- Home

- News

- Property Index

- New Home Market Drives Second-hand Sector Upward: Eva Property Index Rises For 4 Consecutive Weeks, Up 0.44% Weekly

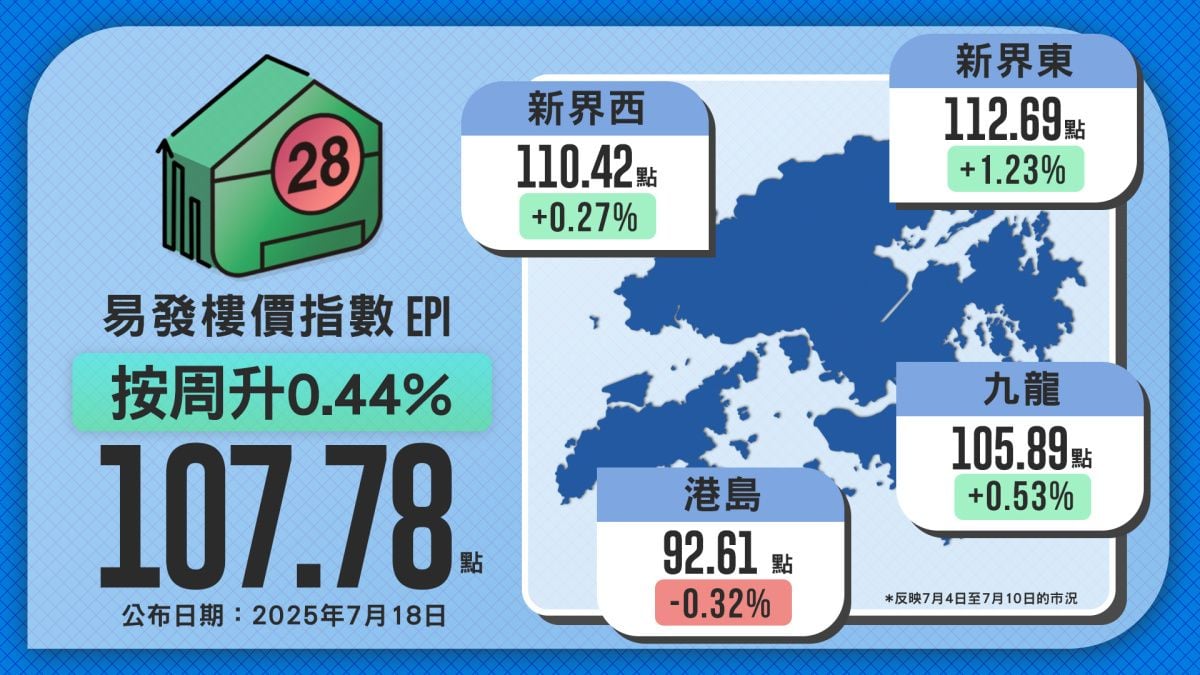

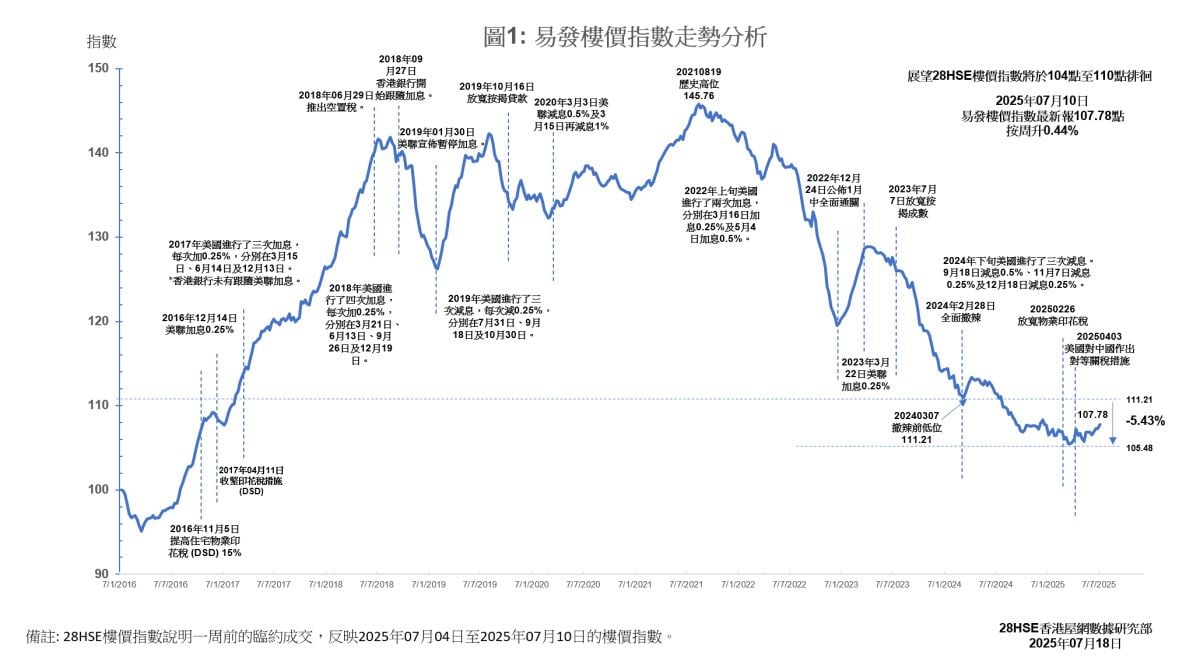

Hong Kong’s property market has recently rebounded, fueled by the strong performance of new developments. Both the primary and secondary markets are active. In Tuen Mun, all 160 units of Phase 3A of “Novoland” were sold out on the first launch day. The EPRC Property Price Index rose to 107.78 points, up 0.44% week-on-week, marking the fourth straight week above the 107-point level.

Among regional indexes, three rose and one fell:

New Territories East: +1.23%

Kowloon: +0.53%

New Territories West: +0.27%

Hong Kong Island: -0.32%

Second-hand transaction volume rose 14% week-on-week, and viewing appointments for the top ten housing estates during the weekend rose slightly by 1.4%.

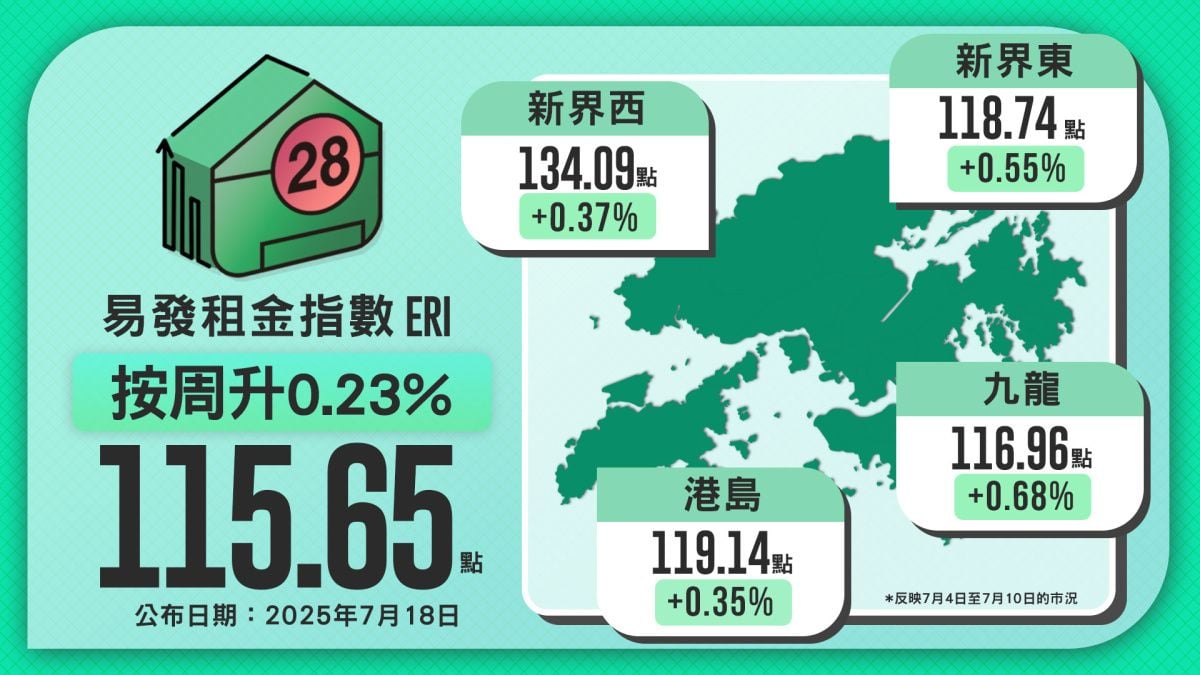

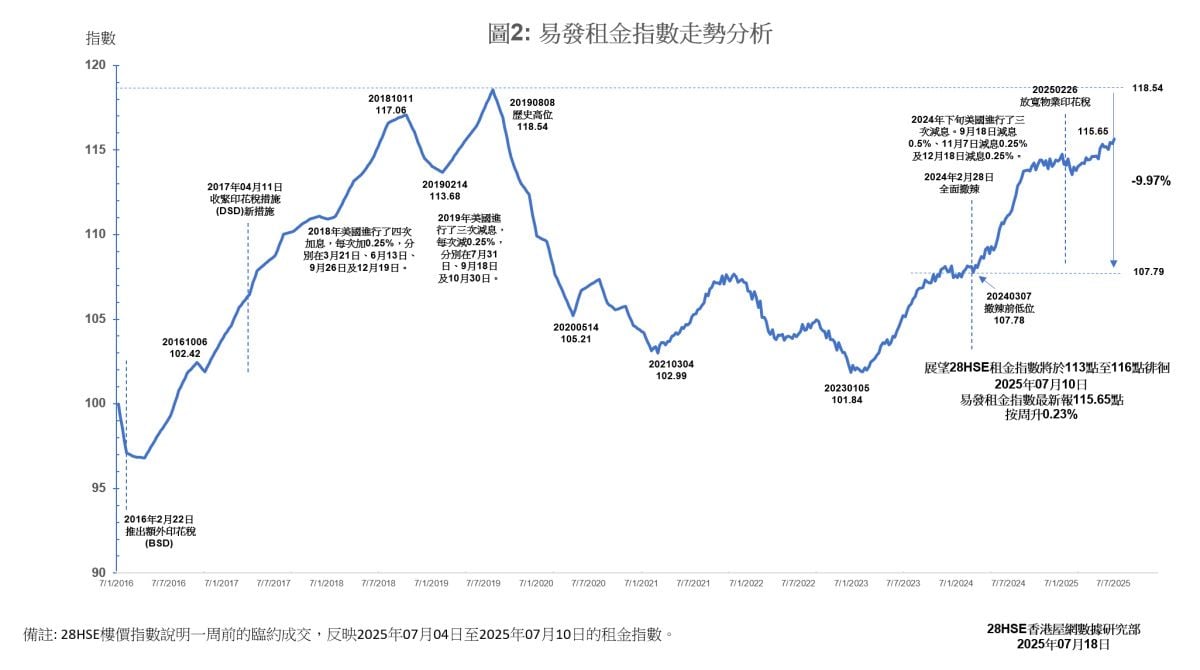

As the summer rental season arrives, rising demand from mainland Chinese students is pushing the rental index to 115.65 points, up 0.23% weekly, with New Territories East and Kowloon leading the gains.

Market expectations suggest the U.S. Federal Reserve may cut interest rates 2 to 3 times in the second half of the year, which would further benefit the property market. The Eva property index is expected to fluctuate between 106 and 108 points this quarter and trend upward steadily in the latter half of the year.

Strong New Launches Stimulate Buying Interest in Second-Hand Market

The success of recent launches, such as Tuen Mun’s “Novoland Phase 3A” which sold out all 160 units on the first day, highlights continued strong purchasing power in the market. This momentum has spilled into the second-hand sector, where buyers who missed out on new units turn their attention.

According to the latest Eva Property index reading of 107.78, weekly prices increased by 0.44%, maintaining above 107 points for three consecutive weeks. Agency data shows 97 transactions in the 50 major housing estates last week—up 14%, the most in three weeks.

Viewing appointments for second-hand homes also increased, with over 370 groups scheduled across the top ten estates—a 1.4% weekly gain—indicating gradually recovering buyer confidence.

Looking ahead, anticipated U.S. rate cuts and improving sentiment may keep prices fluctuating narrowly between 106–108 points this quarter, with a steady upward trend in the second half.

Regional Index: “Three Rise, One Fall” — NT East & West Climb for 3 Straight Weeks

Despite new project launches capturing attention, buyers unable to secure their desired new units have turned to the secondary market, boosting activity. As a result, the four major regional indexes show a “three rise, one fall” pattern:

New Territories East: Most significant gain, reaching 112.69 points, up 1.23% week-on-week, rising for the third consecutive week.

New Territories West: Also on a three-week rise, now at 110.42 points, up 0.27%.

Kowloon: Stable performance at 105.89 points, up 0.53%.

Hong Kong Island: Slight dip to 92.61 points, down 0.32%, hovering at the 92-point level.

Analysts attribute the Hong Kong Island dip to competition from the launch of “9 Eastern Street” in Sai Ying Pun.

Overall, while second-hand sentiment remains stable, trends diverge by region. The outlook depends on the pace of new launches, regional infrastructure, and interest rate developments.

Eva Rental Index Holds Above 115 Points for 8 Weeks — Weekly Rise of 0.23%; All Regions Up

With the summer rental season underway, the influx of mainland students preparing for the new academic year is boosting demand and pushing rents higher. The Eva Rental Index stands at 115.65 points, up 0.23% weekly and rising for three straight weeks.

Key highlights by region:

New Territories East: Strongest performance at 118.74 points, up 0.55% for the fourth week in a row.

Kowloon: Rebounded to 116.96 points, up 0.68% weekly.

New Territories West: Rose to 134.09 points, up 0.37%, continuing a three-week climb.

Hong Kong Island: Recovered to 119.14 points, up 0.35% weekly.

The dual drivers of the summer season and student demand suggest continued upward pressure on rents, especially near universities. Analysts forecast short-term rental prices to stay elevated, with New Territories East and Kowloon likely to see particularly strong demand.

This week's index reflects the market conditions from July 04, 2025 to July 10, 2025

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |