- Home

- News

- Property Index

- Impacted By Low-priced New Launches And Fed's Rate Freeze, Eva Property Index Continues Narrow Sideways Movement, Down 0.59% Week-on-week

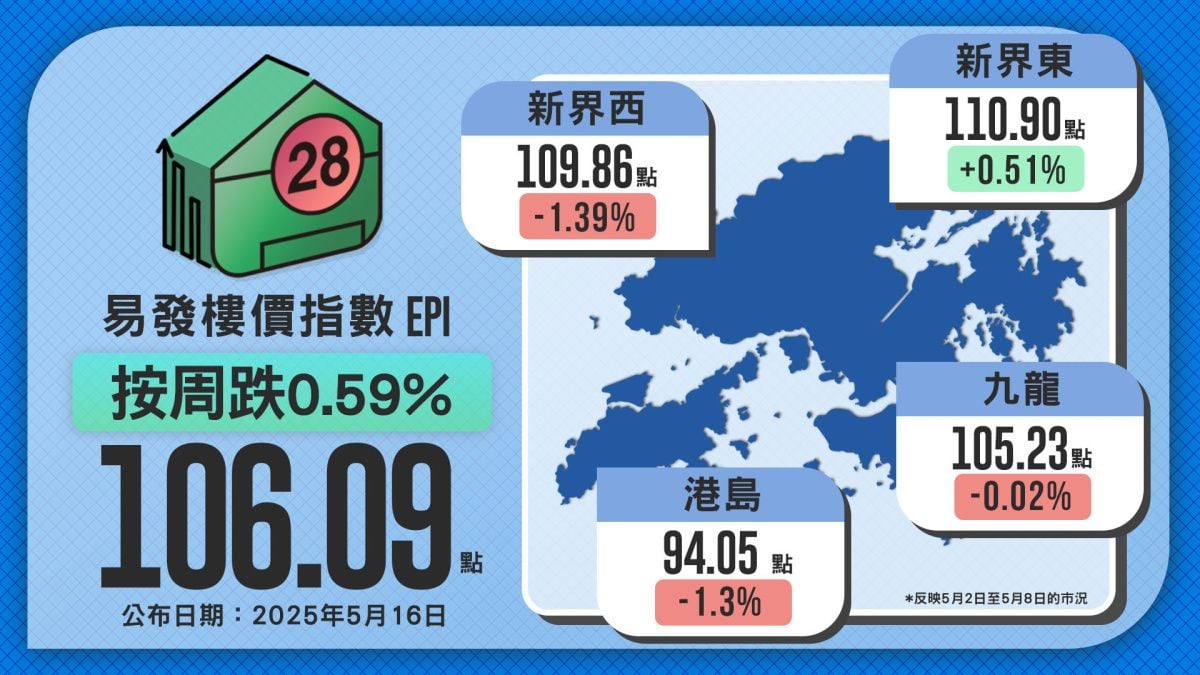

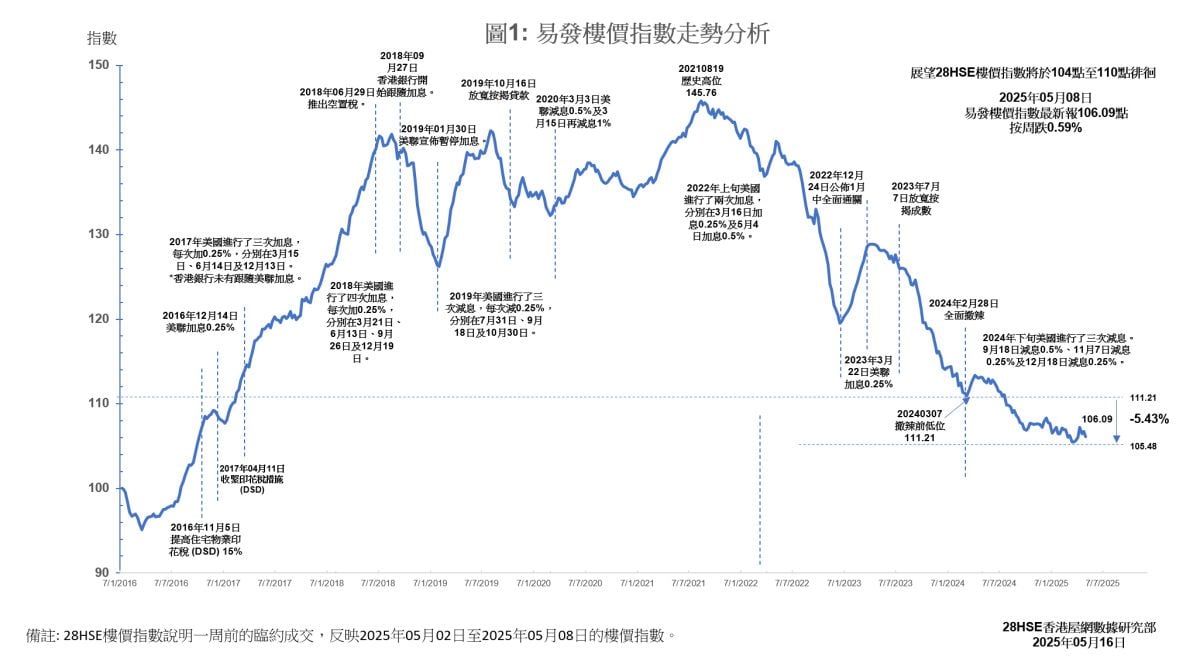

This week, the primary market reignited enthusiasm as the brand-new development “Sierra Sea” in Sai Sha drew attention with a low-price strategy. After all 288 units sold out swiftly over the past weekend, the developer promptly launched an additional 150 units last Wednesday, further drawing in buying power that would otherwise have gone to the secondary market. The latest Eva Property Index stands at 106.09 points, down 0.59% from the previous week. The index has hovered narrowly around 106 for three consecutive weeks, lingering at levels seen in the second half of 2016. Property prices have fallen by 1.5% so far this year, and the secondary market may continue to face downward pressure in the short term.

Furthermore, two major new developments in the Kai Tak area—Cheung Kong’s “Hua Yu Hai” and Wheelock’s “Miai Quay II”—are expected to launch within the month, potentially exerting significant impact on the dynamics of the overall secondary market.

Although the U.S. Federal Reserve has held interest rates steady for three consecutive meetings, and the market generally expects the rate hike cycle to be nearing its end, the prolonged high-interest environment continues to pressure the local secondary housing market. Many potential buyers remain on the sidelines, awaiting a rate cut, which clearly suppresses purchasing intent. According to data from estate agencies, only 30 transactions were recorded last week across the 20 major housing estates in Hong Kong—down by one from the previous week—showing that transaction volume remains low and the secondary market continues to be sluggish.

While there is market speculation that the Fed might begin cutting rates in the second half of this year—sending a positive signal to asset markets—multiple uncertainties remain in the macro environment. In particular, renewed tariff tensions in U.S.-China trade relations and a generally weak global economic recovery contribute to market volatility. These external unfavorable factors further undermine buyer confidence, making it difficult for the local property market to break out of its current stalemate. In the short term, the Eva Property Price Index is expected to continue testing the 105-point level, reaching a new low for the year.

Regional Index: “Three Down, One Up” – New Territories West Underperforms

By region, three of the four zones saw declines this week. New Territories West experienced the largest drop, with the index at 109.86 points, down 1.39% week-on-week. Hong Kong Island and Kowloon came in at 94.05 and 105.23 points, respectively, with week-on-week declines of 1.3% and 0.02%. The only region showing an increase was New Territories East, which rose by 0.51% to 110.9 points.

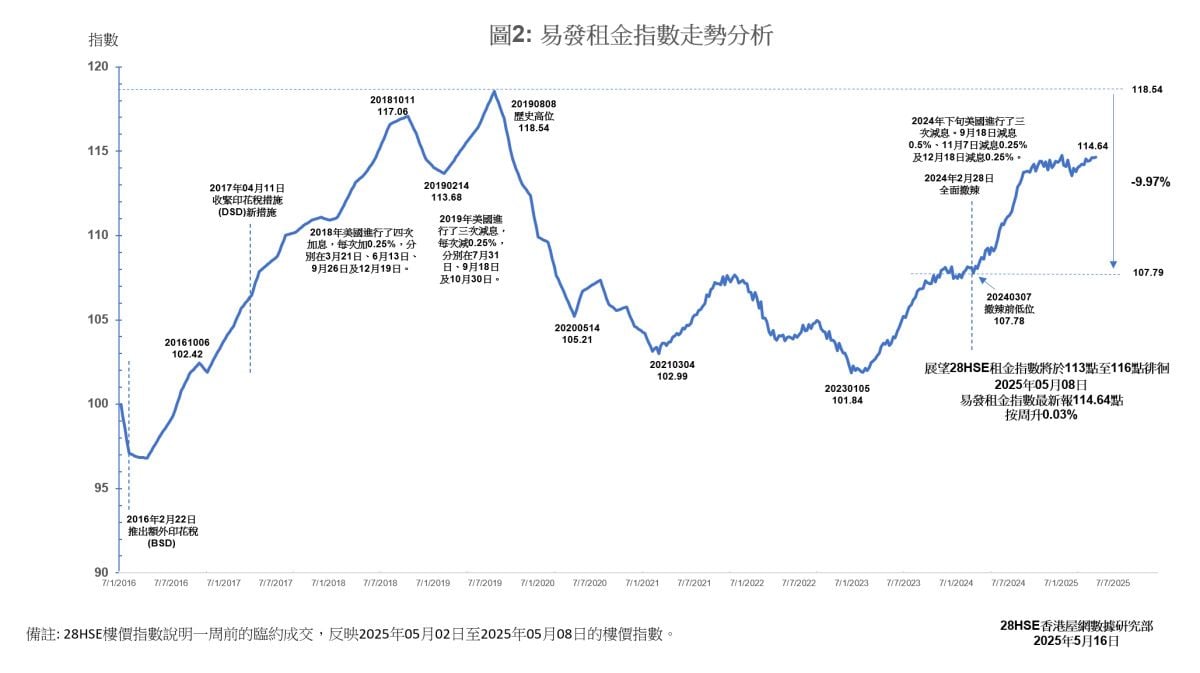

Rental Index Remains High with Four Consecutive Weeks of Increases, Slight Weekly Rise of 0.03%

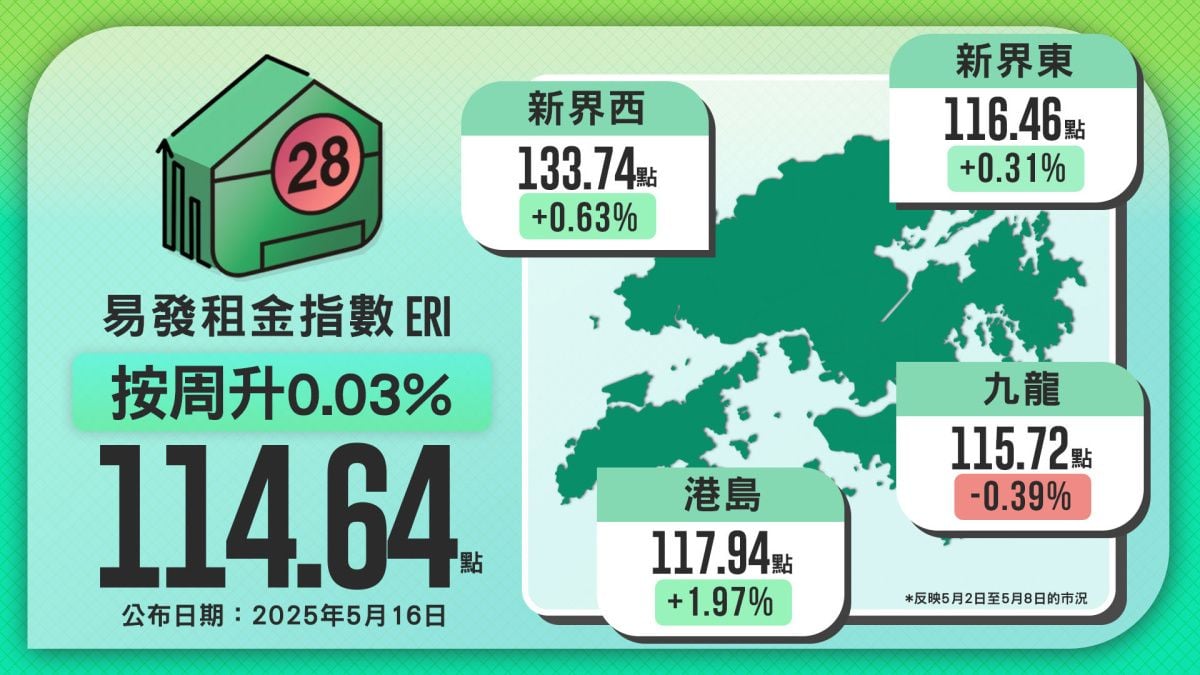

Despite not yet entering the traditional rental peak season, the local residential leasing market continues to perform strongly. According to the latest data, the overall rental index stands at 114.72 points, up slightly by 0.03% week-on-week, maintaining the high level seen since the beginning of the year—reflecting underlying market resilience even in a seasonal lull.

Looking at regional performance, there was a “three up, one down” trend overall. Hong Kong Island was the standout, with the index rising 1.97% to 117.94 points week-on-week. This indicates steady demand in core areas, possibly due to mid-to-high-end tenants returning to the market and the influx of Mainland professionals. New Territories West followed with a 0.63% rise to 133.74 points, maintaining a high level year-to-date. New Territories East reported 116.46 points, up 0.31% week-on-week, continuing to stay at a high level.

This week's index reflects market conditions from May 02 to May 08, 2025.

Like

| Property Type | Price | Ads Period |

|---|---|---|

| For Sale Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:90 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |

| Rental Property | ||

Normal Listing Typical One | HKD:1000 (or Hsemoney:1000) | Valid:80 days |

Golden Top Listing Higher position than Top listing 2-3times better performance | HKD:3000 (or Hsemoney:3000) | Valid:60 days |