- Home

- News

- Property Index

- Affected By The Trade War, Buyers Turn More Cautious; Eprc Property Price Index Slightly Rises By 1.29%

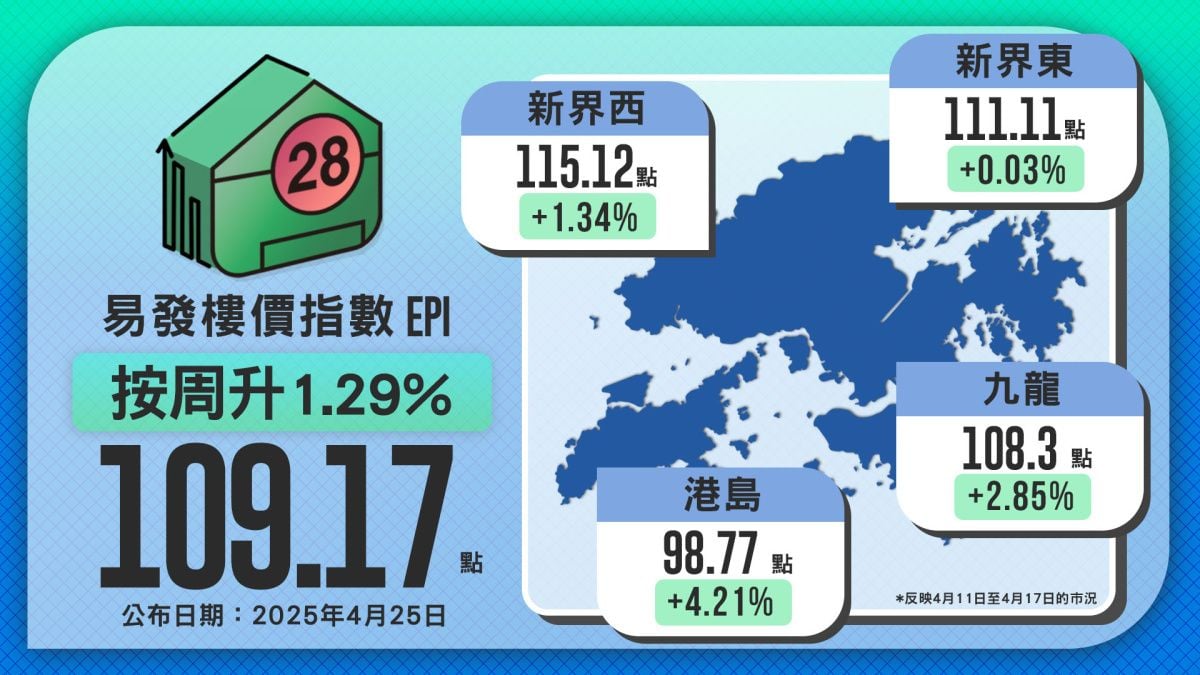

The latest Eva Property Price Index stands at 109.17 points, recording a mild weekly increase of 1.29%. Although the escalating U.S.-China trade conflict continues to put pressure on global financial markets, prompting some potential buyers to adopt a wait-and-see attitude, savvy buyers have taken advantage of the uncertain market to seek out "bargain" properties. According to real estate agency statistics, transaction volumes at the top ten benchmark housing estates rebounded over the weekend, with some estates even seeing double-digit growth, reflecting a certain resilience in the market despite volatility.

However, the overall performance of the second-hand property market has yet to show a significant breakthrough. With expectations rising that the U.S. Federal Reserve may accelerate interest rate cuts, and the Chinese central government possibly introducing more economic stimulus measures, market sentiment has slightly improved, attracting some buyers with genuine needs to cautiously explore or make tentative offers.

In the primary market, only the leftover units from “SIERRA SEA” in Sai Kung West and “The Grand Marine” in Tuen Mun were launched this week, reflecting the developers’ cautious stance amid current market conditions. Based on market analysis, property prices are expected to remain in a bottom-searching phase in the short term, awaiting more positive news or a de-escalation of the trade war to drive further movement.

From the latest regional property price indices, all four major regions recorded increases this week. This indicates that even under rising U.S.-China trade tensions and increasing global economic uncertainty, buyer confidence among those with genuine needs has not been significantly shaken.

Among the regions, Hong Kong Island saw the most significant increase, with its index rising 4.21% week-on-week to 98.77 points. Kowloon also performed well, with a weekly increase of 2.85% to 108.3 points. The New Territories West index rose by 1.34% to 113.12 points, while the New Territories East was relatively stable, with a slight increase of 0.03% to 111.11 points. Overall, the synchronous price increases across all four regions further reflect a gradually stabilizing market, driven by policy expectations and the potential for lower capital costs.

Eva Rental Index Remains High; Leasing Demand Strong; Slight Weekly Increase of 0.05%

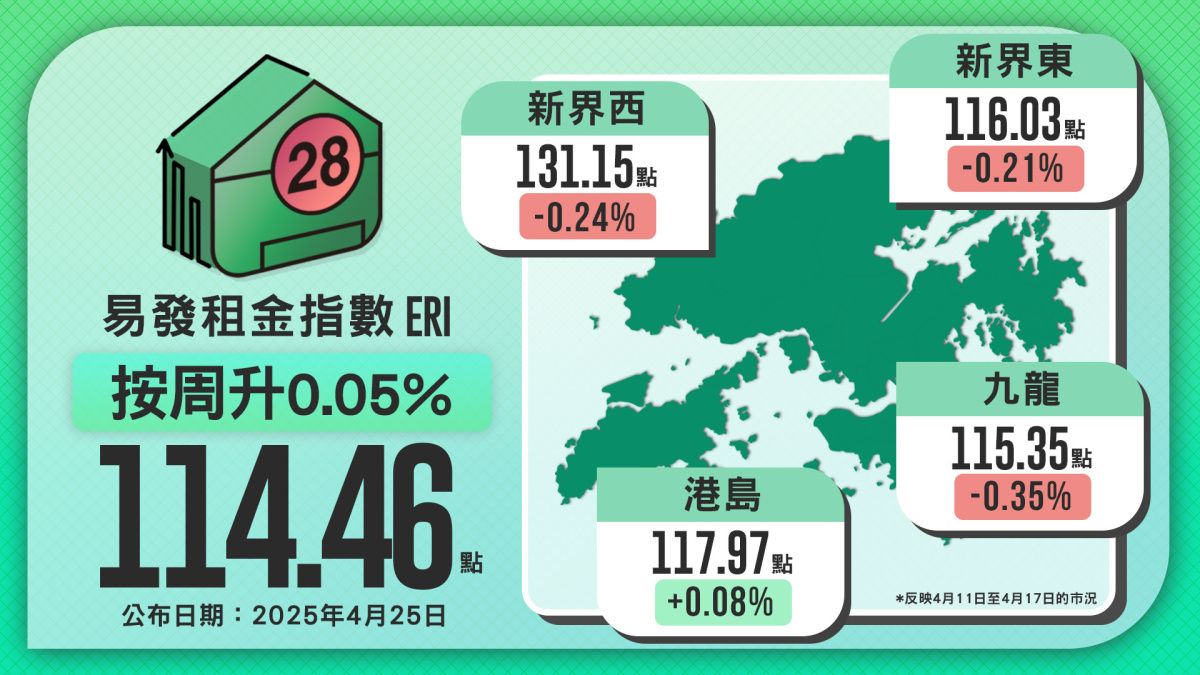

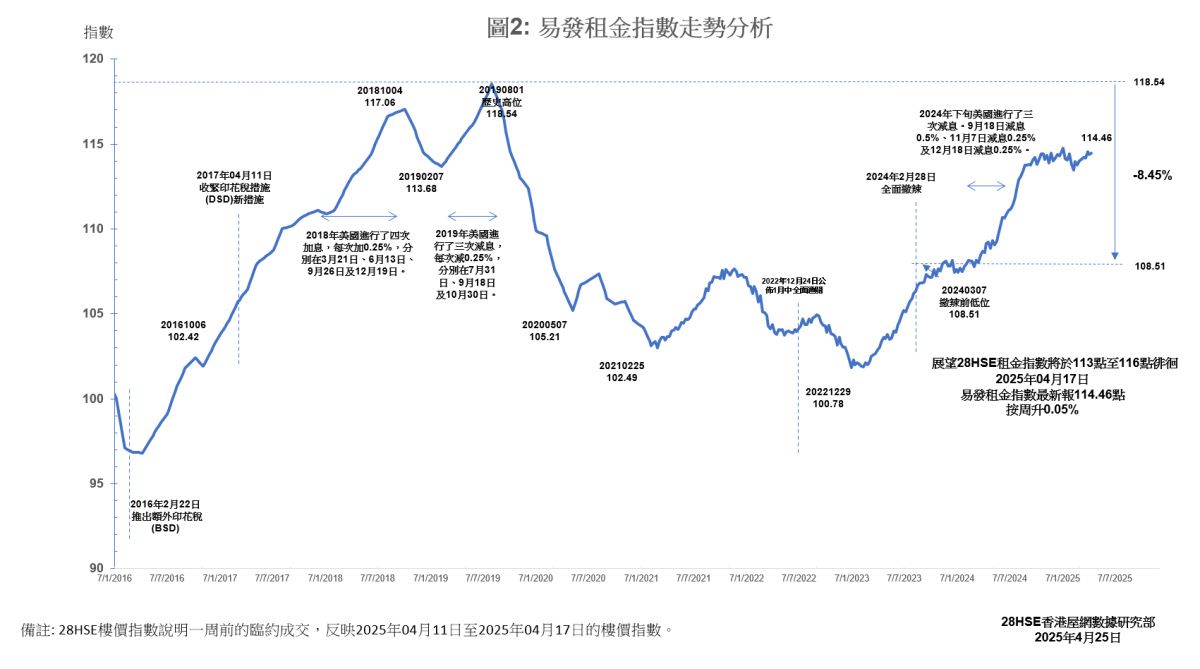

The latest Eva Rental Index rose slightly by 0.05% week-on-week to 114.46 points, showing that overall rental levels in Hong Kong remain steady with a slightly positive trend. Despite the limited increase, the stability of rents amid a highly uncertain macroeconomic environment suggests there is still solid leasing demand.

By region, Hong Kong Island again led the way, with its rental index rising by 0.08% week-on-week to 117.87 points, making it the strongest performer this week. This may be due to limited housing supply in prime areas and some potential buyers opting to rent instead, which has helped push rents upward.

In general, the slight increase in the rental index may reflect a cautiously optimistic market outlook. Especially with property price fluctuations, some residents prefer renting before buying, helping to keep the rental market active.

This week's index reflects market conditions from April 11 to April 17, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |