Property stock is more and more; New projects will be put on sale at low price in the short term.

(By Yan Lunle)

Nearly half of new launched unit in last year are unsalable, laying a foreshadowing for further adjustment of the property market, the property market latest statistics showed. The 43 new projects launched last year included 18,855 units, only 9,899 units among were sold with the sell-through rate in 52.5%, which was sharply down by 15.4% comparing with the sell-through rate of 67.9% in 2017, in other words, nearly half (8,956 units) are unsalable, according to the first-hand sales information network. The weakening of the purchasing power because of unreasonable property price and developers slowing down on project sales to wait and see market trend are the major reasons of sharply decline on first hand property sell-through rate in last year, and it is predicted new projects will be put on sale at low price in the short term, since the stock is getting larger at the same time there will be more supply in this year, analysis believed.

The 43 new projects (excluding village houses and some special cases) launched last year involved 18,855 units, of which about 9,899 were sold, that is, the sell-through rate was about 52.5%,according to the first-hand sales information network. In other words, there are 8,956 units that nearly half are unsalable.

51 new projects including 22,210 units were launched in 2017, 15,076 units among were sold, leading the sell-through rate reached 67.9%, which means that the sell-through rate dropped 15.4% year-on-year, according to data.

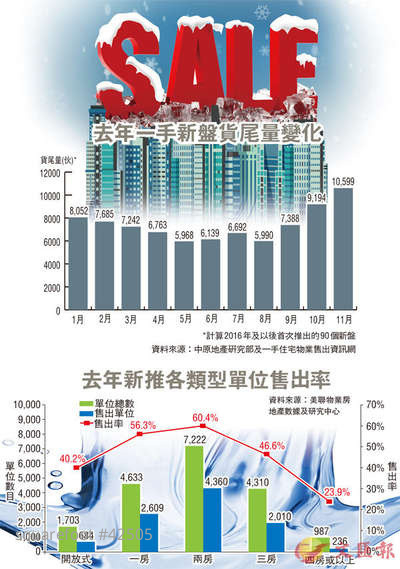

Two-room units accounted for 38%, with the sell-through rate in 60%.

About the reasons of the sharp decline of the sell-through rate, first is the pricing of the new project is unreasonable after the boom property market in last year, second is the purchasing power is weakening base on a limited property price reduction although it has turned from hot to cold in the middle of the year, the industry analysis pointed. On the other hand, after the second half of last year, factors of property measures launched by the Chief Executive Lam Cheng Yuet-ngor, Sino-us trade war, stock market fluctuations, and developers slowing down property sales to wait and see market trend have caused the unsalable first hand properties getting more and more. .

Dividing by layouts, two-bedrooms units were the most that up to 7,222 units accounting for about 38.3% of the total of 18,855 units, and its sell-through rate was 60.4%, which had the best performance among all layouts, the Chief Analyst of Midland, Liu Jiahui pointed. The supply and sell-through rate of one-bedroom units are second to that of the two-bedroom units, which were 4,633 units (accounting for 24.6%) and about 56.3%.

Open style units only sold 40%, in downhill.

Layouts in poor performance were open style, three-bedrooms and four-bedrooms plus above. Open style were 1,703 units in last year with the sell-through rate in about 40.2%, down 17.1% from 57.3% in 2017, reflecting the market's decline in interest in open style units. The sell-through rate of the three-bedrooms last year was about 46.6%, while for the four-bedrooms and above it was only about 23.9%.

In fact, in addition to the drop in sell-through rate, the overall first-hand transaction volume last year also significantly declined, reflecting the first hand property sales slowed down as the property market falling last year. According to the Land Registry, a total of 15,730 cases of first hand private residential property transaction were recorded in 2018, a decrease of about 15.7% from 18,657 cases in 2017 and the latest lowest in five years after 9,986 cases in 2013.

In addition, property prices remained high last year, and developers were aggressively on pricing to drive up the transaction price of the first hand property. Among about 9,899 units of the first hand property which were launched and sold in 2018, about 57.59% were in usable area sq ft prices from more than HKD 15,000 to HKD 20,000, about 21.46% were in usable area sq ft prices from more than HKD 20,000 to HKD 30,000, about 18.56% were in usable area sq ft prices from more than HKD 10,000 to HKD 15,000, and about 2.37% were in usable area sq ft price above HKD 30,000, while only about 0.01% was in usable area sq ft prices in or under HKD 10,000.

The unsalable units are concentrated in the New Territories West and New Territories East.

And the unsalable units in the market also increased sharply due to the slow sales of the new property last year. Centaline made statistics on the 90 new projects firstly launched in 2016 and after and found, unsalable properties were 10,599 units in November 2018, being the latest peak in 11 months, also again went back above the level of 10 thousand, the Senior Associate Director of the Research Department of Centaline, Huang Liangsheng expressed. The unsalable units are concentrated in the New Territories West and New Territories East, with 3,224 units and 3,076 units respectively. There are 2,872 units in Kowloon and 1,427 units in Hong Kong Island.

Developers have begun to "face the reality" in recent months seeing the more stock and launched a few new projects in low price for selling more rather than in higher price, such as GRAND CENTRAL in Kwun Tong started sales in December, Paragon in Tai Po and MAYFAIR by the sea 8 both of which will start sales this month etc,. The market's response is also quite straightforward. The low-priced new project sales is ideal, while the new project without price reductions is dull. The industry believed, developers will still be more cautious on property launching in the short term and will continue to test the bottom line of market acceptance.