- Home

- News

- Property Index

- Property Prices Hold Steady At 108 Points; Only Kowloon Sees Decline Among Four Major Districts; Eva Rental Index Hits New High For 2025

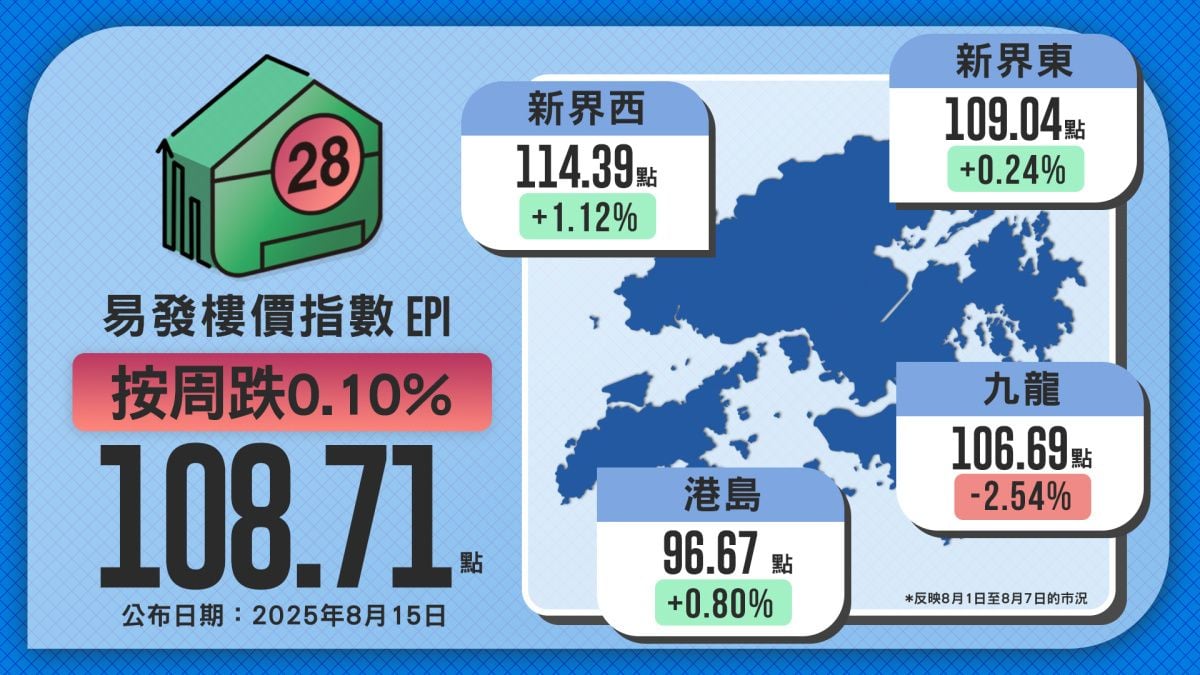

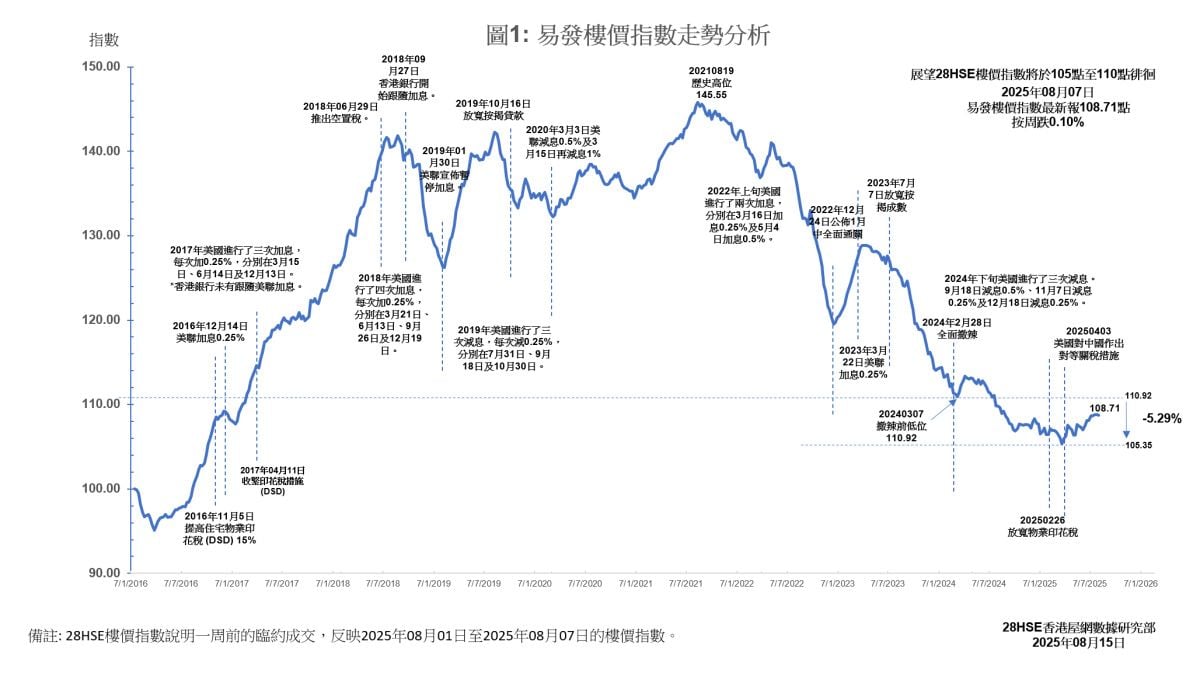

The Eva Property Index now stands at 108.71 points, holding above the 108-point level for seven consecutive weeks. It slipped slightly by 0.1% week-on-week, but has risen over 2% compared with May, when the one-month HIBOR began to fall, reflecting a gradually improving property market sentiment with a mild upward trend. The black rainstorm in early August disrupted viewing schedules for many prospective buyers, slowing their pace of entry into the market. Agency data shows that transactions in the top 10 housing estates fell to single digits in the first week of August, with a maximum of just eight deals. At the same time, some owners became firmer in their asking prices, reducing the appeal of the secondary market, with many buyers turning to the primary market instead. Market statistics reveal that between August 2 and 3, over 100 primary transactions were recorded, up about 40% from the previous week, mainly driven by sales at LOHAS Park’s The Coast Line III and Mid-Levels West’s No.1 Mid-Levels. August’s primary market remains active, with around five projects — including Grand Jete in Chai Wan, The Coastline Bay in Kai Tak, and Upper Riverbank Phase 3 in Tai Po — launched or in the pipeline, offering about 2,000 units in total. This has encouraged some buyers to adopt a wait-and-see approach or priorities new launches, further dampening secondary market activity. The market generally expects the U.S. Federal Reserve to cut interest rates in September, which could further ease mortgage burdens and unlock latent purchasing power. The Eva Property Index is projected to rise back above 110 points by late August.

Diverging District Trends — Kowloon Down Over 2%

By district, the market showed a “three up, one down” pattern this week. Kowloon recorded the sharpest decline, with its sub-index falling 2.54% to 106.69 points. New Territories West continued its strong run, rising 1.12% to 114.39 points, its ninth consecutive weekly gain, supported by relatively lower property prices and eligibility for the HK$100 stamp duty threshold on properties below HK$4 million, which boosted demand from first-time buyers. New Territories East edged up 0.24% to 109.04 points, marking two weeks of gains, while Hong Kong Island rose 0.8% to 96.67 points. The gains in NT East and Hong Kong Island are believed to have been driven by robust primary sales at The Coast Line III and No.1 Mid-Levels.

Eva Rental Index Hits New High in 2025 — Latest at 116.65 Points

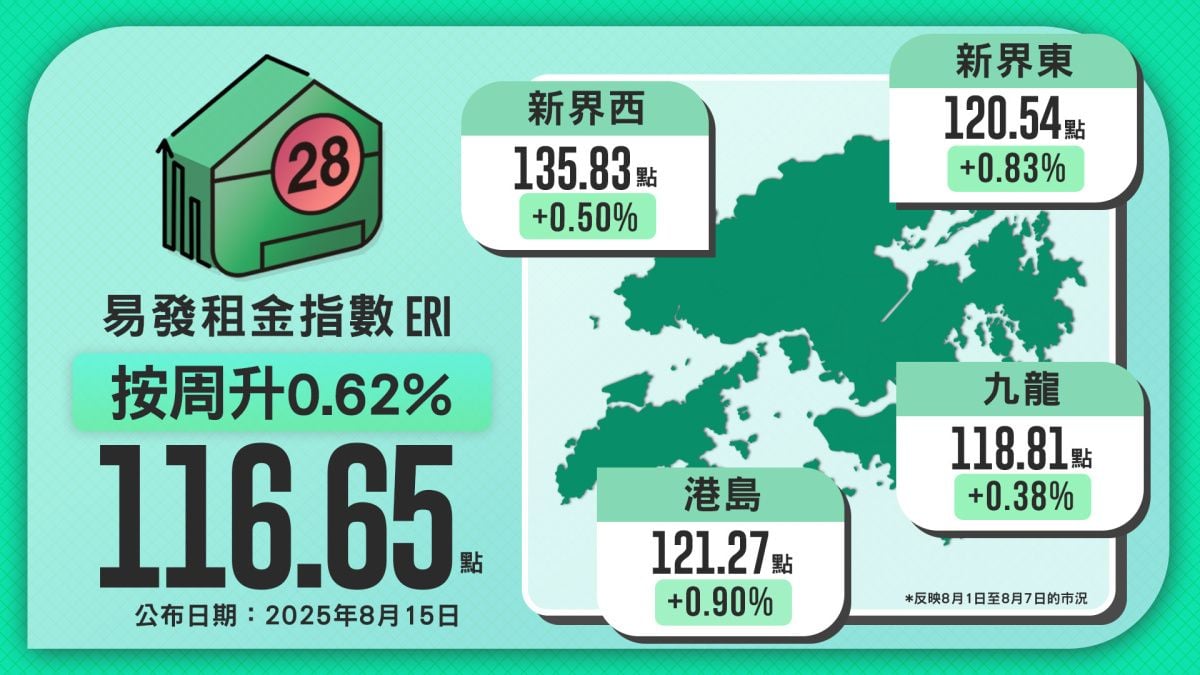

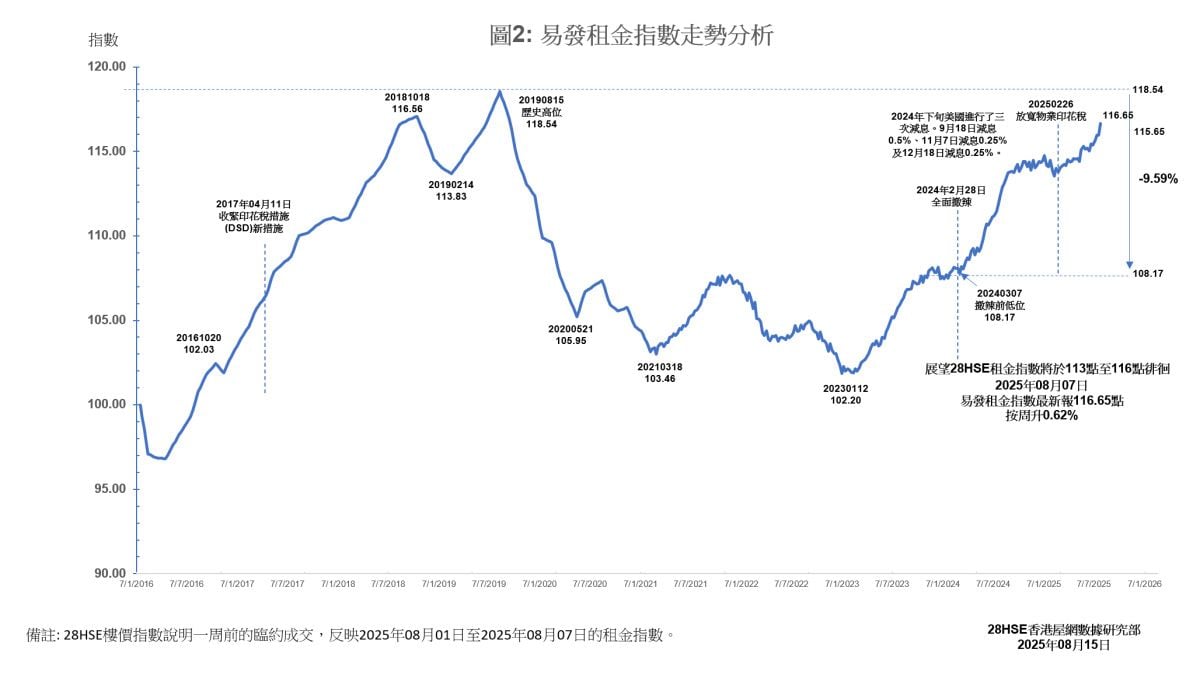

The rental market remains buoyant, fueled by a steady inflow of Mainland Chinese professionals who often choose to rent first to familiarize themselves with the city, pushing rental levels higher. The latest Eva Rental Index climbed 0.62% week-on-week to 116.65 points, a new high for the year. All four major districts saw increases: Hong Kong Island led with a 0.9% rise to 121.27 points, setting a new annual high; New Territories East gained 0.83% to 120.54 points, also a record; New Territories West rose 0.5% to 135.83 points, marking two straight weeks of growth; and Kowloon added 0.38% to 118.81 points. Analysts attribute the across-the-board gains to the peak summer leasing season and many families aiming to finalize rental arrangements before the new school year, further lifting rental demand and pushing the index to fresh highs.

This week's index reflects the market conditions from August 01, 2025 to August 07, 2025

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |