Property prices remained steady at 109 points, with mixed trends across districts.

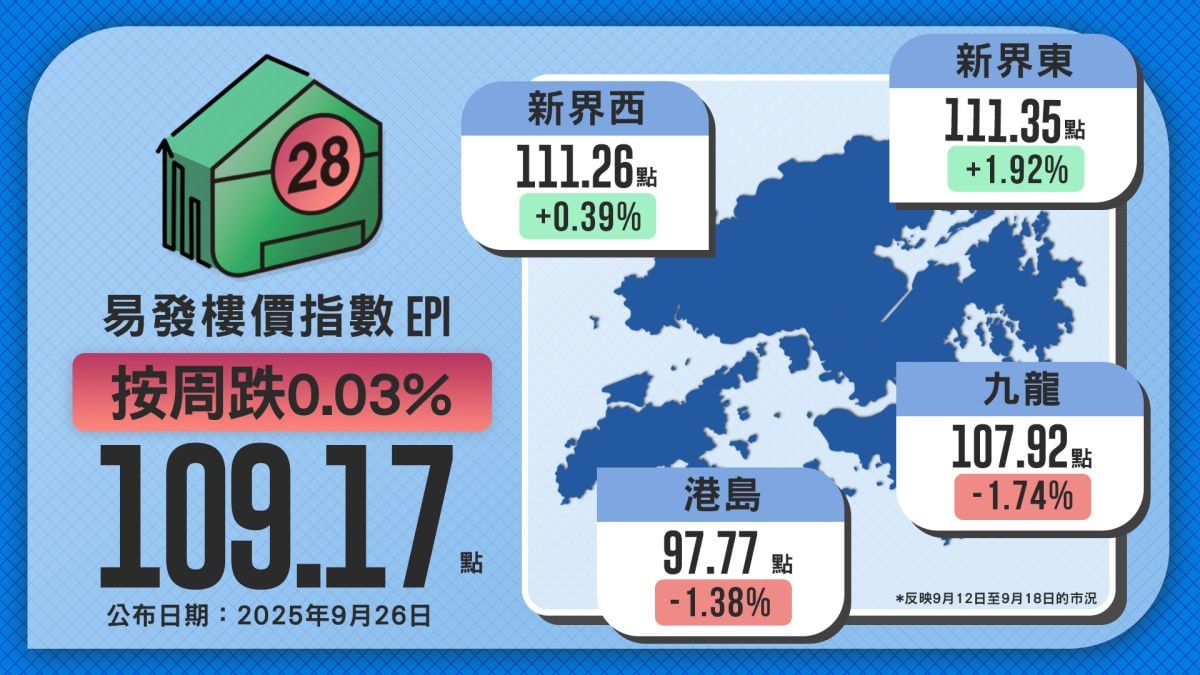

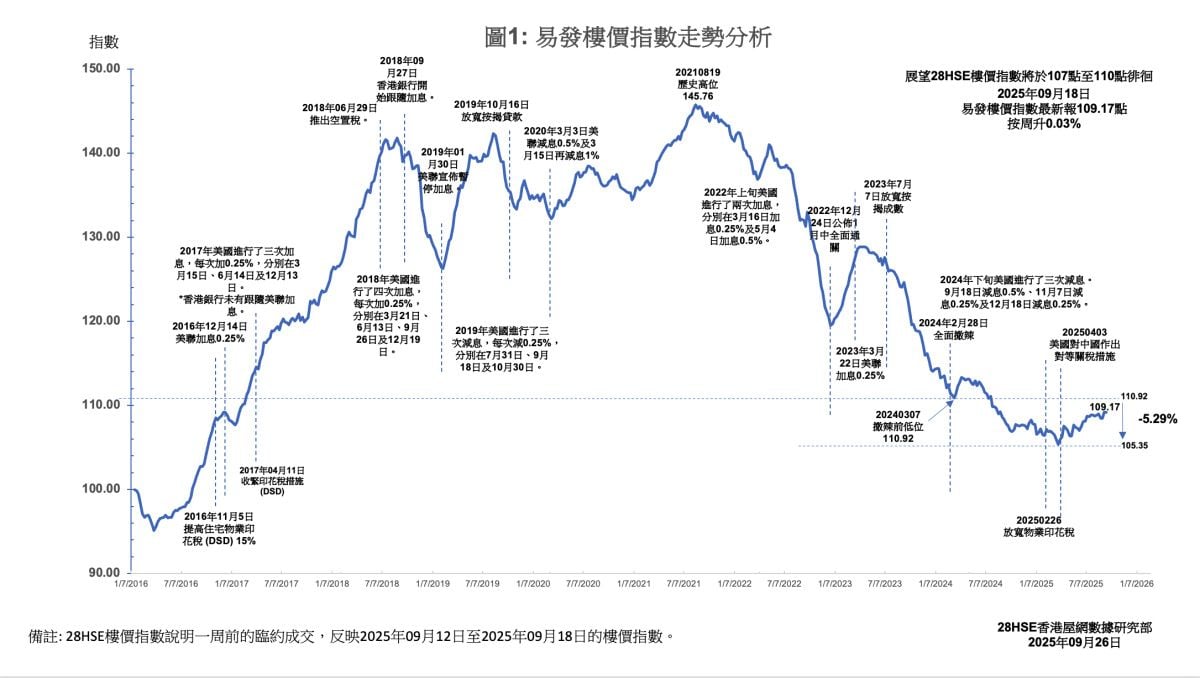

The latest Eva Property Index stands at 109.17 points, recording a slight 0.03% decline week-on-week, retreating slightly from last week’s yearly high of 109.20 points. The slight decrease in the index may be attributed to market sentiment between September 12 and September 18, amid heightened caution and uncertainty..

During that period, there was widespread speculation about whether the new Policy Address would introduce property market stimulus measures and whether the US Federal Reserve would initiate another round of interest rate cuts. As a result, overall market activity slowed significantly, affecting the performance of the property price index.

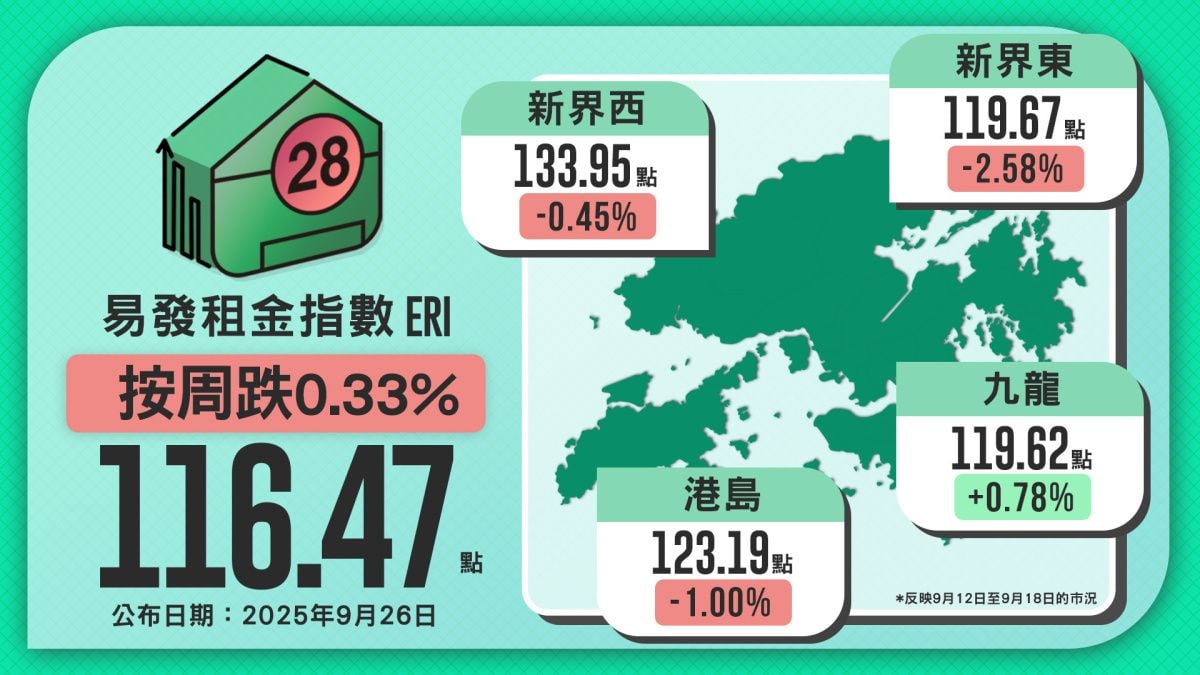

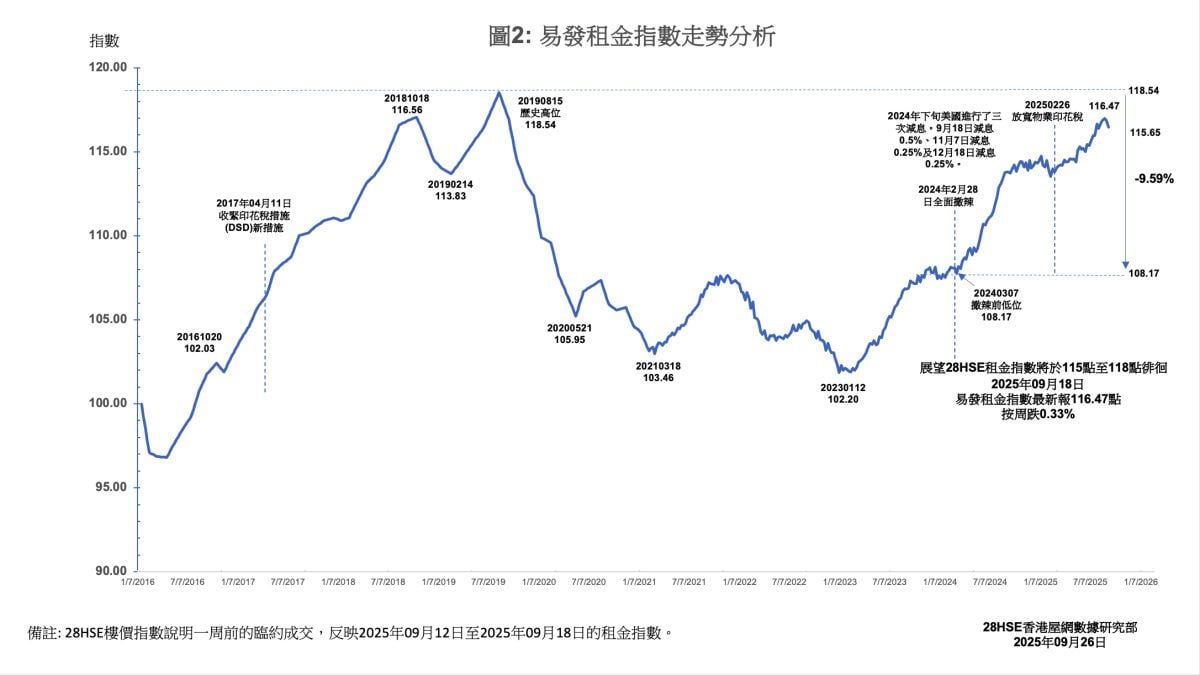

In terms of regional property price indices, a “two-up, two-down” trend was observed. Both Hong Kong Island and Kowloon were under pressure due to the sales of new developments in their respective districts. Meanwhile, the Eva Rental Index continues to hover near historical highs. Although it recorded a slight 0.33% decline week-on-week, the index now stands at 116.47 points, just 1.7% below its historical peak.

Amid a strong atmosphere of market caution, the latest Eva Property Index of 109.17 points represents a 0.03% weekly decrease. According to the 28Hse Research Team, the key factor influencing short-term property price trends remains interest rate policies. While the new Policy Address did not introduce significant stimulus measures for the private housing market, the US Federal Reserve announced a 0.25% interest rate cut last week. Following this, several major banks in Hong Kong also lowered their prime lending rates (P) by 0.125%, which may help ease the financial burden on mortgage holders and boost buyer confidence. The research team predicts that the property price index could break through the 110-point threshold in October, with transaction volumes likely to recover as a result. This would provide a boost to the economy and the mortgage market, fostering a degree of recovery.

Regional price trends diverged, showing a “two-up, two-down” pattern.

In terms of district property price indices, two districts recorded increases, while two districts saw declines. Among them, New Territories East experienced the most significant rise, with a week-on-week increase of 1.92%, reaching 111.35 points. New Territories West also recorded a modest increase of 0.39%, with the latest index at 111.26 points.

In contrast, Kowloon saw a relatively large decline, with the index falling 1.74% week-on-week to 107.92 points. Hong Kong Island also recorded a 1.38% weekly decline, with the latest index at 97.77 points.

The decline in Kowloon’s property index was primarily driven by the entry of lower-priced new developments into the market. For instance, the first batch of 50 units at House Muse in Kowloon City was launched with a discounted starting price of just HK$3.778 million, the lowest in the district over the past nine years. This price is approximately 20% lower than the remaining unsold units of other developments in the same district. Additionally, the first-round sales of Highwood (PHASE 1) in To Kwa Wan saw more than half of its units sold, which further weakened the competitiveness of the secondary market in the area.

On Hong Kong Island, the simultaneous launch of several new developments, including The Headland Residences Phase 1 in Chai Wan, the MVP in Mid-Levels West, and Kabitat Tin Hau in Tin Hau, diverted buyers’ attention to the primary market, putting pressure on secondary market property prices.

In comparison, the New Territories did not see the launch of any major new developments recently. This allowed purchasing power to flow into the secondary market, resulting in relatively stable performance.

The Eva Rental Index recorded a slight 0.33% decline week-on-week but remains near historical highs.

This week, the Eva Rental Index stood at 116.47 points, down 0.33% week-on-week, but still close to its historical peak, with only a 1.7% gap to the all-time high. Benefitting from the strong rental demand during the summer, the rental market remained active during September’s back-to-school season. However, as the summer rental rush gradually subsides, the rental index is expected to stabilise.

The 28Hse Research Team predicts that the rental index will fluctuate between 115 and 117 points over the next two months, with a low likelihood of surpassing its historical high.

Regional rental indices displayed a “three-down, one-up” pattern.

In terms of regional rental indices, New Territories East saw the largest decline, dropping 2.58% week-on-week to 119.67 points. During the summer, high-priced rental transactions in several estates in the area pushed the index higher. However, with the end of the peak season, the rental index experienced a notable correction.

Hong Kong Island recorded a 1% weekly decline, with the latest index at 123.19 points. New Territories West also saw a slight decline of 0.45%, with the latest index at 133.95 points.

Meanwhile, Kowloon was the only district to record an increase, with the rental index rising 0.78% week-on-week to 119.62 points, showing relatively stable performance.

This week's index reflects the market conditions from September 12, 2025 to September 18, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |