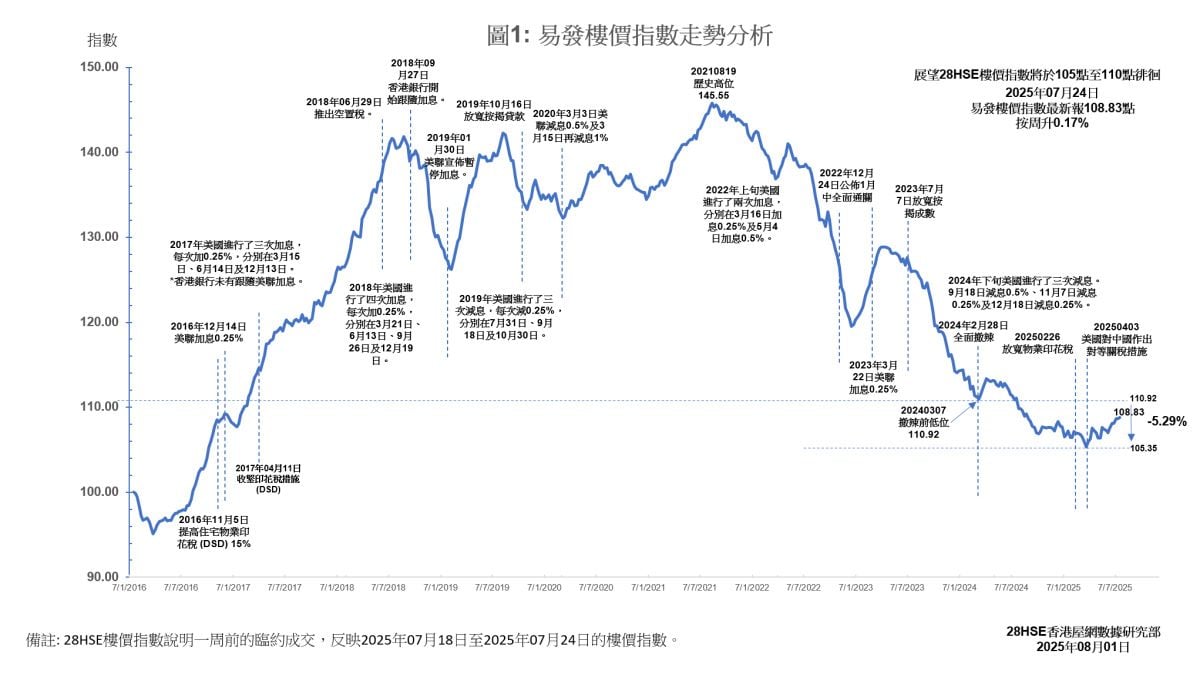

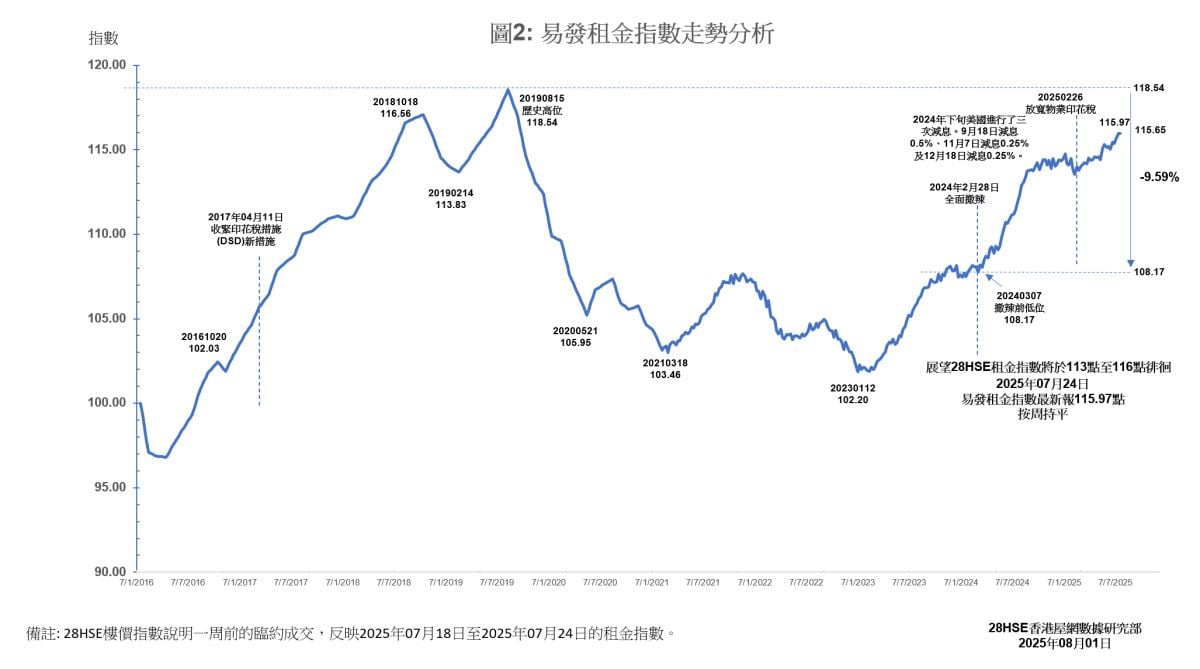

Amid growing expectations of interest rate cuts, property developers have slowed the pace of new project launches, leading to a more cautious sentiment in the property market. As buying power shifts to the secondary market, transaction volume remains weak. The Eva Property Index stands at 108.83 points, hovering around its 8.5-year low. Regionally, Hong Kong Island saw a 2.71% weekly rise supported by new projects, while the New Territories West also posted gains. However, both the New Territories East and Kowloon recorded declines. On the other hand, the rental market remains robust, bolstered by peak season demand. The Eva Rental Index has stayed above 115 for 10 consecutive weeks, with particularly strong growth in the New Territories. In the short term, rents are expected to remain firm and upward-biased.

Market Enters Wait-and-See Mode as Rate Cut Hopes Rise – New Launches Paused

With the U.S. Federal Reserve expected to begin a rate cut cycle in the second half of the year, the local property market has adopted a wait-and-see stance. Many developers have held back on launching new projects this week, awaiting clearer signals of economic recovery. As a result, some purchasing power has shifted to the secondary market.

However, overall market confidence remains weak. The latest Eva Property Index recorded a slight weekly increase of 0.17% to 108.83 points, still lingering at an 8.5-year low and showing a year-to-date decline of 1.03%. Despite the marginal uptick in the index, transaction activity has not improved. According to agency statistics, only 61 transactions were recorded across 35 major housing estates during the weekend of July 16–17, a weekly drop of nearly 27% and the lowest in 11 weeks. This underscores that market attention remains focused on the primary market, while the secondary market is mired in a tug-of-war between buyers and sellers, limiting transaction momentum.

Without substantial positive developments or a clear improvement in economic fundamentals, property prices are expected to fluctuate narrowly between 107 and 109 points in the short term, with overall downward pressure still present in the market.

Mixed Regional Performance – Hong Kong Island Leads with 2.71% Weekly Growth

The latest regional data indicates a “two-up, two-down” pattern. Hong Kong Island recorded the strongest performance, driven by positive sentiment from strong subscription numbers at the new Wong Chuk Hang MTR project “La Montagne II”. The index rose for the second consecutive week to 97.34 points, up 2.71% weekly. Meanwhile, the New Territories West posted its seventh straight weekly gain, up 0.1% to 112.93 points.

In contrast, the New Territories East experienced a second week of decline, down 1.73% weekly, reflecting a notable cooling of sentiment. Kowloon also remained subdued, slipping 0.16% to 109.08 points. Overall, the housing market continues to show regional divergence. Areas supported by new launches and positive catalysts perform relatively better, while regions lacking fresh supply or transaction support remain under pressure. The road to recovery remains uncertain and will depend on further developments in macroeconomic conditions and interest rate movements.

Eva Rental Index Holds Firm for 10 Straight Weeks – Currently at 115.97 Points

With Hong Kong entering the traditional peak leasing season, overall rental performance remains solid. The Eva Rental Index stood flat at 115.97 points for the week, marking the 10th consecutive week above the 115-point threshold. This reflects sustained rental demand.

New Territories West led the gains, rising 0.31% weekly to 133.93 points, extending its winning streak to six weeks. New Territories East also notched a sixth straight weekly gain, edging up 0.01% to 120.01 points, indicating continued rental strength.

In contrast, rental performance in urban districts softened slightly. Hong Kong Island dropped 0.46% to 120.06 points, while Kowloon declined 0.21% to 118.97 points. Overall, seasonal factors, the upcoming academic year, and deferred home purchases by some upgrading households have all contributed to rental demand. In the short term, the rental market is expected to remain on a steady upward trend.

This week's index reflects the market conditions from July 18, 2025 to July 24, 2025

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |