- Home

- News

- Property Index

- Eva Property Index Remains Volatile, Secondary Market Cools As New Projects Dominate; Rental Index Hits New High With Growth Across All Districts

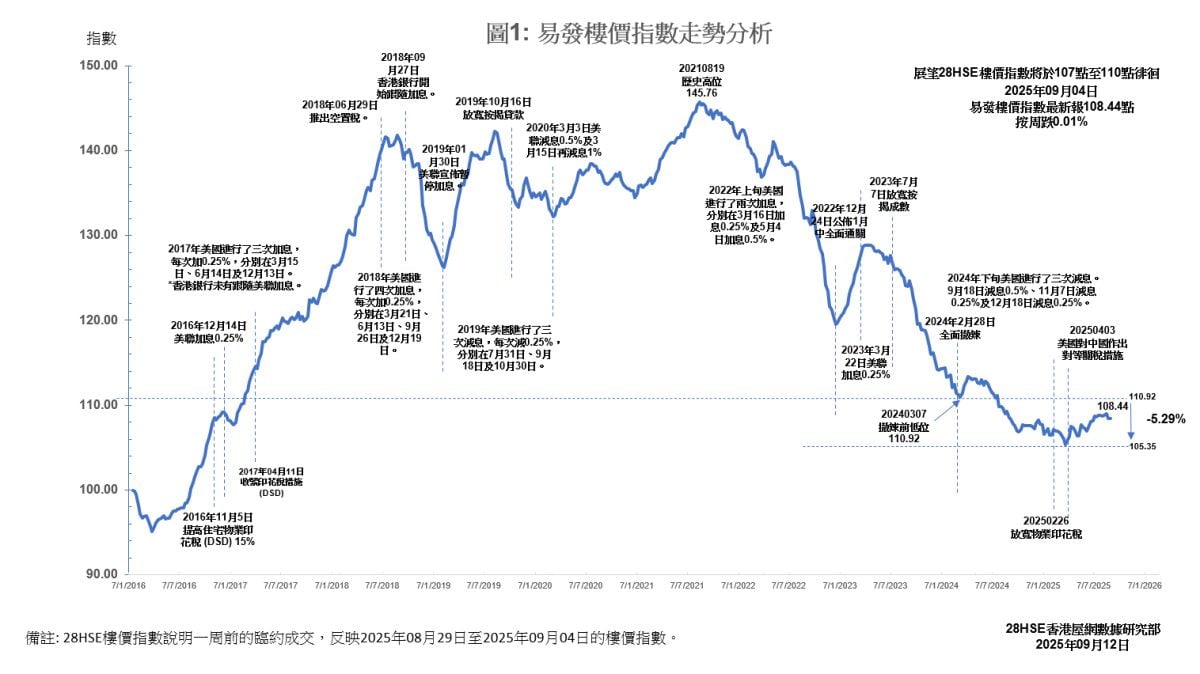

The property market remained volatile this week, with secondary transactions under pressure. However, aggressive promotions from developers continued to drive demand, keeping primary sales active. With hopes pinned on potential interest rate cuts by the US Federal Reserve in September and supportive housing measures in the upcoming Policy Address, prices are expected to see mild short-term gains. By district, the Eva Property Index showed a “three up, one down” pattern, with New Territories West extending its decline, while other regions maintained an upward trend. Meanwhile, the rental market stayed strong, with the Eva Rental Index rising for four consecutive weeks to a new high, as all four major districts recorded gains, reflecting robust demand.

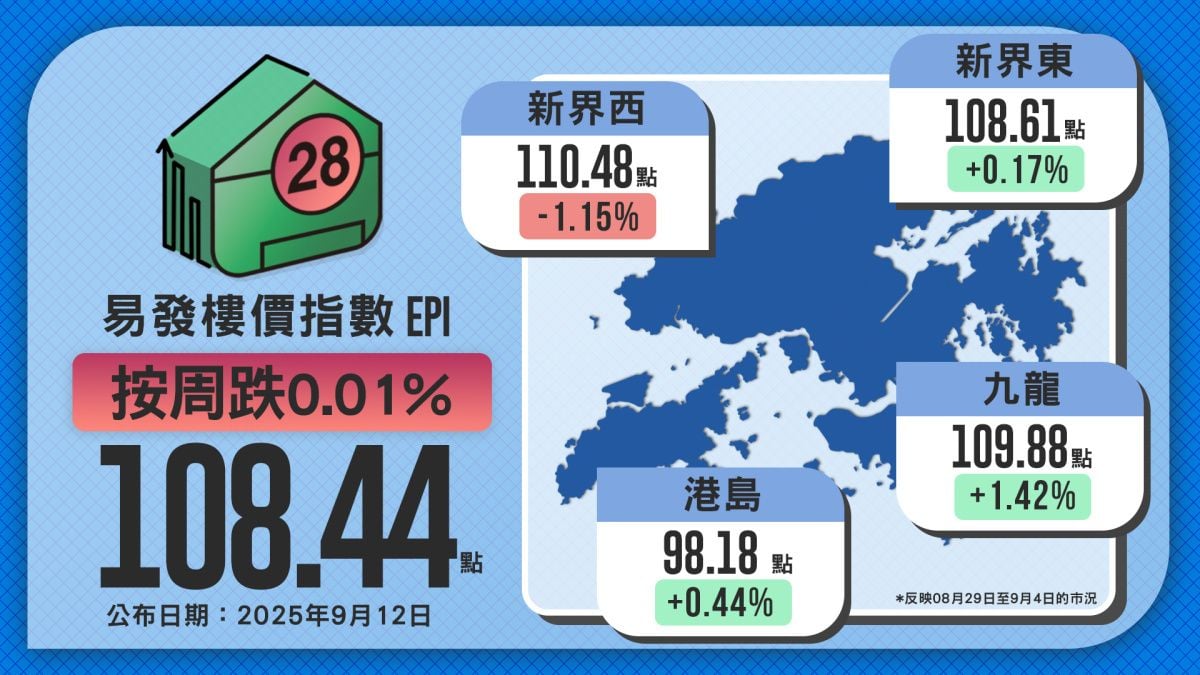

The Eva Property Index closed at 108.44 points, marking a slight weekly dip of 0.01% and a two-week losing streak. Compared to the peak in August 2021, the index has fallen over 34%, though it is still up about 1.78% year-to-date. The pullback was mainly due to intensified bargaining between buyers and sellers in the secondary market, with many owners narrowing negotiation margins, causing transaction volumes to slow. Over the past weekend (August 30–31), the four major agencies reported only single-digit secondary transactions, with a maximum of 9 deals, while 20 major estates recorded just 40 transactions, down 11% week-on-week. This reflected strong holding sentiment among owners, further cooling market activity.

By contrast, new projects continued to dominate. Over the same weekend, more than 180 primary transactions were recorded, mainly from Urban Renewal Authority’s Kai Tak “eResidence”, as well as leftover stock from projects such as LOHAS Park’s “The Coastline” (Phase 3A – The Vertex), YOHO West (Phase 1) in Tin Shui Wai, and Southside “La Marina II” in Wong Chuk Hang. This shows some frustrated secondary buyers have turned to the primary market. With rate-cut expectations and potential policy support, the Eva Property index is projected to edge upward and test the 109-point level in the short term.

District Divergence: “Three Up, One Down” with New Territories West Falling for 4 Weeks

The latest district price indices showed divergence. New Territories West fell the most, down 1.15% to 110.48 points, marking its fourth consecutive weekly decline. While transaction numbers remained similar to last week, agency data showed that discount listings were more prevalent in New Territories—especially in Tsuen Wan—dragging prices lower.

In contrast, other districts remained resilient or strengthened further. Kowloon rose 1.42% to 109.88 points, marking a three-week uptrend as buyers and sellers reached more consensus. Hong Kong Island climbed 0.44% to 98.18 points, its fifth straight weekly gain, showing steady upward momentum. New Territories East edged up 0.17% to 108.61 points, its second consecutive weekly increase, reflecting solid underlying demand despite modest growth.

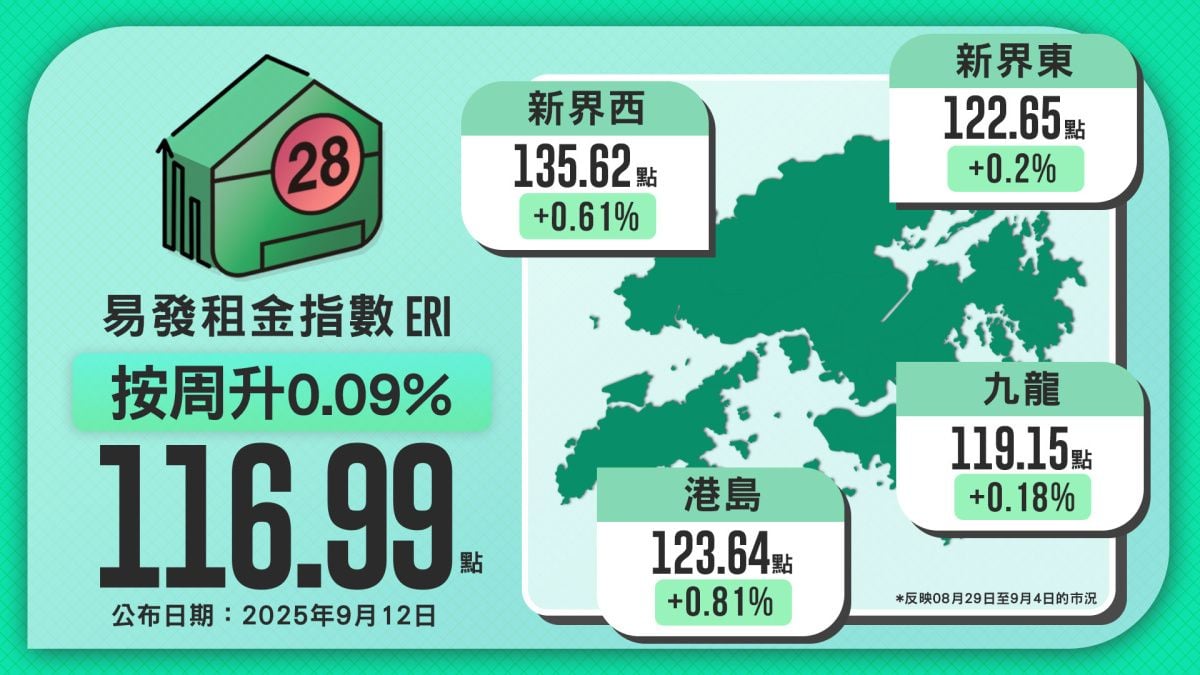

Eva Rental Index Hits Another Record at 116.99 Points, Rising for 4 Weeks

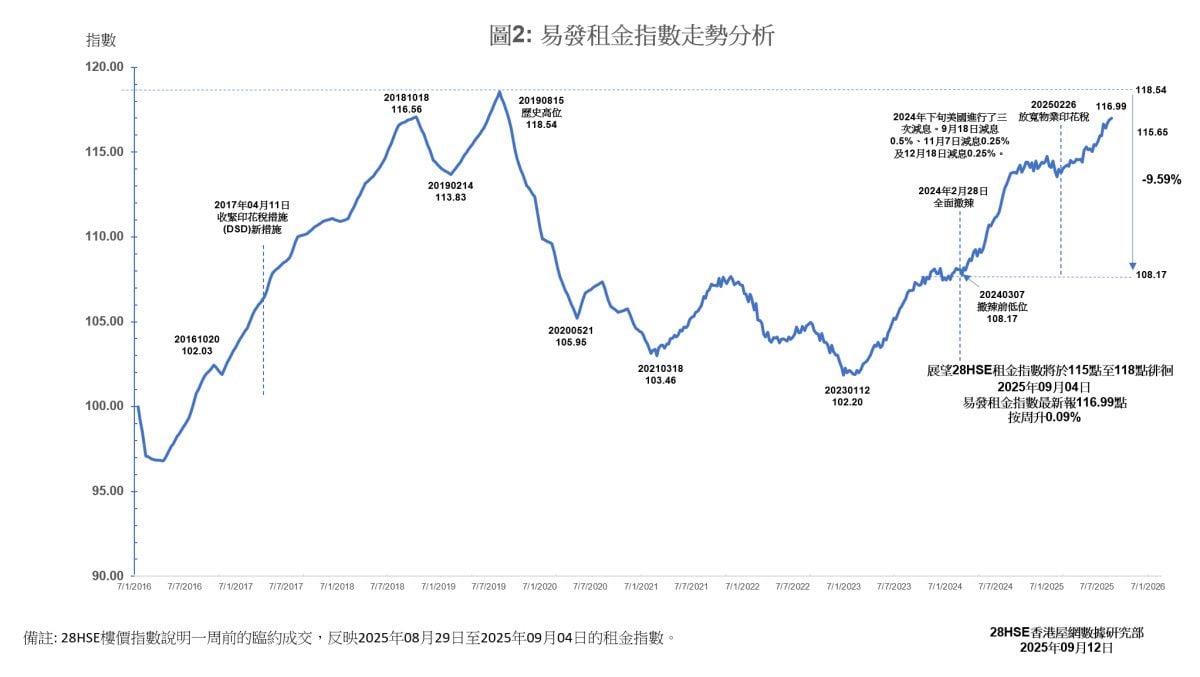

The rental market remained robust, supported by the tail end of the leasing season and the start of the academic year. Many Mainland students finalized leases ahead of school openings, boosting demand. The Eva Rental Index reached 116.99 points, up 0.09% weekly, marking its fourth consecutive rise and setting another new yearly high. This highlights strong market absorption and sustained upward momentum underpinned by rigid demand.

By district, rental indices rose across the board. Hong Kong Island led the growth, climbing 0.81% to 123.64 points, its sixth straight weekly gain. Kowloon edged up 0.18% to 119.15 points, recording two weeks of increases. New Territories West rose 0.61% to 135.62 points, also up for two consecutive weeks, while New Territories East gained 0.2% to 122.65 points, its fifth consecutive weekly rise. Although some increases were moderate, the overall trend of four districts rising confirms a buoyant rental market, with further upward pressure expected in the short term.

This week's index reflects the market conditions from August 29, 2025 to September 04, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |