- Home

- News

- Property Index

- Property Prices Maintain Sideways Trend — Three Districts Down, One Up Eva Rental Index Steady At 116 Points For 10 Consecutive Weeks

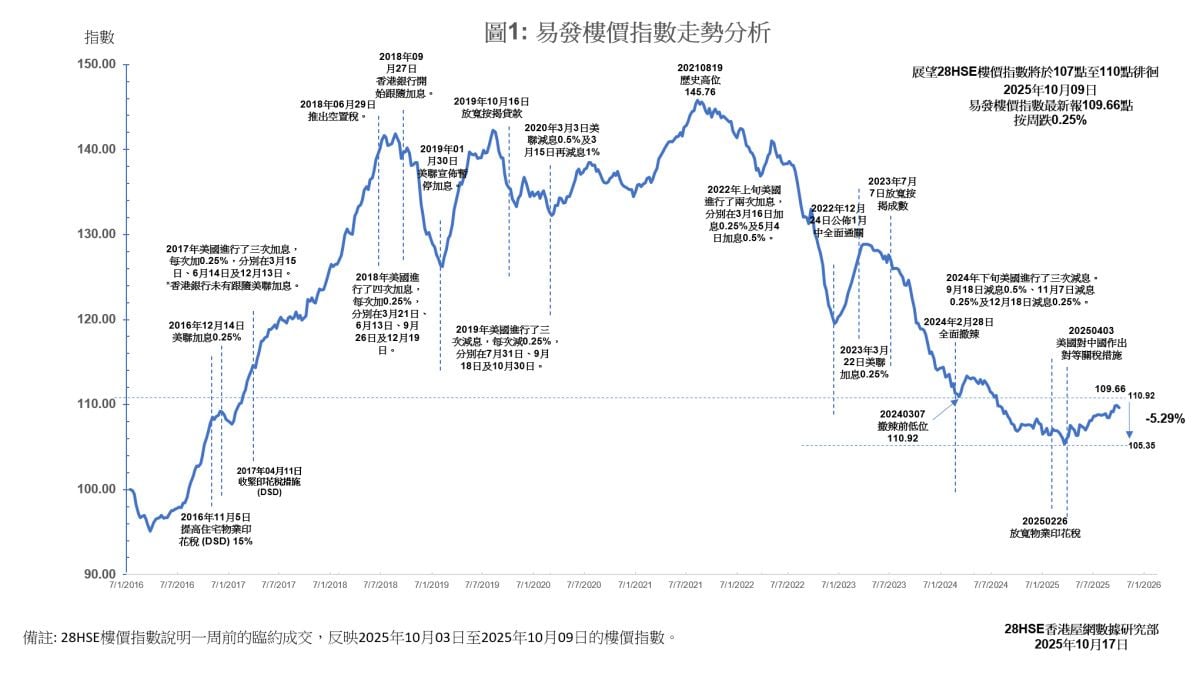

Hong Kong property prices continue to consolidate sideways. The latest Eva Property Index stands at 109.66 points, up about 2.93% year-to-date, though still around 30% below the peak. The start of the rate-cutting cycle has revived buying sentiment, boosting second-hand transactions and improving overall market confidence. Across districts, a “three down, one up” pattern emerged: New Territories West saw the most noticeable pullback, while Hong Kong Island prices rose, supported by new launches.

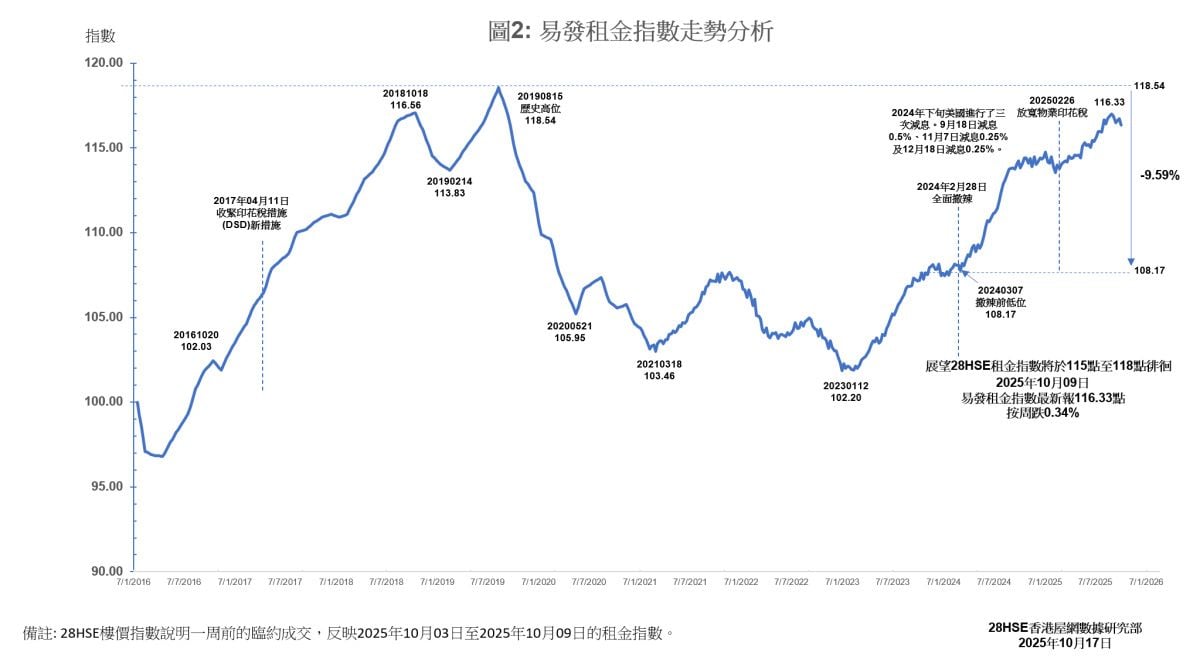

On rentals, the Eva Rental Index recorded 116.33 points, remaining at a high level for 10 consecutive weeks. However, as more tenants turn to homebuying, rents are expected to fluctuate narrowly between 115 and 118 points in the short term.

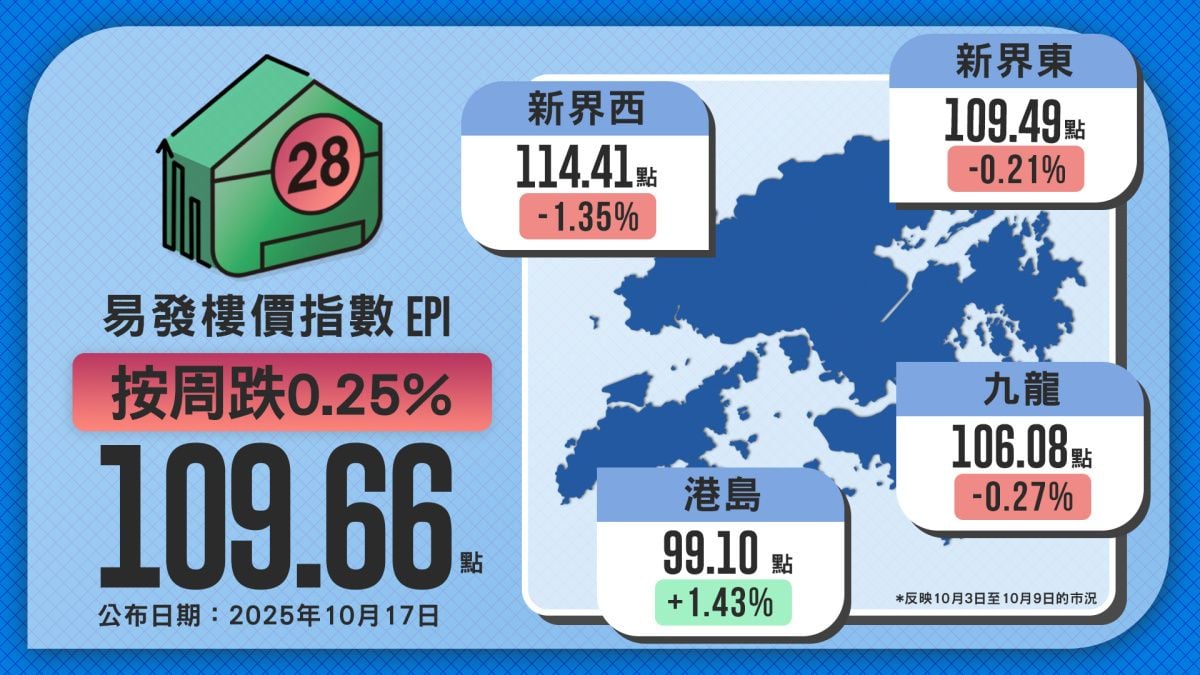

Prices Consolidating Around 109 Points

The latest Eva Property Index of 109.66 represents a weekly dip of 0.25% and a 2.9% gain since the start of the year, still 33% below the 2021 peak. The Eva Property index has hovered around the 109-point level for five weeks, indicating that prices are stabilizing and nearing the pre–cooling measure low of 110.92 points. The market is now entering a sideways adjustment phase.

With interest rate cuts restarting, lower funding costs are encouraging more buyers to enter the market, improving sentiment. During China’s Golden Week holidays, no major new projects were launched, shifting focus to the second-hand market. According to estate agent data, transactions in the top ten housing estates handled by the four largest agencies rose across the board during the October 4–5 weekend, with up to 16 recorded deals, reflecting more active trading.

However, some sellers widened their negotiation margins to close deals, leading to minor price corrections. Overall, prices are expected to stay range-bound in the short term, but with rate-cut effects unfolding and buyer confidence improving, a gradual recovery is likely in the medium term, signaling a slow market rebound.

“Three Down, One Up” — New Territories West Pulls Back, Hong Kong Island Rises

The latest district-based price index shows a divergent trend: three regions fell while one rose.

New Territories West: 114.41 points (–1.35% week-on-week), the sharpest decline. A high proportion of price-cut listings in Tsuen Wan suggests owners are more flexible on prices, leading to notable corrections.

Kowloon: 106.08 points (–0.27%), down for the second consecutive week.

New Territories East: 109.49 points (–0.21%), marking a third consecutive weekly drop.

Hong Kong Island: 99.1 points (+1.43%), rising for the second straight week.

Analysts attribute Hong Kong Island’s rise to renewed interest sparked by the upcoming new launches in Wan Chai’s “Woodis” and “Spring Garden” projects. Overall, the market remains in a structural consolidation phase, with regional variations driven by differences in supply, demand, and sentiment.

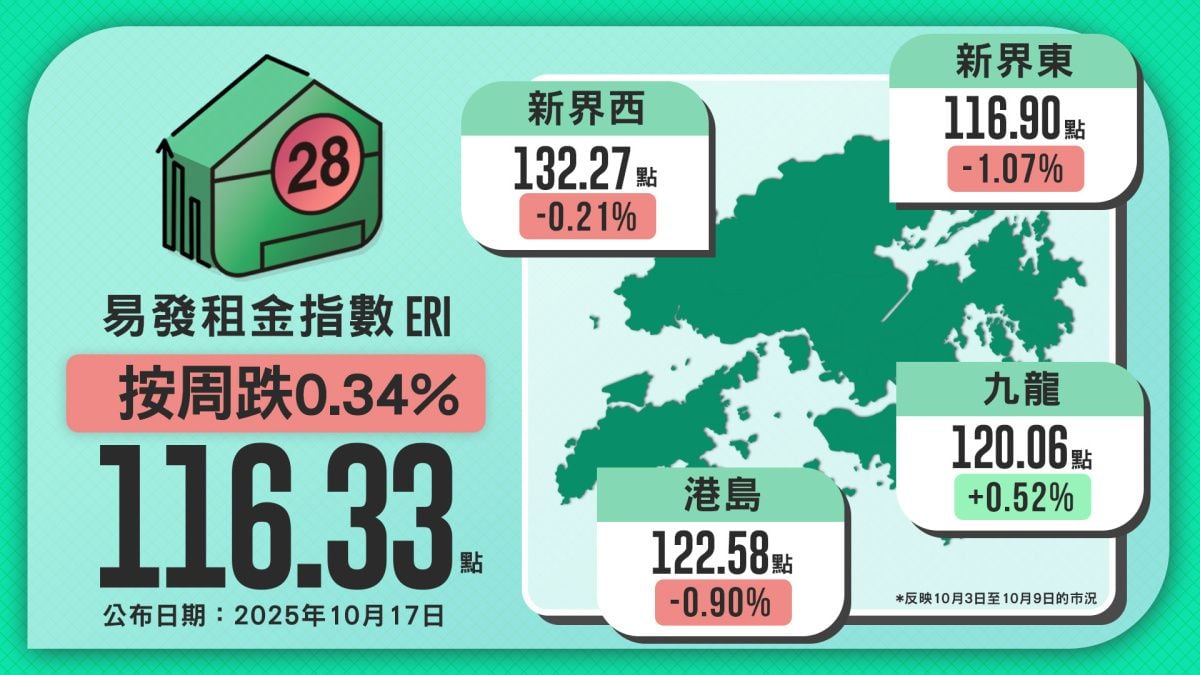

Eva Rental Index Holds at 116 Points for 10 Weeks — “Three Down, One Up” by District

With the peak rental season ending, rent growth has slightly moderated. The Eva Rental Index stands at 116.33 points, down 0.34% weekly, but holding steady around 116 points for 10 weeks, indicating solid market support, particularly from mainland student demand.

As banks continue to lower mortgage rates and the market anticipates another rate cut this year, homeownership costs are falling. This trend encourages some tenants to “switch from renting to buying,” easing rental demand slightly. Rents are expected to move narrowly between 115–118 points, maintaining a high-level consolidation.

By region:

New Territories East: 116.9 points (–1.07%), down four weeks in a row.

Hong Kong Island: 122.58 points (–0.9%).

New Territories West: 132.27 points (–0.21%), down two consecutive weeks.

Kowloon: 120.06 points (+0.52%), the only region to rise, up two weeks in a row, showing stable rental demand in the area.

This week's index reflects the market conditions from October 03, 2025 to October 09, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |